Credit Suisse Investment Banking Pitch Book

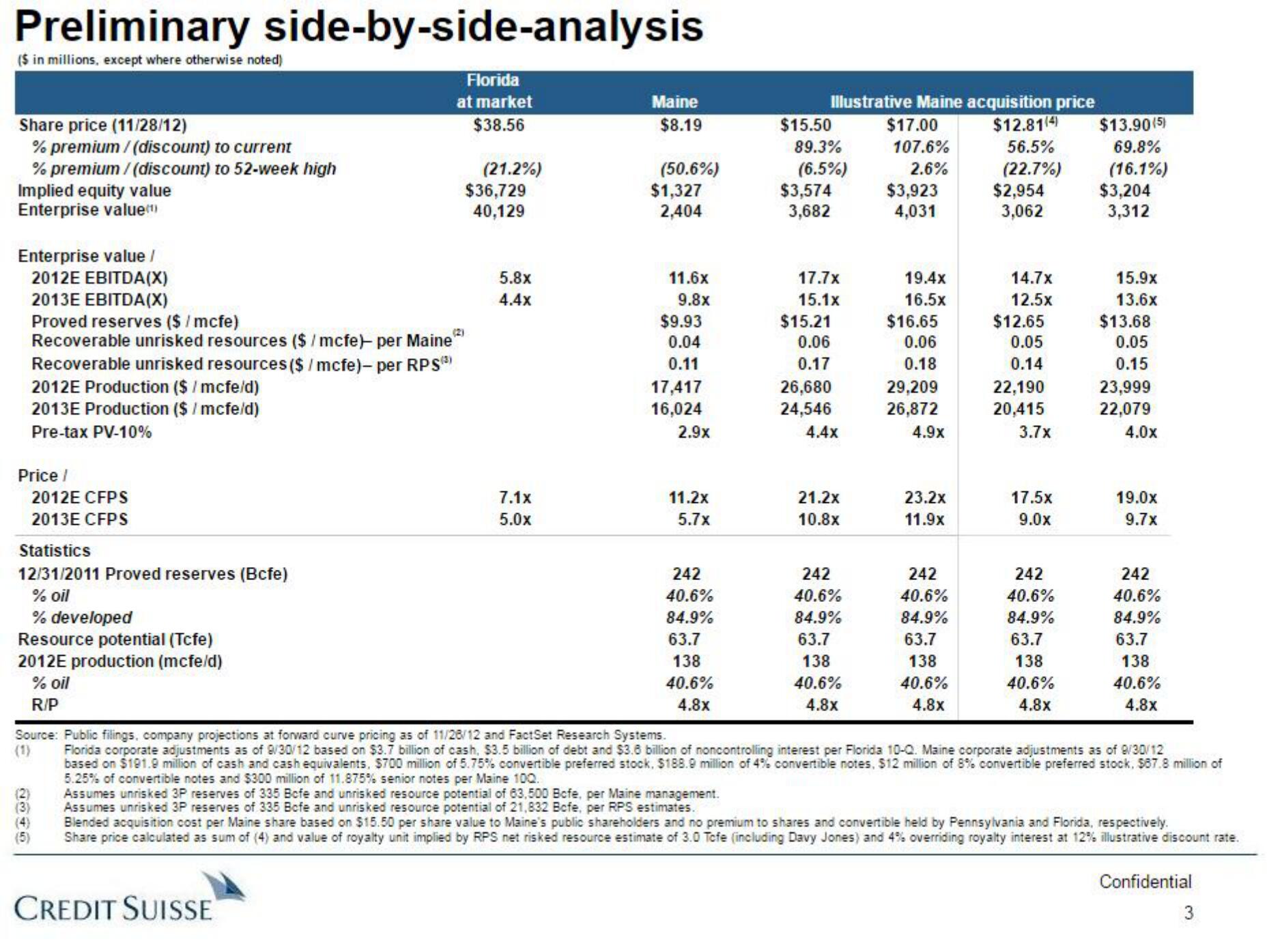

Preliminary side-by-side-analysis

($ in millions, except where otherwise noted)

Share price (11/28/12)

% premium/(discount) to current

% premium/(discount) to 52-week high

Implied equity value

Enterprise value

Enterprise value /

2012E EBITDA(X)

2013E EBITDA(X)

Proved reserves ($/mcfe)

Recoverable unrisked resources ($/mcfe)- per Maine

Recoverable unrisked resources ($/mcfe)- per RPS(3)

2012E Production ($/mcfe/d)

2013E Production ($/mcfe/d)

Pre-tax PV-10%

Price /

2012E CFPS

2013E CFPS

Statistics

12/31/2011 Proved reserves (Bcfe)

% oil

% developed

Resource potential (Tcfe)

2012E production (mcfe/d)

% oil

R/P

(3)

(5)

Florida

at market

$38.56

(21.2%)

CREDIT SUISSE

$36,729

40,129

5.8x

4.4x

7.1x

5.0x

Maine

$8.19

(50.6%)

$1,327

2,404

11.6x

9.8x

$9.93

0.04

0.11

17,417

16,024

2.9x

11.2x

5.7x

242

40.6%

84.9%

63.7

138

40.6%

4.8x

Illustrative Maine acquisition price

$15.50

89.3%

(6.5%)

$3,574

3,682

17.7x

15.1x

$15.21

0.06

0.17

26,680

24,546

4.4x

21.2x

10.8x

242

40.6%

84.9%

63.7

138

40.6%

4.8x

$17.00

107.6%

2.6%

$3,923

4,031

19.4x

16.5x

$16.65

0.06

0.18

29,209

26,872

4.9x

23.2x

11.9x

242

40.6%

84.9%

63.7

138

40.6%

4.8x

$12.81(4) $13.90(5)

56.5%

69.8%

(22.7%)

(16.1%)

$2,954

3,062

14.7x

12.5x

$12.65

0.05

0.14

22,190

20,415

3.7x

17.5x

9.0x

242

40.6%

84.9%

63.7

138

40.6%

4.8x

$3,204

3,312

15.9x

13.6x

$13.68

0.05

0.15

23,999

22,079

4.0x

19.0x

9.7x

Source: Public filings, company projections at forward curve pricing as of 11/28/12 and FactSet Research Systems.

(1) Florida corporate adjustments as of 9/30/12 based on $3.7 billion of cash, $3.5 billion of debt and $3.8 billion of noncontrolling interest per Florida 10-Q. Maine corporate adjustments as of 9/30/12

based on $191.9 million of cash and cash equivalents, $700 million of 5.75% convertible preferred stock, $188.9 million of 4% convertible notes, $12 million of 8% convertible preferred stock, $87.8 million of

5.25% of convertible notes and $300 million of 11.875% senior notes per Maine 100.

Assumes unrisked 3P reserves of 335 Befe and unrisked resource potential of 63,500 Bofe, per Maine management.

Assumes unrisked 3P reserves of 335 Bofe and unrisked resource potential of 21,832 Befe, per RPS estimates.

242

40.6%

84.9%

63.7

138

40.6%

4.8x

Blended acquisition cost per Maine share based on $15.50 per share value to Maine's public shareholders and no premium to shares and convertible held by Pennsylvania and Florida, respectively.

Share price calculated as sum of (4) and value of royalty unit implied by RPS net risked resource estimate of 3.0 Tcfe (including Davy Jones) and 4% overriding royalty interest at 12% illustrative discount rate.

Confidential

3View entire presentation