Main Street Capital Fixed Income Presentation Deck

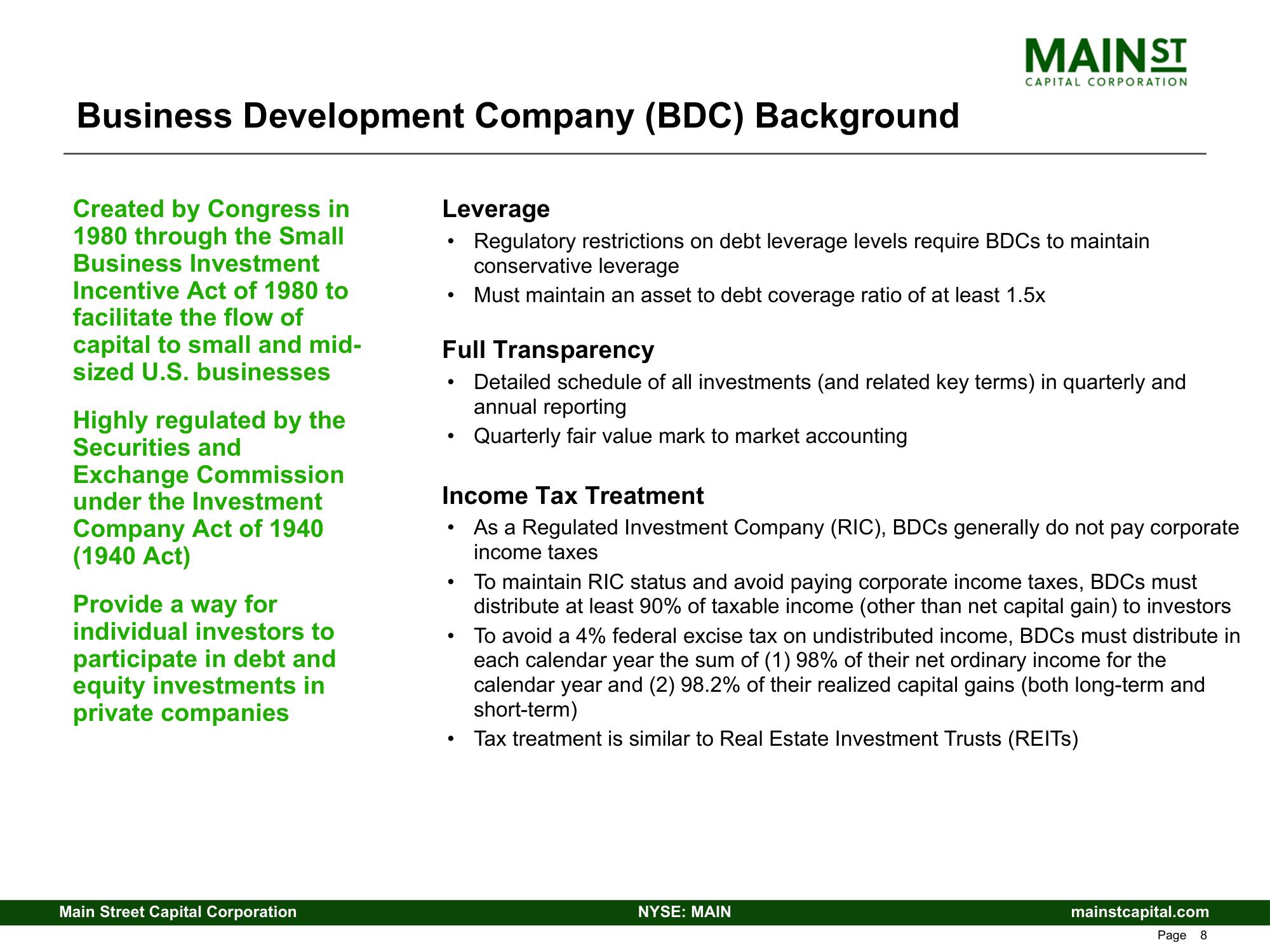

Business Development Company (BDC) Background

Created by Congress in

1980 through the Small

Business Investment

Incentive Act of 1980 to

facilitate the flow of

capital to small and mid-

sized U.S. businesses

Highly regulated by the

Securities and

Exchange Commission

under the Investment

Company Act of 1940

(1940 Act)

Provide a way for

individual investors to

participate in debt and

equity investments in

private companies

Main Street Capital Corporation

Leverage

Regulatory restrictions on debt leverage levels require BDCs to maintain

conservative leverage

Must maintain an asset to debt coverage ratio of at least 1.5x

●

Full Transparency

Detailed schedule of all investments (and related key terms) in quarterly and

annual reporting

Quarterly fair value mark to market accounting

●

●

Income Tax Treatment

As a Regulated Investment Company (RIC), BDCs generally do not pay corporate

income taxes

●

MAIN ST

CAPITAL CORPORATION

●

●

To maintain RIC status and avoid paying corporate income taxes, BDCs must

distribute at least 90% of taxable income (other than net capital gain) to investors

To avoid a 4% federal excise tax on undistributed income, BDCs must distribute in

each calendar year the sum of (1) 98% of their net ordinary income for the

calendar year and (2) 98.2% of their realized capital gains (both long-term and

short-term)

Tax treatment is similar to Real Estate Investment Trusts (REITS)

NYSE: MAIN

mainstcapital.com

Page 8View entire presentation