Advent Capital Balanced Strategy Update

BALANCED STRATEGY

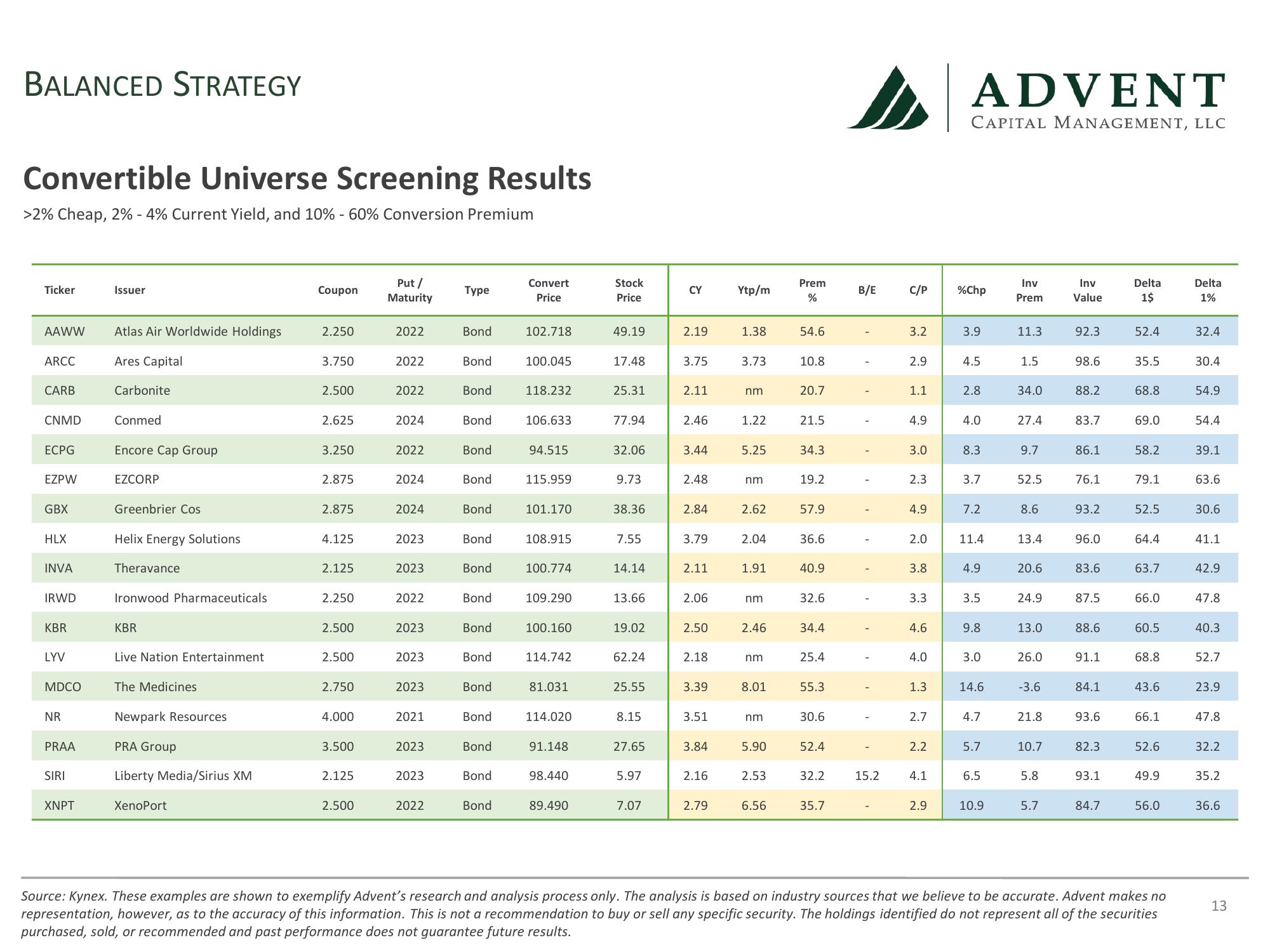

Convertible Universe Screening Results

>2% Cheap, 2% -4% Current Yield, and 10% - 60% Conversion Premium

Ticker

AAWW

ARCC

CARB

CNMD

ECPG

EZPW

GBX

HLX

INVA

IRWD

KBR

LYV

MDCO

NR

PRAA

SIRI

XNPT

Issuer

Atlas Air Worldwide Holdings

Ares Capital

Carbonite

Conmed

Encore Cap Group

EZCORP

Greenbrier Cos

Helix Energy Solutions.

Theravance

Ironwood Pharmaceuticals

KBR

Live Nation Entertainment

The Medicines

Newpark Resources

PRA Group

Liberty Media/Sirius XM

XenoPort

Coupon

2.250

3.750

2.500

2.625

3.250

2.875

2.875

4.125

2.125

2.250

2.500

2.500

2.750

4.000

3.500

2.125

2.500

Put /

Maturity

2022

2022

2022

2024

2022

2024

2024

2023

2023

2022

2023

2023

2023

2021

2023

2023

2022

Type

Bond

Bond

Bond

Bond

Bond

Bond

Bond

Bond

Bond

Bond

Bond

Bond

Bond

Bond

Bond

Bond

Bond

Convert

Price

102.718

100.045

118.232

106.633

94.515

115.959

101.170

108.915

100.774

109.290

100.160

114.742

81.031

114.020

91.148

98.440

89.490

Stock

Price

49.19

17.48

25.31

77.94

32.06

9.73

38.36

7.55

14.14

13.66

19.02

62.24

25.55

8.15

27.65

5.97

7.07

CY

2.19

3.75

2.11

2.46

3.44

2.48

2.84

3.79

2.11

2.06

2.50

2.18

3.39

3.51

3.84

2.16

2.79

Ytp/m

1.38

3.73

