One Medical SPAC Presentation Deck

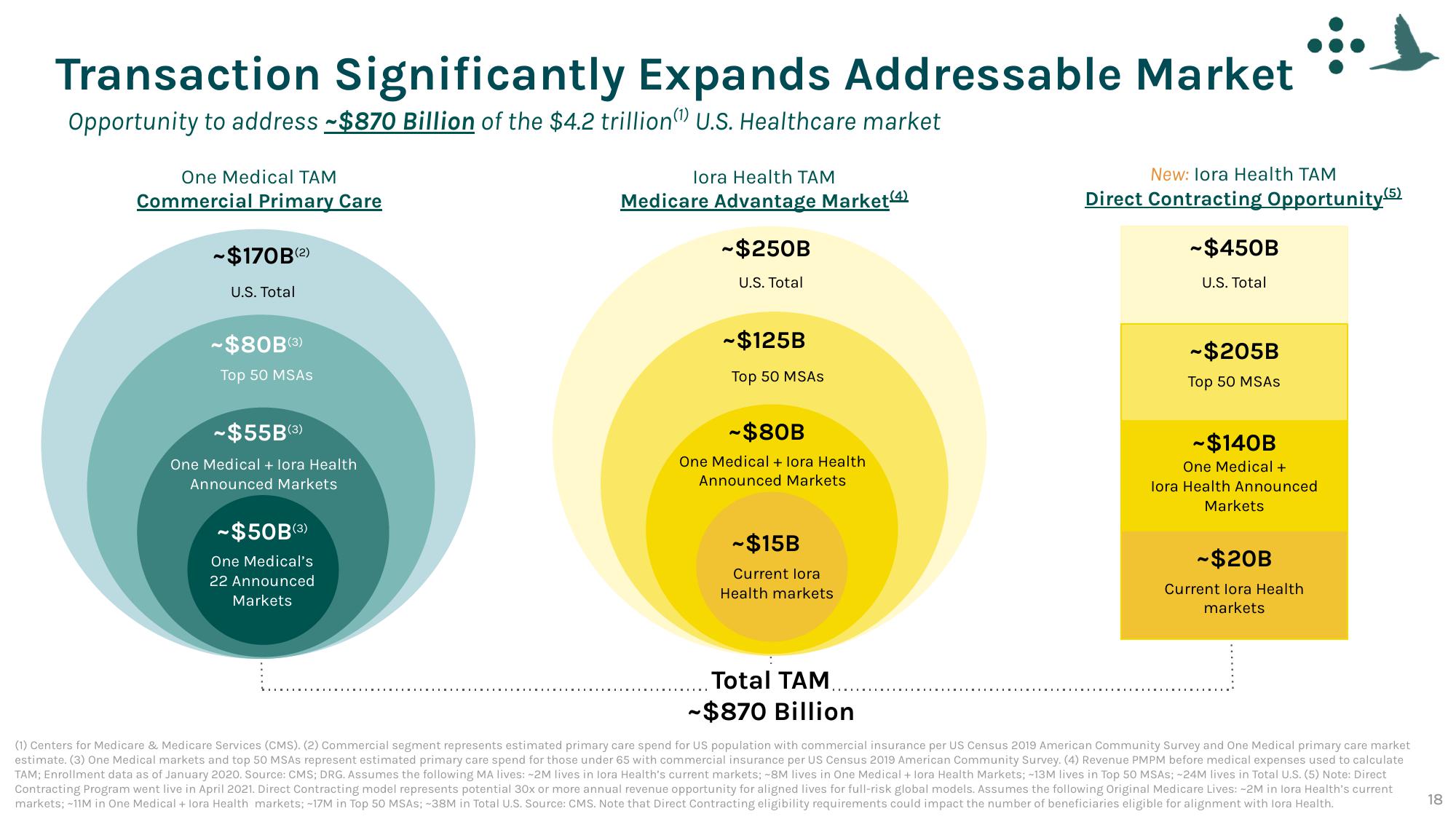

Transaction Significantly Expands Addressable Market

Opportunity to address ~$870 Billion of the $4.2 trillion (¹) U.S. Healthcare market

One Medical TAM

Commercial Primary Care

~$170B(2)

U.S. Total

~$80B(3)

Top 50 MSAS

~$55B(3)

One Medical + lora Health

Announced Markets

-$50B (3)

One Medical's.

22 Announced

Markets

lora Health TAM

Medicare Advantage Market¹4)

-$250B

U.S. Total

~$125B

Top 50 MSAS

-$80B

One Medical + lora Health

Announced Markets

~$15B

Current lora

Health markets

Total TAM

-$870 Billion

New: lora Health TAM

Direct Contracting Opportunity(5)

~$450B

U.S. Total

-$205B

Top 50 MSAS

~$140B

One Medical +

lora Health Announced

Markets

-$20B

Current lora Health

markets

(1) Centers for Medicare & Medicare Services (CMS). (2) Commercial segment represents estimated primary care spend for US population with commercial insurance per US Census 2019 American Community Survey and One Medical primary care market

estimate. (3) One Medical markets and top 50 MSAS represent estimated primary care spend for those under 65 with commercial insurance per US Census 2019 American Community Survey. (4) Revenue PMPM before medical expenses used to calculate

TAM; Enrollment data as of January 2020. Source: CMS; DRG. Assumes the following MA lives: -2M lives in lora Health's current markets; -8M lives in One Medical + lora Health Markets; -13M lives in Top 50 MSAS; -24M lives in Total U.S. (5) Note: Direct

Contracting Program went live in April 2021. Direct Contracting model represents potential 30x or more annual revenue opportunity for aligned lives for full-risk global models. Assumes the following Original Medicare Lives: -2M in lora Health's current

markets; -11M in One Medical + lora Health markets; -17M in Top 50 MSAS; -38M in Total U.S. Source: CMS. Note that Direct Contracting eligibility requirements could impact the number of beneficiaries eligible for alignment with lora Health.

18View entire presentation