Crocs Investor Presentation Deck

NON-GAAP RECONCILIATION

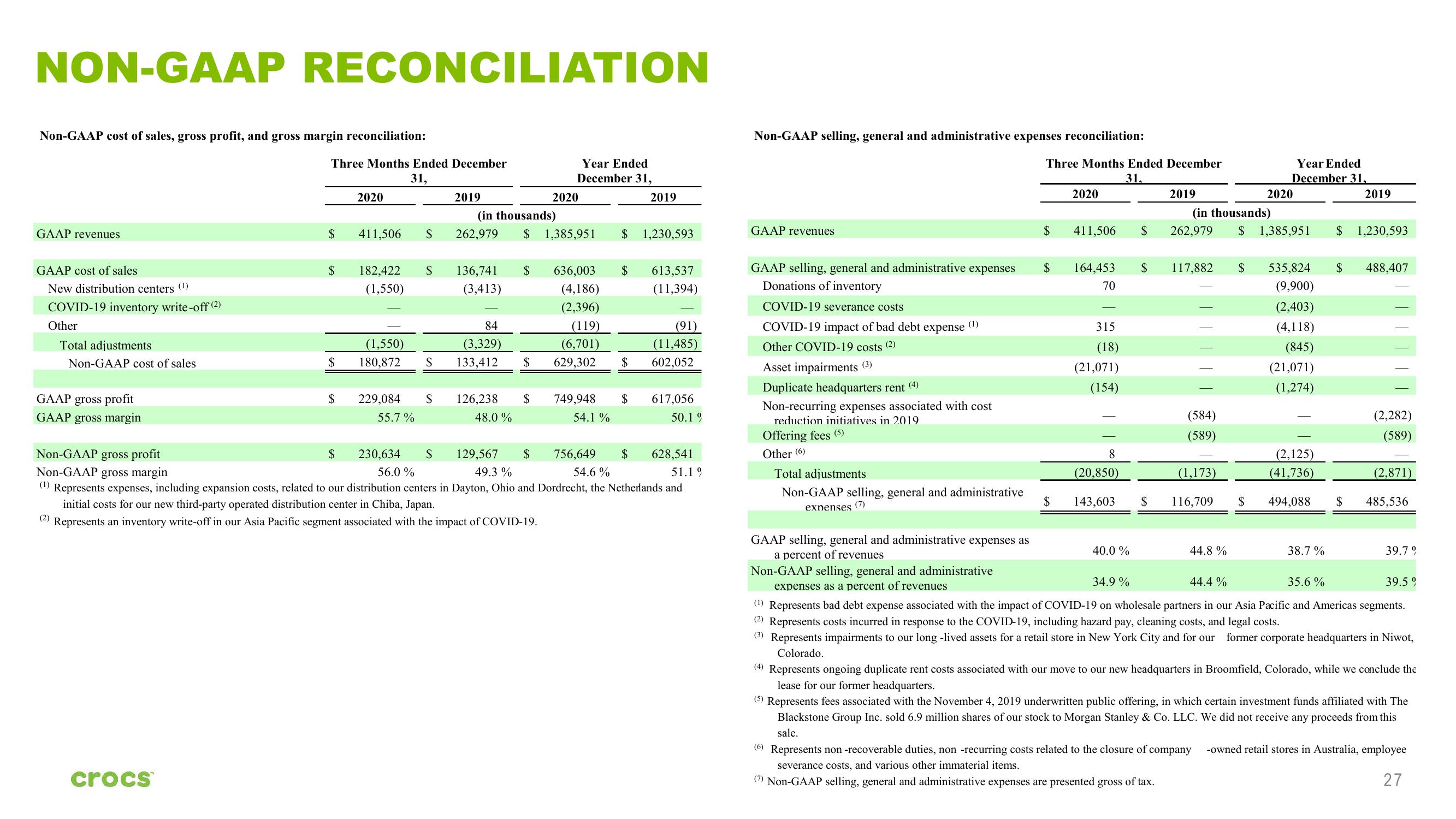

Non-GAAP cost of sales, gross profit, and gross margin reconciliation:

GAAP revenues

GAAP cost of sales

New distribution centers (1)

COVID-19 inventory write-off (2)

Other

Total adjustments

Non-GAAP cost of sales

GAAP gross profit

GAAP gross margin

Non-GAAP gross profit

Non-GAAP gross margin

(2)

Three Months Ended December

31,

crocs™

$

$

$

2020

$

411,506

182,422

(1,550)

$

(1,550)

$ 180,872 $

$

229,084 $

55.7%

2019

(in thousands)

262,979 $ 1,385,951

136,741

(3,413)

Year Ended

December 31,

84

(3,329)

133,412 $

$ 636,003

(4,186)

(2,396)

(119)

(6,701)

629,302

126,238 $

48.0 %

2020

749,948

54.1 %

$ 1,230,593

$

$

2019

$

613,537

(11,394)

230,634 $

56.0 %

129,567 $

49.3 %

756,649 $

54.6%

51.19

(1) Represents expenses, including expansion costs, related to our distribution centers in Dayton, Ohio and Dordrecht, the Netherlands and

initial costs for our new third-party operated distribution center in Chiba, Japan.

Represents an inventory write-off in our Asia Pacific segment associated with the impact of COVID-19.

(91)

(11,485)

602,052

617,056

50.1 %

628,541

Non-GAAP selling, general and administrative expenses reconciliation:

GAAP revenues

GAAP selling, general and administrative expenses

Donations of inventory

COVID-19 severance costs

COVID-19 impact of bad debt expense (1)

Other COVID-19 costs (2)

Asset impairments (3)

(4)

Duplicate headquarters rent

Non-recurring expenses associated with cost

reduction initiatives in 2019

Offering fees (5)

Other (6)

Total adjustments

GAAP selling, general and administrative expenses as

a percent of revenues

Non-GAAP selling, general and administrative

expenses (7)

Non-GAAP selling, general and administrative

expenses as a percent of revenues

(5)

(6)

Three Months Ended December

31,

$

$

$

2020

411,506

164,453

70

315

(18)

(21,071)

(154)

8

(20,850)

143,603

40.0 %

$

$

$

117,882 $

2019

(in thousands)

262,979 $ 1,385,951

(584)

(589)

(1,173)

116,709

44.8%

Year Ended

December 31.

2019

2020

Represents non-recoverable duties, non -recurring costs related to the closure of company

severance costs, and various other immaterial items.

(7) Non-GAAP selling, general and administrative expenses are presented gross of tax.

535,824

(9,900)

(2,403)

(4,118)

(845)

(21,071)

(1,274)

$ 1,230,593

38.7%

$ 488,407

(2,125)

(41,736)

$ 494,088 $

(2,282)

(589)

34.9%

44.4%

35.6%

39.5 9

(¹) Represents bad debt expense associated with the impact of COVID-19 on wholesale partners in our Asia Pacific and Americas segments.

(2) Represents costs incurred in response to the COVID-19, including hazard pay, cleaning costs, and legal costs.

(3) Represents impairments to our long -lived assets for a retail store in New York City and for our former corporate headquarters in Niwot,

Colorado.

(2,871)

485,536

(4) Represents ongoing duplicate rent costs associated with our move to our new headquarters in Broomfield, Colorado, while we conclude the

lease for our former headquarters.

Represents fees associated with the November 4, 2019 underwritten public offering, in which certain investment funds affiliated with The

Blackstone Group Inc. sold 6.9 million shares of our stock to Morgan Stanley & Co. LLC. We did not receive any proceeds from this

sale.

-owned retail stores in Australia, employee

27

39.79View entire presentation