MSR Value Growth & Market Trends

6 |

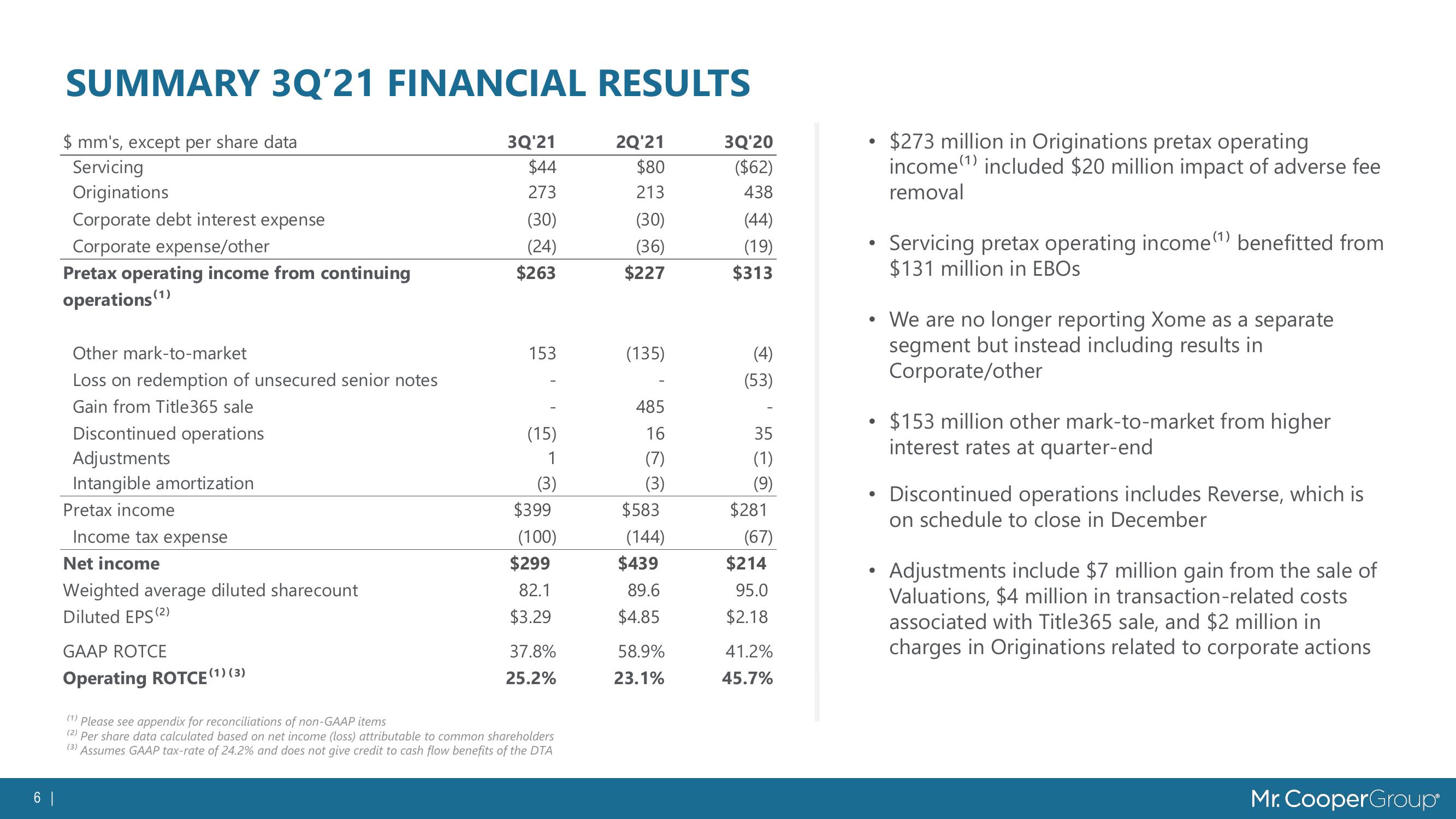

SUMMARY 3Q'21 FINANCIAL RESULTS

$ mm's, except per share data

Servicing

Originations

Corporate debt interest expense

Corporate expense/other

Pretax operating income from continuing

operations (1)

Other mark-to-market

Loss on redemption of unsecured senior notes

Gain from Title365 sale

Discontinued operations

Adjustments

Intangible amortization

Pretax income

Income tax expense

Net income

Weighted average diluted sharecount

Diluted EPS (2)

GAAP ROTCE

Operating ROTCE (1) (3)

3Q'21

$44

273

(30)

(24)

$263

153

(15)

1

(3)

$399

(100)

$299

82.1

$3.29

37.8%

25.2%

(1) Please see appendix for reconciliations of non-GAAP items

(2) Per share data calculated based on net income (loss) attributable to common shareholders

(3) Assumes GAAP tax-rate of 24.2% and does not give credit to cash flow benefits of the DTA

2Q¹21

$80

213

(30)

(36)

$227

(135)

485

16

(7)

(3)

$583

(144)

$439

89.6

$4.85

58.9%

23.1%

3Q'20

($62)

438

(44)

(19)

$313

(4)

(53)

35

(1)

(9)

$281

(67)

$214

95.0

$2.18

41.2%

45.7%

$273 million in Originations pretax operating

income (1) included $20 million impact of adverse fee

removal

Servicing pretax operating income (1) benefitted from

$131 million in EBOS

• We are no longer reporting Xome as a separate

segment but instead including results in

Corporate/other

●

• $153 million other mark-to-market from higher

interest rates at quarter-end

●

• Discontinued operations includes Reverse, which is

on schedule to close in December

Adjustments include $7 million gain from the sale of

Valuations, $4 million in transaction-related costs

associated with Title365 sale, and $2 million in

charges in Originations related to corporate actions

Mr. CooperGroupView entire presentation