HSBC ESG Presentation Deck

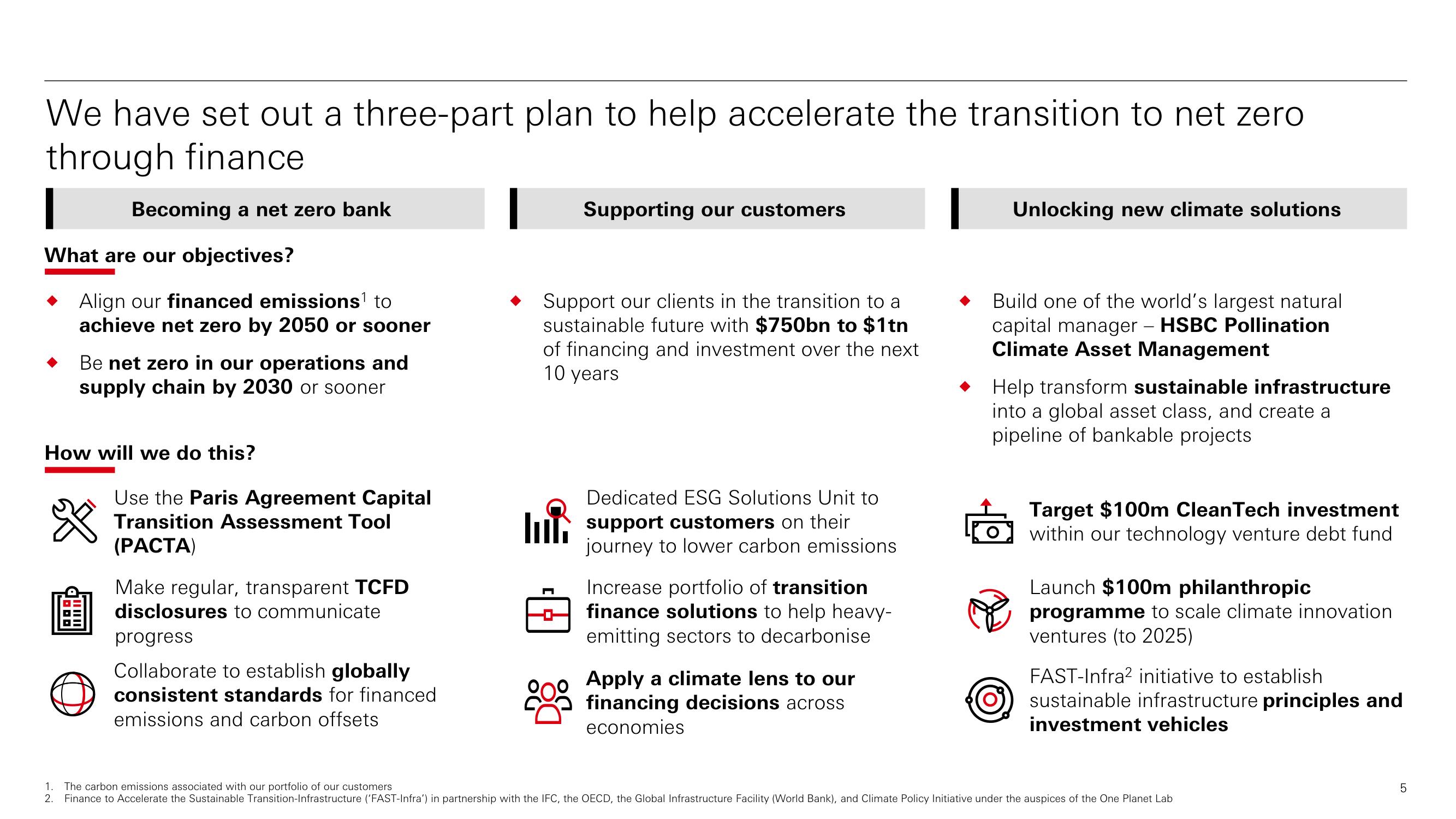

We have set out a three-part plan to help accelerate the transition to net zero

through finance

Becoming a net zero bank

|

What are our objectives?

Align our financed emissions¹ to

achieve net zero by 2050 or sooner

Be net zero in our operations and

supply chain by 2030 or sooner

How will we do this?

☆

Use the Paris Agreement Capital

Transition Assessment Tool

(PACTA)

Make regular, transparent TCFD

disclosures to communicate

progress

Collaborate to establish globally

consistent standards for financed

emissions and carbon offsets

Supporting our customers

Support our clients in the transition to a

sustainable future with $750bn to $1tn

of financing and investment over the next

10 years

Dedicated ESG Solutions Unit to

support customers on their

journey to lower carbon emissions

Increase portfolio of transition

finance solutions to help heavy-

emitting sectors to decarbonise

Apply a climate lens to our

financing decisions across

economies

Unlocking new climate solutions

Build one of the world's largest natural

capital manager - HSBC Pollination

Climate Asset Management

Help transform sustainable infrastructure

into a global asset class, and create a

pipeline of bankable projects

B

Target $100m CleanTech investment

within our technology venture debt fund

Launch $100m philanthropic

programme to scale climate innovation

ventures (to 2025)

FAST-Infra² initiative to establish

sustainable infrastructure principles and

investment vehicles

1. The carbon emissions associated with our portfolio of our customers

2. Finance to Accelerate the Sustainable Transition-Infrastructure ('FAST-Infra') in partnership with the IFC, the OECD, the Global Infrastructure Facility (World Bank), and Climate Policy Initiative under the auspices of the One Planet Lab

10

5View entire presentation