Greenlight Company Presentation

iPrefs Would Be Very Safe, Even at This Scale

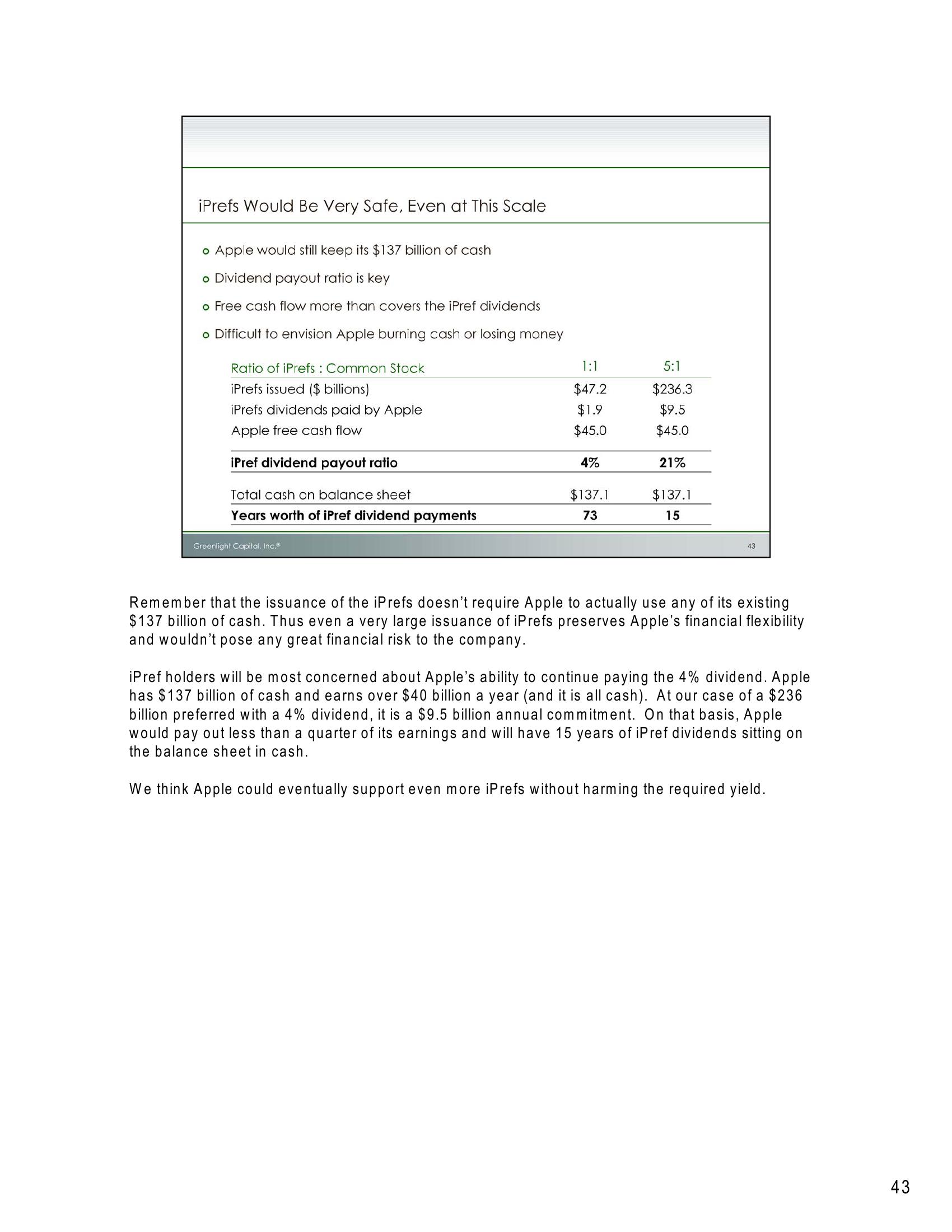

o Apple would still keep its $137 billion of cash

o Dividend payout ratio is key

o Free cash flow more than covers the iPref dividends

o Difficult to envision Apple burning cash or losing money

Ratio of iPrefs : Common Stock

iPrefs issued ($ billions)

iPrefs dividends paid by Apple

Apple free cash flow

iPref dividend payout ratio

Total cash on balance sheet

Years worth of iPref dividend payments

Greenlight Capital, Inc.

1:1

$47.2

$1.9

$45.0

4%

$137.1

73

5:1

$236.3

$9.5

$45.0

21%

$137.1

15

43

Remember that the issuance of the iPrefs doesn't require Apple to actually use any of its existing

$137 billion of cash. Thus even a very large issuance of iPrefs preserves Apple's financial flexibility

and wouldn't pose any great financial risk to the company.

iPref holders will be most concerned about Apple's ability to continue paying the 4% dividend. Apple

has $137 billion of cash and earns over $40 billion a year (and it is all cash). At our case of a $236

billion preferred with a 4% dividend, it is a $9.5 billion annual commitment. On that basis, Apple

would pay out less than a quarter of its earnings and will have 15 years of iPref dividends sitting on

the balance sheet in cash.

We think Apple could eventually support even more iPrefs without harming the required yield.

43View entire presentation