Baird Investment Banking Pitch Book

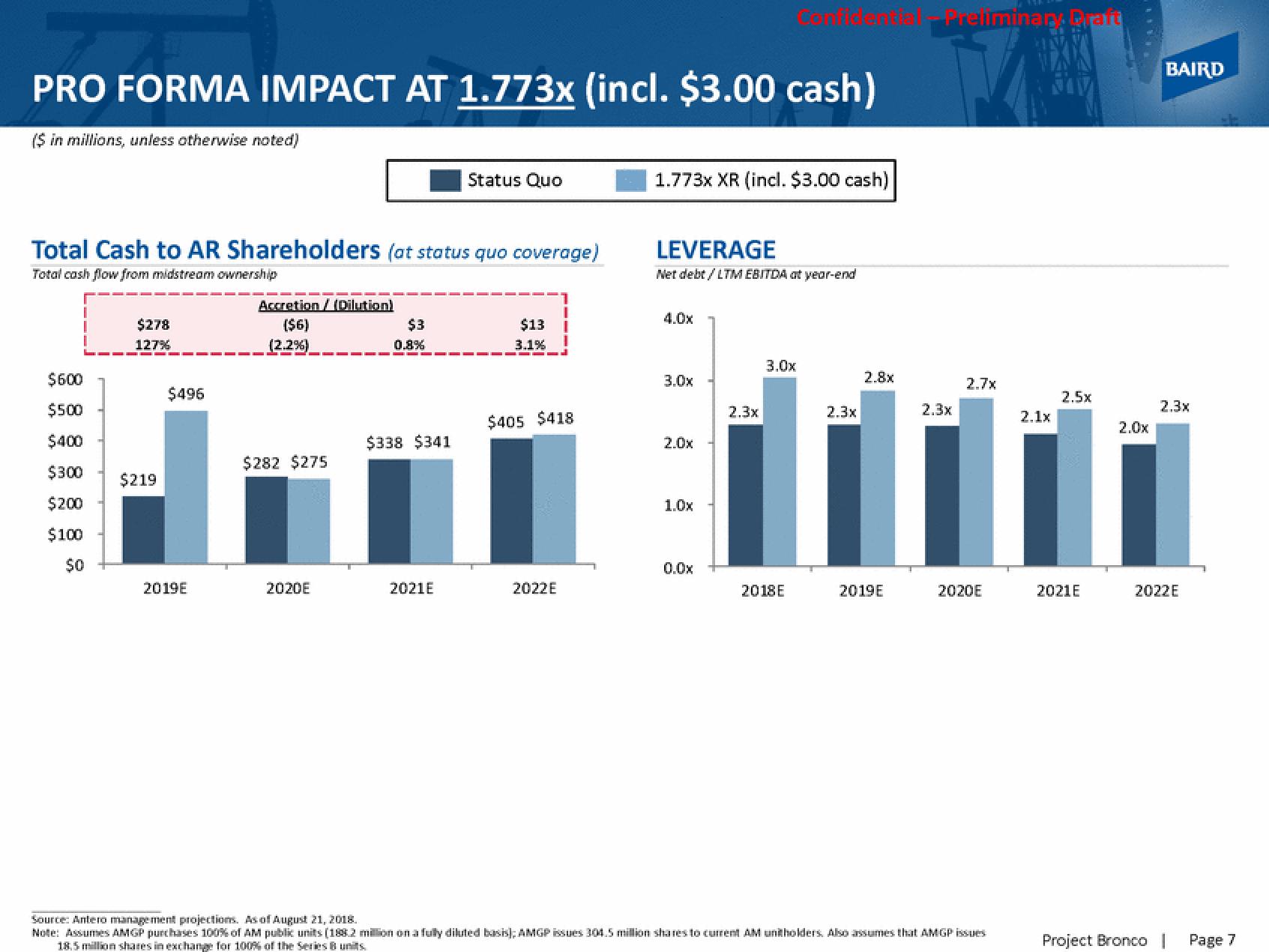

PRO FORMA IMPACT AT 1.773x (incl. $3.00 cash)

($ in millions, unless otherwise noted)

Total Cash to AR Shareholders (at status quo coverage)

Total cash flow from midstream ownership

$600

$5.00

$400

$300

$200

$100

$0

$278

127%

$219

$496

2019E

Accretion / (Dilution)

($6)

(2.2%)

$282 $275

2020E

$3

0.8%

Status Quo

$338 $341

▬▬▬▬▬▬▬▬▬▬▬▬▬▬-L

2021E

$13

3.1%

$405 $418

2022E

1.773x XR (incl. $3.00 cash)

LEVERAGE

Net debt/LTM EBITDA at year-end

4.0x

3.0x

2.0x

1.0x

0.0x

2.3x

3.0x

2018E

2.3x

2.8x

2019E

Trellminar Draft

2.3x

2.7x

2020E

Source: Antero management projections. As of August 21, 2018.

Note: Assumes AMGP purchases 100% of AM public units (188.2 million on a fully diluted basis); AMGP issues 304.5 million shares to current AM unitholders. Also assumes that AMGP issues

18.5 million shares in exchange for 100% of the Series 8 units.

2.1x

2.5x

2021E

2.0x

BAIRD

Project Bronco

2.3x

2022E

Page 7View entire presentation