Hilltop Holdings Results Presentation Deck

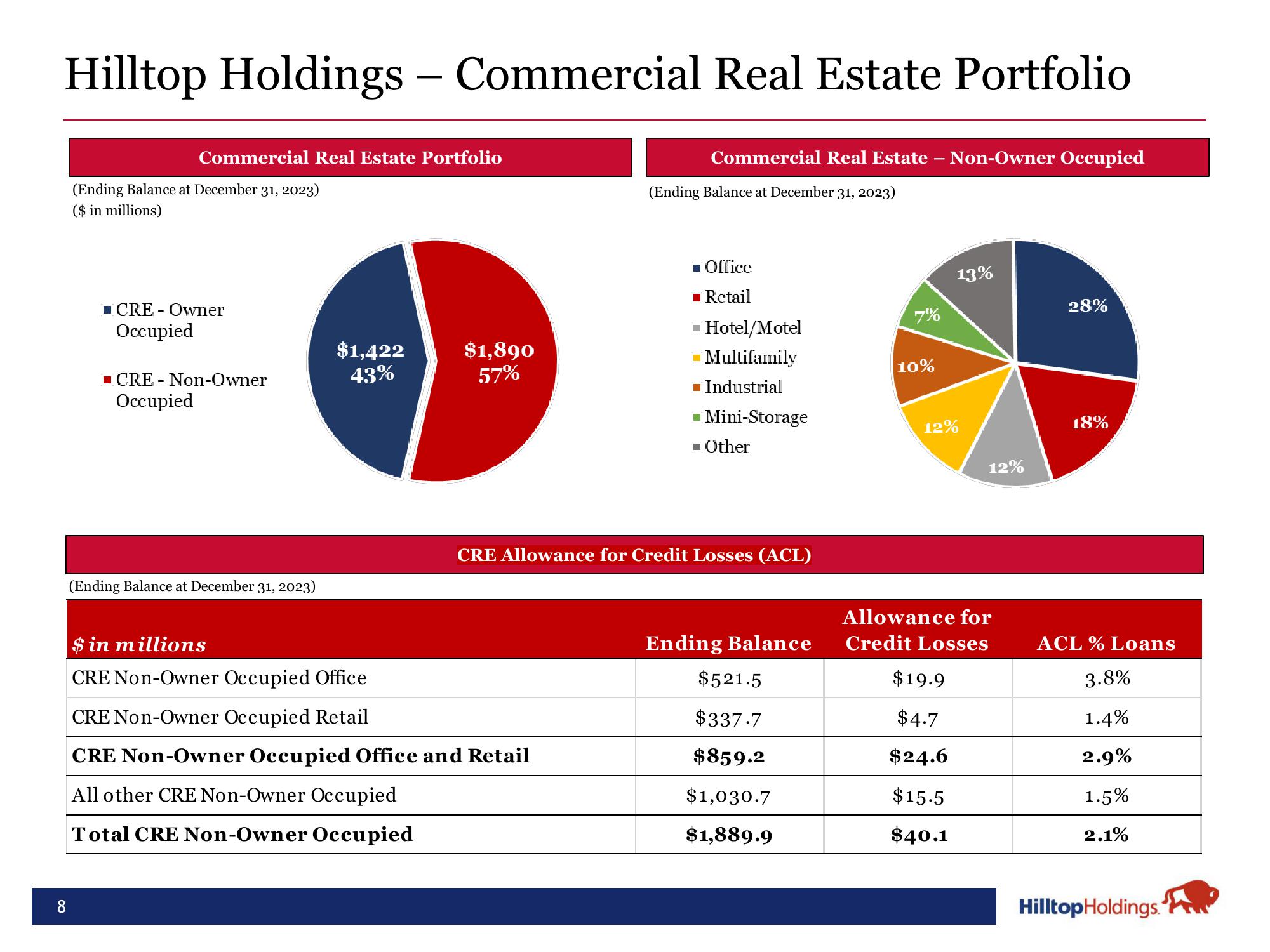

Hilltop Holdings - Commercial Real Estate Portfolio

8

Commercial Real Estate Portfolio

(Ending Balance at December 31, 2023)

($ in millions)

■CRE - Owner

Occupied

CRE- Non-Owner

Occupied

(Ending Balance at December 31, 2023)

$1,422

43%

$1,890

57%

Commercial Real Estate Non-Owner Occupied

in millions

CRE Non-Owner Occupied Office

CRE Non-Owner Occupied Retail

CRE Non-Owner Occupied Office and Retail

All other CRE Non-Owner Occupied

Total CRE Non-Owner Occupied

(Ending Balance at December 31, 2023)

■ Office

■ Retail

■ Hotel/Motel

-Multifamily

■Industrial

■Mini-Storage

■ Other

CRE Allowance for Credit Losses (ACL)

Ending Balance

$521.5

$337.7

$859.2

$1,030.7

$1,889.9

7%

10%

12%

13%

$19.9

$4.7

$24.6

Allowance for

Credit Losses

$15.5

$40.1

12%

28%

18%

ACL % Loans

3.8%

1.4%

2.9%

1.5%

2.1%

Hilltop Holdings.View entire presentation