Bank of America Results Presentation Deck

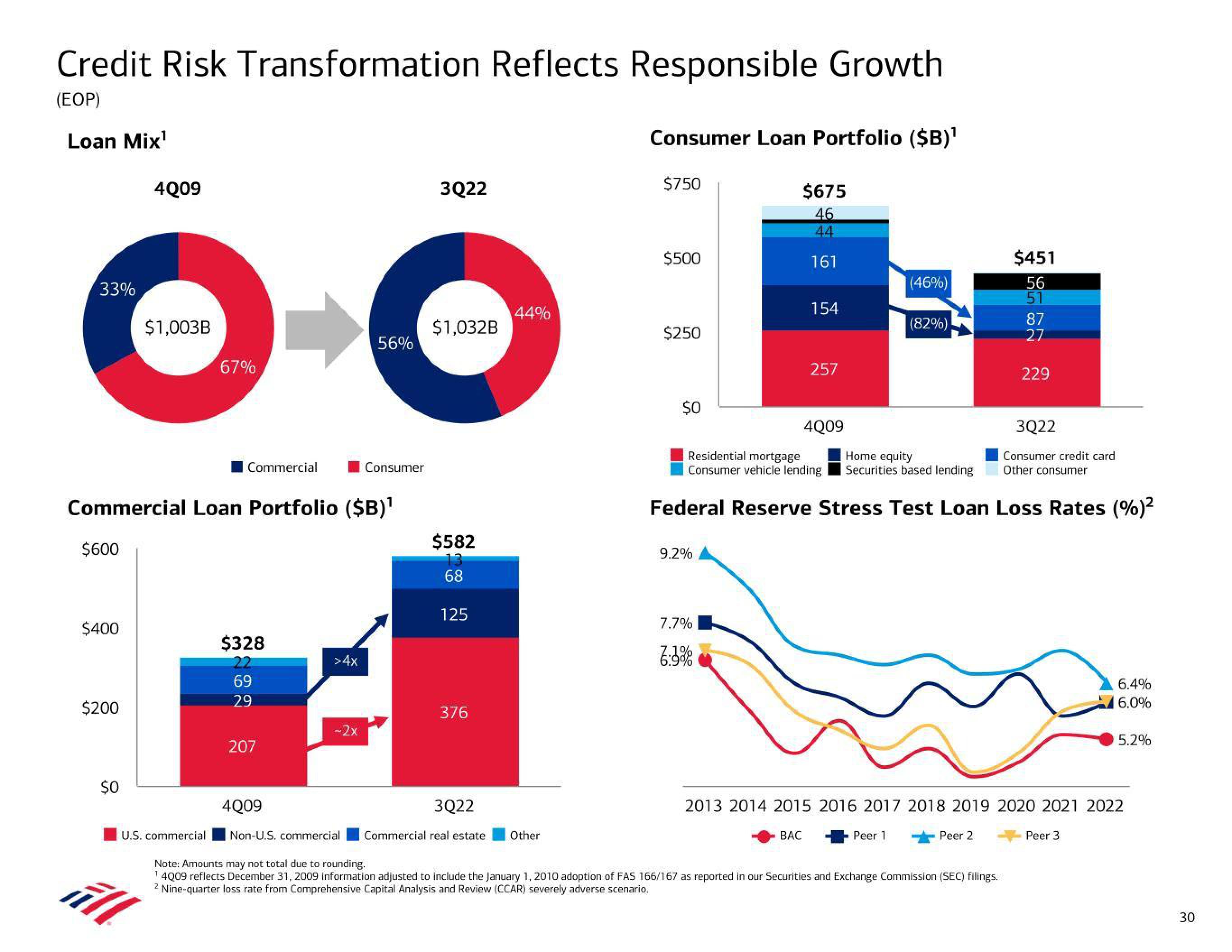

Credit Risk Transformation Reflects Responsible Growth

(EOP)

Loan Mix¹

33%

$600

$400

$200

4Q09

$0

$1,003B

Commercial Loan Portfolio ($B)¹

67%

Commercial

U.S. commercial

$328

22

69

29

207

>4x

56%

-2x

Consumer

3Q22

$1,032B

$582

13

68

125

376

3Q22

44%

Commercial real estate

Consumer Loan Portfolio ($B)¹

Other

$750

$500

$250

$0

9.2%

$675

46

44

161

7.7%

154

7:3%

257

Residential mortgage

Consumer vehicle lending

4Q09

4Q09

Non-U.S. commercial

Note: Amounts may not total due to rounding.

¹4009 reflects December 31, 2009 information adjusted to include the January 1, 2010 adoption of FAS 166/167 as reported in our Securities and Exchange Commission (SEC) filings.

2 Nine-quarter loss rate from Comprehensive Capital Analysis and Review (CCAR) severely adverse scenario.

(46%)

(82%)

Home equity

Securities based lending

Federal Reserve Stress Test Loan Loss Rates (%)²

Peer 1

$451

56

87

27

Peer 2

229

3Q22

Consumer credit card

Other consumer

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

BAC

6.4%

6.0%

Peer 3

5.2%

30View entire presentation