Snap Inc Results Presentation Deck

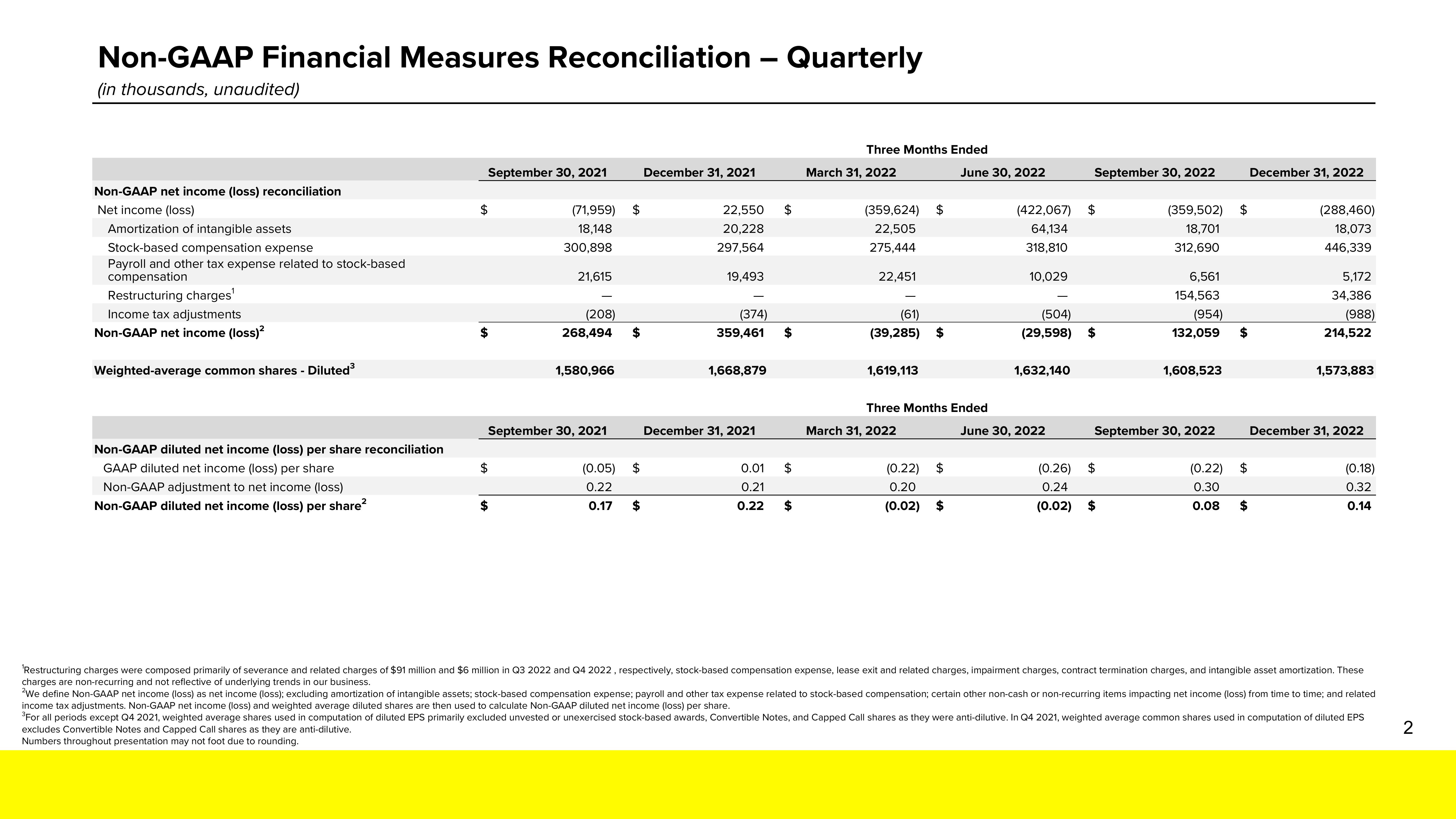

Non-GAAP Financial Measures Reconciliation - - Quarterly

(in thousands, unaudited)

Non-GAAP net income (loss) reconciliation

Net income (loss)

Amortization of intangible assets

Stock-based compensation expense

Payroll and other tax expense related to stock-based

compensation

Restructuring charges¹

Income tax adjustments

Non-GAAP net income (loss)²

Weighted-average common shares - Diluted³

Non-GAAP diluted net income (loss) per share reconciliation

GAAP diluted net income (loss) per share

Non-GAAP adjustment to net income (loss)

Non-GAAP diluted net income (loss) per share²

September 30, 2021

$

$

$

(71,959) $

18,148

300,898

$

21,615

(208)

268,494 $

September 30, 2021

1,580,966

(0.05)

0.22

0.17

$

$

December 31, 2021

22,550

20,228

297,564

19,493

(374)

359,461

1,668,879

December 31, 2021

0.01

0.21

0.22

$

$

$

$

Three Months Ended

June 30, 2022

March 31, 2022

(359,624)

22,505

275,444

22,451

(61)

(39,285) $

1,619,113

$

Three Months Ended

March 31, 2022

(0.22) $

0.20

(0.02)

$

(422,067)

64,134

318,810

10,029

1,632,140

September 30, 2022

(504)

(29,598) $

June 30, 2022

$

$

(359,502)

18,701

312,690

(0.26)

0.24

(0.02) $

September 30, 2022

6,561

154,563

(954)

132,059 $

1,608,523

$

(0.22)

0.30

0.08

$

$

December 31, 2022

(288,460)

18,073

446,339

5,172

34,386

(988)

214,522

1,573,883

December 31, 2022

(0.18)

0.32

0.14

'Restructuring charges were composed primarily of severance and related charges of $91 million and $6 million in Q3 2022 and Q4 2022, respectively, stock-based compensation expense, lease exit and related charges, impairment charges, contract termination charges, and intangible asset amortization. These

charges are non-recurring and not reflective of underlying trends in our business.

"We define Non-GAAP net income (loss) as net income (loss); excluding amortization of intangible assets; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; certain other non-cash or non-recurring items impacting net income (loss) from time to time; and related

income tax adjustments. Non-GAAP net income (loss) and weighted average diluted shares are then used to calculate Non-GAAP diluted net income (loss) per share.

³For all periods except Q4 2021, weighted average shares used in computation of diluted EPS primarily excluded unvested or unexercised stock-based awards, Convertible Notes, and Capped Call shares as they were anti-dilutive. In Q4 2021, weighted average common shares used in computation of diluted EPS

excludes Convertible Notes and Capped Call shares as they are anti-dilutive.

Numbers throughout presentation may not foot due to rounding.

2View entire presentation