Expanding Retail Access to Private Markets

Expanding Retail Investor Access to Private Markets

PE Funds Facilitate Access to Private Companies

Private equity funds provide access to companies that are not public.

Retail investors are increasingly looking for opportunities to outperform the public market, including through

investment in private companies.

●

Studies by Harris et al. show that private equity buyout funds have generally outperformed public markets. This

has major implications for the potential returns to retail investors and retirees from private equity funds.

●

Studies of private equity performance consistently find that private equity funds outperform public market

alternatives, while providing diversification, lower volatility and protection in times of market stress

●

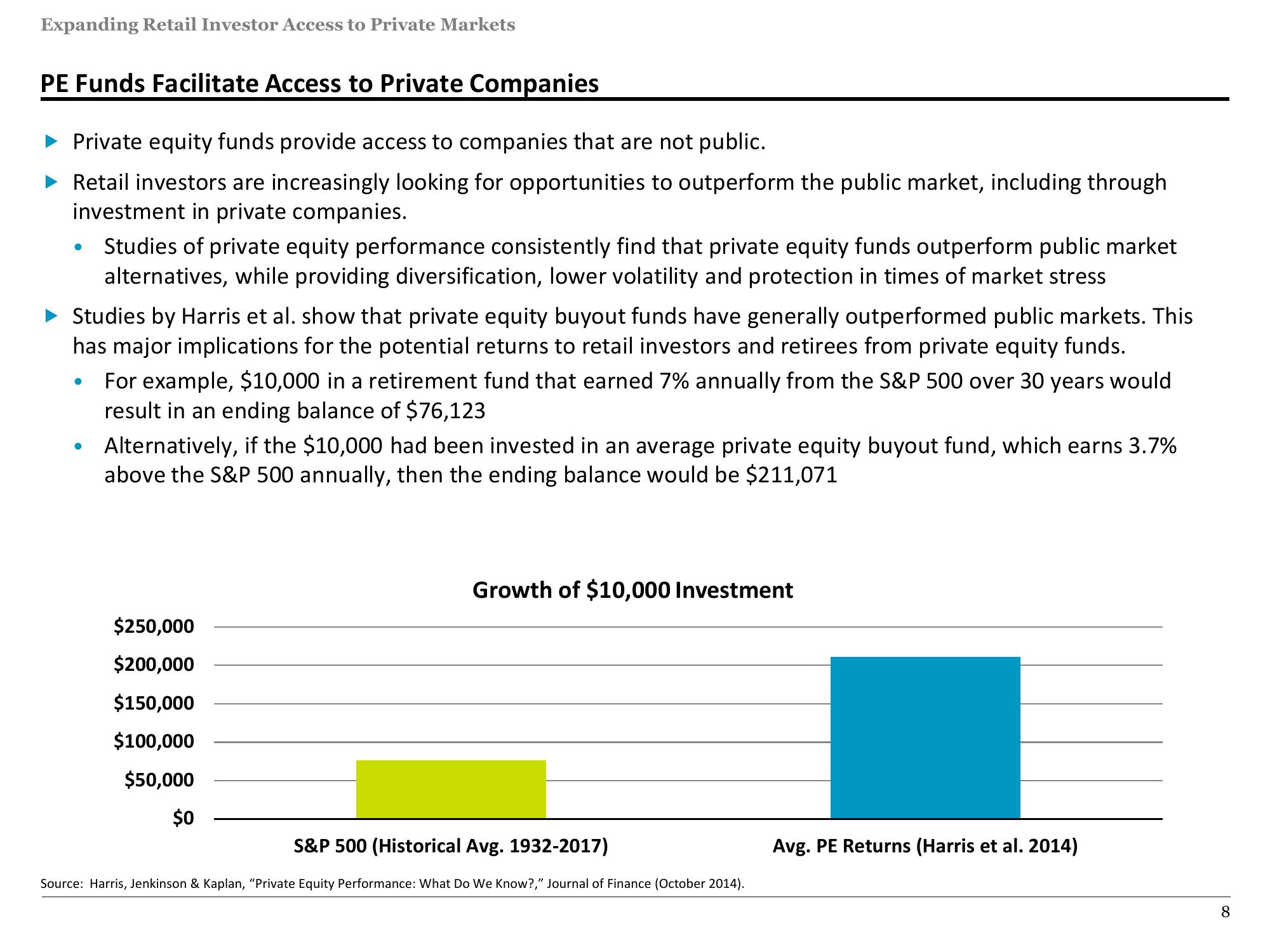

For example, $10,000 in a retirement fund that earned 7% annually from the S&P 500 over 30 years would

result in an ending balance of $76,123

Alternatively, if the $10,000 had been invested in an average private equity buyout fund, which earns 3.7%

above the S&P 500 annually, then the ending balance would be $211,071

$250,000

$200,000

$150,000

$100,000

$50,000

$0

Growth of $10,000 Investment

S&P 500 (Historical Avg. 1932-2017)

Source: Harris, Jenkinson & Kaplan, "Private Equity Performance: What Do We Know?," Journal of Finance (October 2014).

Avg. PE Returns (Harris et al. 2014)

8View entire presentation