J.P.Morgan Results Presentation Deck

Overview

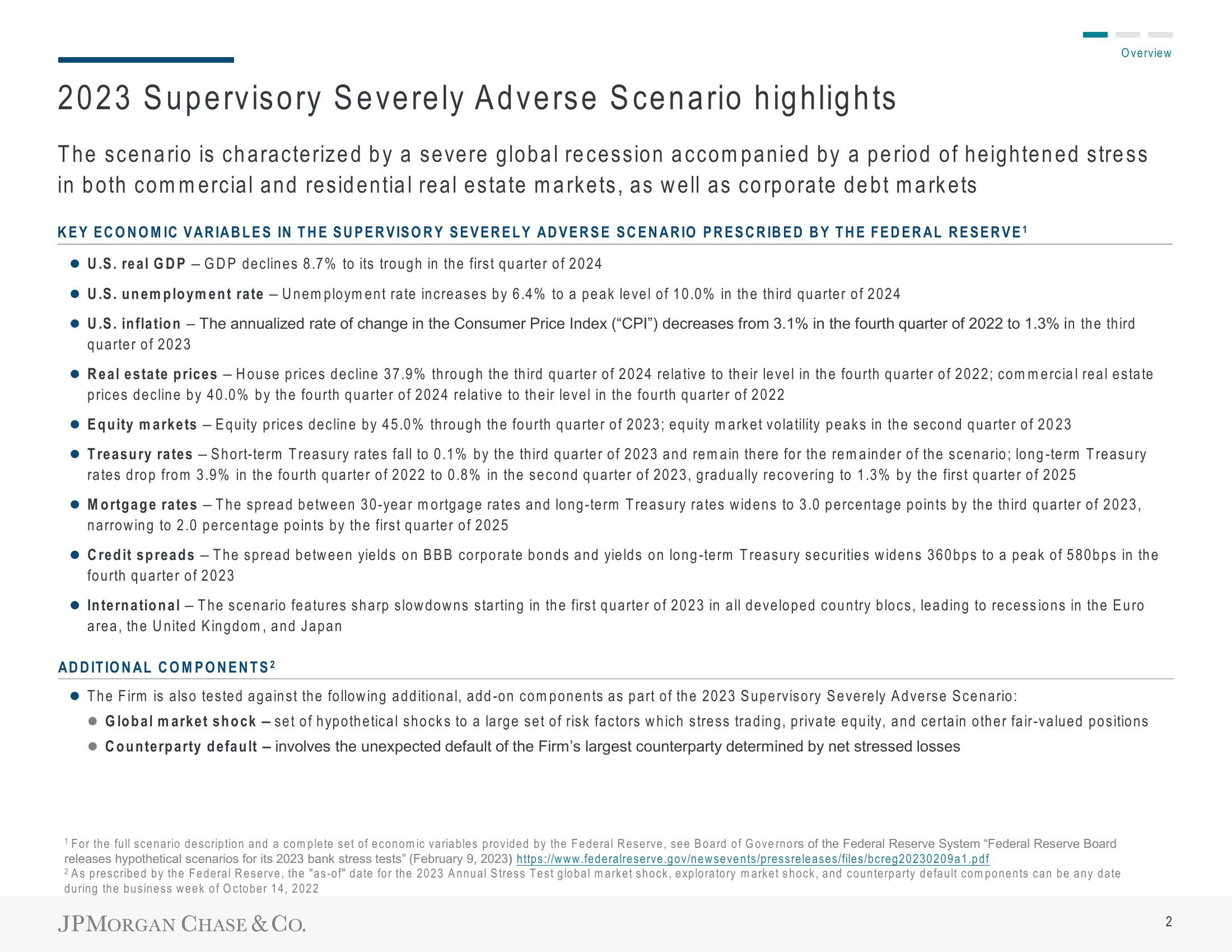

2023 Supervisory Severely Adverse Scenario highlights

The scenario is characterized by a severe global recession accompanied by a period of heightened stress

in both commercial and residential real estate markets, as well as corporate debt markets

KEY ECONOMIC VARIABLES IN THE SUPERVISORY SEVERELY ADVERSE SCENARIO PRESCRIBED BY THE FEDERAL RESERVE¹

● U.S. real GDP - GDP declines 8.7% to its trough in the first quarter of 2024

U.S. unemployment rate - Unemployment rate increases by 6.4% to a peak level of 10.0% in the third quarter of 2024

U.S. inflation - The annualized rate of change in the Consumer Price Index ("CPI") decreases from 3.1% in the fourth quarter of 2022 to 1.3% in the third

quarter of 2023

● Real estate prices - House prices decline 37.9% through the third quarter of 2024 relative to their level in the fourth quarter of 2022; commercial real estate

prices decline by 40.0% by the fourth quarter of 2024 relative to their level in the fourth quarter of 2022

• Equity markets - Equity prices decline by 45.0% through the fourth quarter of 2023; equity market volatility peaks in the second quarter of 2023

• Treasury rates - Short-term Treasury rates fall to 0.1% by the third quarter of 2023 and remain there for the remainder of the scenario; long-term Treasury

rates drop from 3.9% in the fourth quarter of 2022 to 0.8% in the second quarter of 2023, gradually recovering to 1.3% by the first quarter of 2025

• Mortgage rates - The spread between 30-year mortgage rates and long-term Treasury rates widens to 3.0 percentage points by the third quarter of 2023,

narrowing to 2.0 percentage points by the first quarter of 2025

● Credit spreads - The spread between yields on BBB corporate bonds and yields on long-term Treasury securities widens 360bps to a peak of 580bps in the

fourth quarter of 2023

International - The scenario features sharp slowdowns starting in the first quarter of 2023 in all developed country blocs, leading to recessions in the Euro

area, the United Kingdom, and Japan

ADDITIONAL COMPONENTS²

The Firm is also tested against the following additional, add-on components as part of the 2023 Supervisory Severely Adverse Scenario:

• Global market shock - set of hypothetical shocks to a large set risk factors which stress trading, private equity, and certain other fair-valued positions

Counterparty default - involves the unexpected default of the Firm's largest counterparty determined by net stressed losses

1 For the full scenario description and a complete set of economic variables provided by the Federal Reserve, see Board of Governors of the Federal Reserve System "Federal Reserve Board

releases hypothetical scenarios for its 2023 bank stress tests" (February 9, 2023) https://www.federalreserve.gov/newsevents/press releases/files/bcreg20230209a1.pdf

2 As prescribed by the Federal Reserve, the "as-of" date for the 2023 Annual Stress Test global market shock, exploratory market shock, and counterparty default components can be any date

during the business week of October 14, 2022

JPMORGAN CHASE & CO.

2View entire presentation