First Busey Results Presentation Deck

4Q23 Earnings Investor Presentation

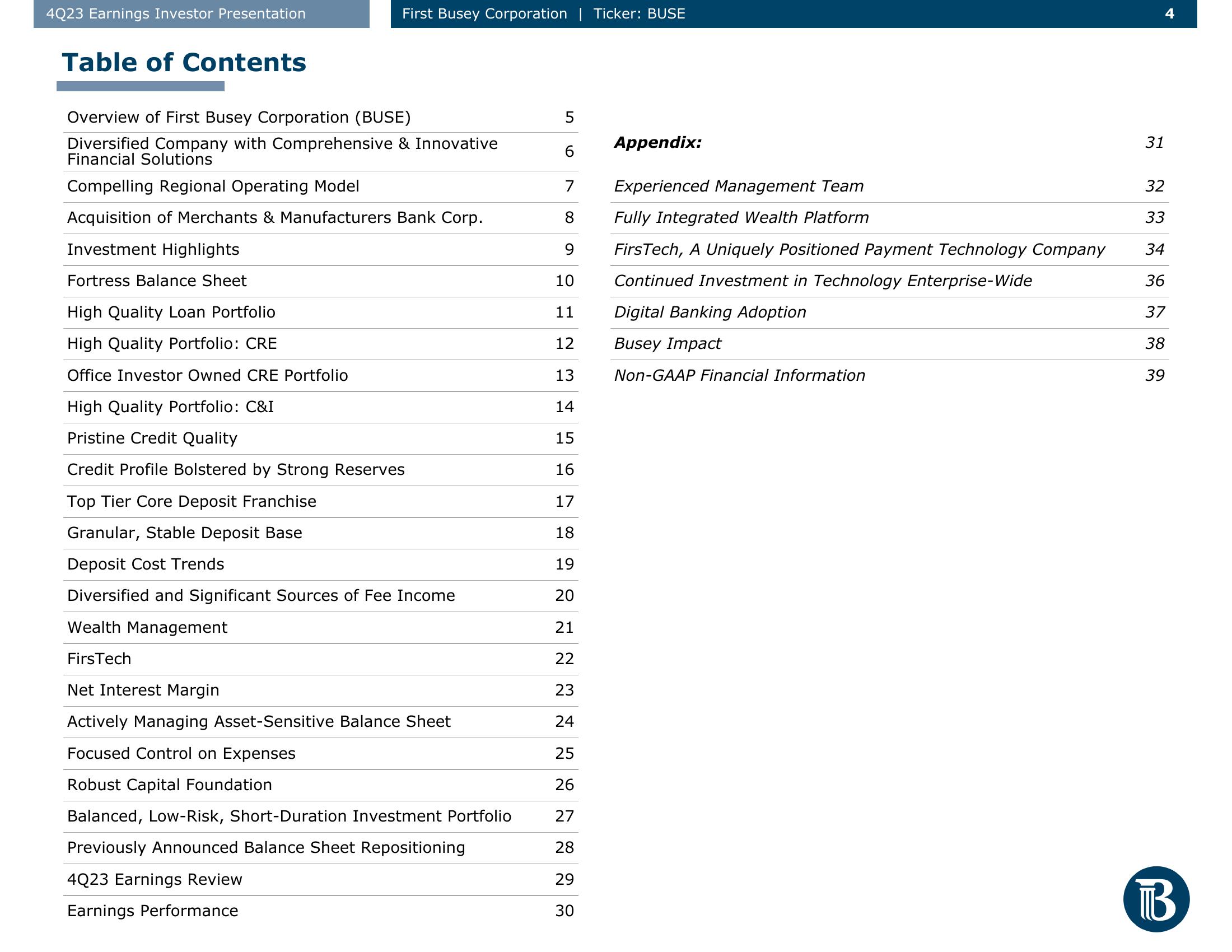

Table of Contents

First Busey Corporation | Ticker: BUSE

Overview of First Busey Corporation (BUSE)

Diversified Company with Comprehensive & Innovative

Financial Solutions

Compelling Regional Operating Model

Acquisition of Merchants & Manufacturers Bank Corp.

Investment Highlights

Fortress Balance Sheet

High Quality Loan Portfolio

High Quality Portfolio: CRE

Office Investor Owned CRE Portfolio

High Quality Portfolio: C&I

Pristine Credit Quality

Credit Profile Bolstered by Strong Reserves

Top Tier Core Deposit Franchise

Granular, Stable Deposit Base

Deposit Cost Trends

Diversified and Significant Sources of Fee Income

Wealth Management

FirsTech

Net Interest Margin

Actively Managing Asset-Sensitive Balance Sheet

Focused Control on Expenses

Robust Capital Foundation

Balanced, Low-Risk, Short-Duration Investment Portfolio

Previously Announced Balance Sheet Repositioning

4Q23 Earnings Review

Earnings Performance

6

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

Appendix:

Experienced Management Team

Fully Integrated Wealth Platform

FirsTech, A Uniquely Positioned Payment Technology Company

Continued Investment in Technology Enterprise-Wide

Digital Banking Adoption

Busey Impact

Non-GAAP Financial Information

31

32

33

34

36

37

38

39

BView entire presentation