KinderCare IPO Presentation Deck

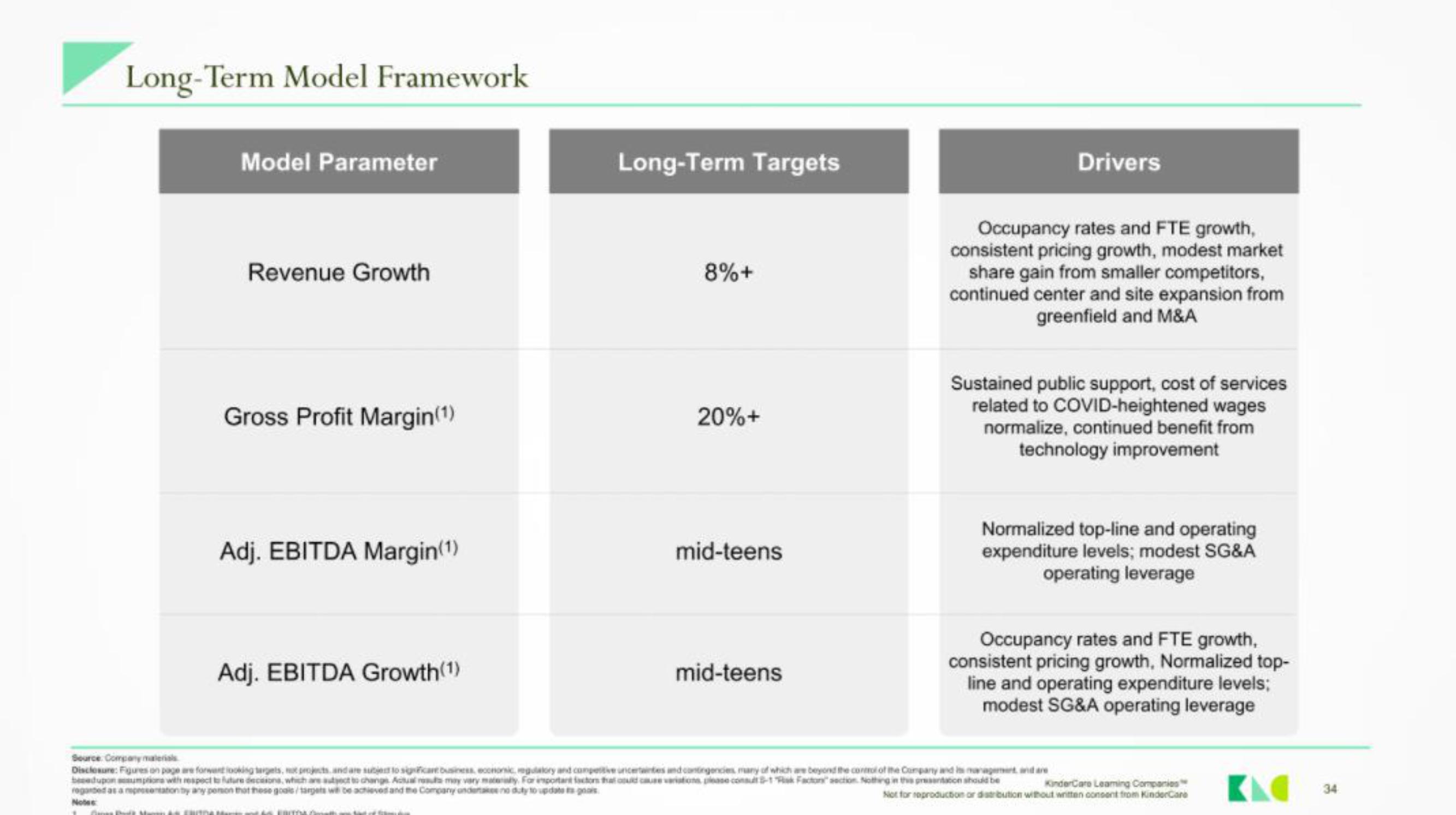

Long-Term Model Framework

Model Parameter

Revenue Growth

Gross Profit Margin(¹)

Adj. EBITDA Margin(¹)

Adj. EBITDA Growth(1)

Long-Term Targets

EBITDA math

8%+

20%+

mid-teens

mid-teens

Drivers

Occupancy rates and FTE growth,

consistent pricing growth, modest market

share gain from smaller competitors,

continued center and site expansion from

greenfield and M&A

Sustained public support, cost of services

related to COVID-heightened wages

normalize, continued benefit from

technology improvement

Normalized top-line and operating

expenditure levels; modest SG&A

operating leverage

Occupancy rates and FTE growth,

consistent pricing growth, Normalized top-

line and operating expenditure levels;

modest SG&A operating leverage

Source Company materials

Disclosure: Figures on page are forwart looking targets, not projects, and are subject to significant business, economic, regulatory and competitive uncertainties and contingencies, many of which are beyond the control of the Company and in management, and are

beadupon assumptions with respect to future decisions, which are subject to change Actual rus may vary materially. For important factors that could cause variations, please consult-1 Rak Facton" section. Nothing in this presentation should be

KinderCare Leaming Companies

regarded as a representation by any person that these goals/targets we be achieved and the Company undertakes no duty to update gas

Not for reproduction or distribution without written consent from KinderCare

Note:

34View entire presentation