nm

1.22

5.25

nm

2.62

2.04

1.91

nm

2.46

nm

8.01

nm

5.90

2.53

6.56

Prem

%

54.6

10.8

20.7

21.5

34.3

19.2

57.9

36.6

40.9

32.6

34.4

25.4

55.3

30.6

52.4

32.2

35.7

B/E

1

1

15.2

C/P

3.2

2.9

1.1

4.9

3.0

2.3

4.9

2.0

3.8

3.3

4.6

4.0

1.3.

2.7

2.2

4.1

2.9

ADVENT

CAPITAL MANAGEMENT, LLC

%Chp

3.9

4.5

2.8

4.0

8.3

3.7

7.2

11.4

4.9

3.5

9.8

3.0

14.6

4.7

5.7

6.5

10.9

Inv

Prem

11.3

1.5

34.0

27.4

9.7

52.5

8.6

13.4

20.6

24.9

13.0

26.0

-3.6

21.8

10.7

5.8

5.7

Inv

Value

92.3

98.6

88.2

83.7

86.1

76.1

93.2

96.0

83.6

87.5

88.6

91.1

84.1

93.6

82.3

93.1

84.7

Delta

1$

52.4

35.5

68.8

69.0

58.2

79.1

52.5

64.4

63.7

66.0

60.5

68.8

43.6

66.1

52.6

49.9

56.0

Source: Kynex. These examples are shown to exemplify Advent's research and analysis process only. The analysis is based on industry sources that we believe to be accurate. Advent makes no

representation, however, as to the accuracy of this information. This is not a recommendation to buy or sell any specific security. The holdings identified do not represent all of the securities

purchased, sold, or recommended and past performance does not guarantee future results.

Delta

1%

32.4

30.4

54.9

54.4

39.1

63.6

30.6

41.1

42.9

47.8

40.3

52.7

23.9

47.8

32.2

35.2

36.6

13View entire presentation