Blackwells Capital Activist Presentation Deck

■

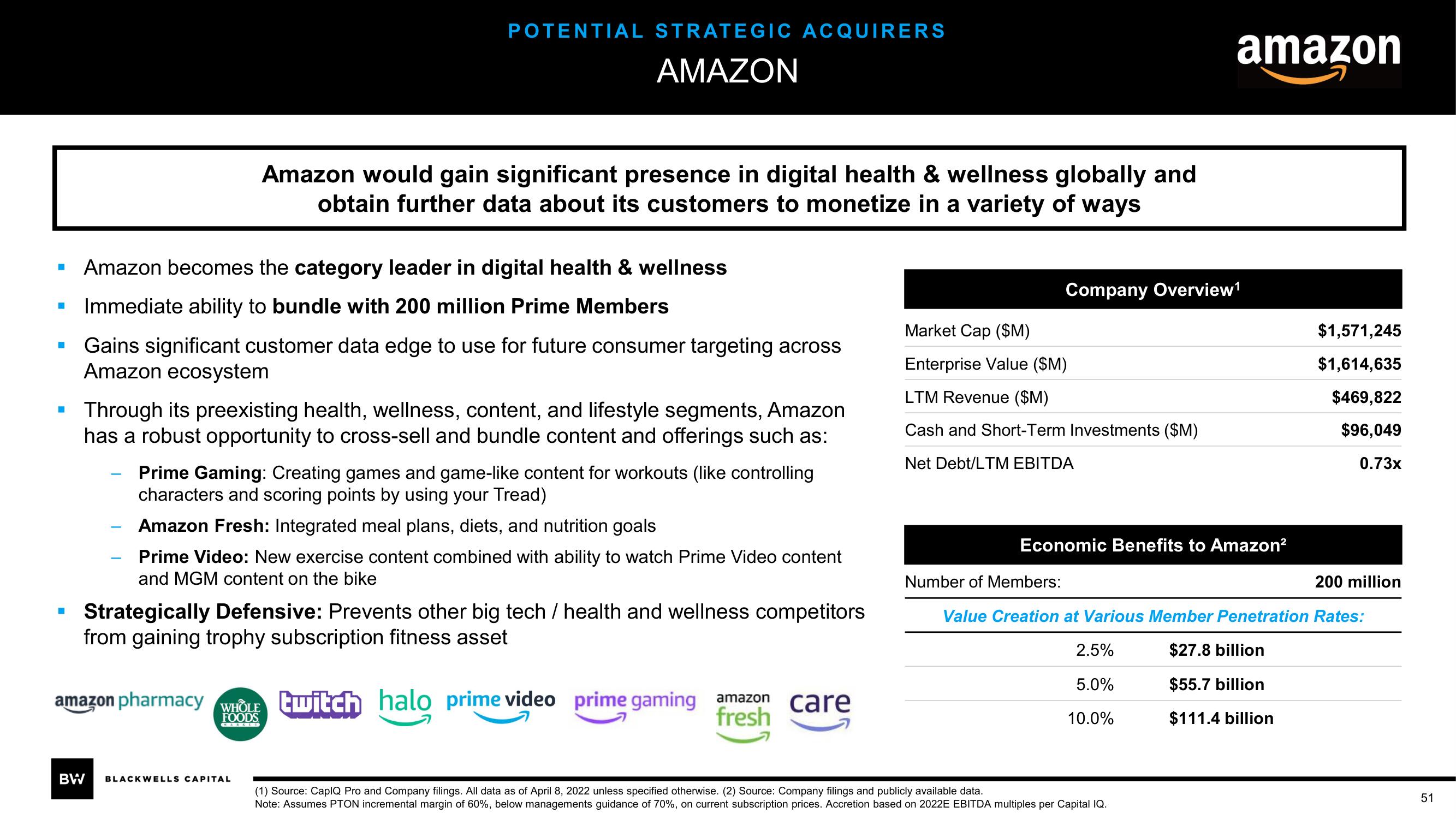

Amazon becomes the category leader in digital health & wellness

Immediate ability to bundle with 200 million Prime Members

Gains significant customer data edge to use for future consumer targeting across

Amazon ecosystem

-

Through its preexisting health, wellness, content, and lifestyle segments, Amazon

has a robust opportunity to cross-sell and bundle content and offerings such as:

-

POTENTIAL STRATEGIC ACQUIRERS

AMAZON

Amazon would gain significant presence in digital health & wellness globally and

obtain further data about its customers to monetize in a variety of ways

Prime Gaming: Creating games and game-like content for workouts (like controlling

characters and scoring points by using your Tread)

Amazon Fresh: Integrated meal plans, diets, and nutrition goals

Prime Video: New exercise content combined with ability to watch Prime Video content

and MGM content on the bike

amazon pharmacy

Strategically Defensive: Prevents other big tech / health and wellness competitors

from gaining trophy subscription fitness asset

WHOLE

FOODS

MARKET

BW BLACKWELLS CAPITAL

twitch halo prime video prime gaming amazon care

fresh

Company Overview¹

Market Cap ($M)

Enterprise Value ($M)

LTM Revenue ($M)

Cash and Short-Term Investments ($M)

Net Debt/LTM EBITDA

amazon

Economic Benefits to Amazon²

2.5%

5.0%

10.0%

Number of Members:

200 million

Value Creation at Various Member Penetration Rates:

$27.8 billion

$55.7 billion

$111.4 billion

(1) Source: CapIQ Pro and Company filings. All data as of April 8, 2022 unless specified otherwise. (2) Source: Company filings and publicly available data.

Note: Assumes PTON incremental margin of 60%, below managements guidance of 70%, on current subscription prices. Accretion based on 2022E EBITDA multiples per Capital IQ.

$1,571,245

$1,614,635

$469,822

$96,049

0.73x

51View entire presentation