AngloAmerican Results Presentation Deck

FOOTNOTES

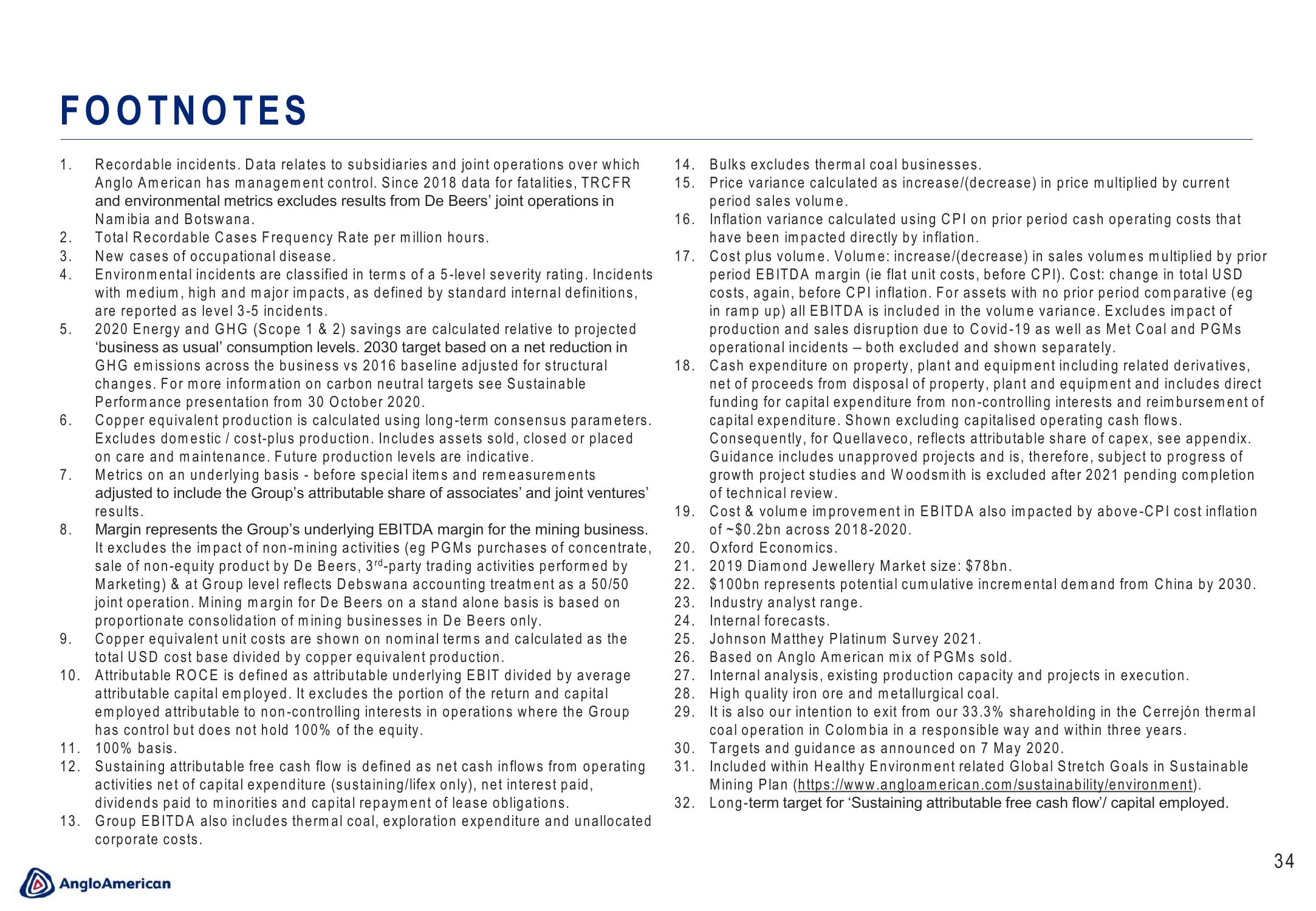

Recordable incidents. Data relates to subsidiaries and joint operations over which

Anglo American has management control. Since 2018 data for fatalities, TRCFR

and environmental metrics excludes results from De Beers' joint operations in

Namibia and Botswana.

1.

2.

3.

4.

5.

6.

7.

8.

Total Recordable Cases Frequency Rate per million hours.

New cases of occupational disease.

Margin represents the Group's underlying EBITDA margin for the mining business.

It excludes the impact of non-mining activities (eg PGMs purchases of concentrate,

sale of non-equity product by De Beers, 3rd-party trading activities performed by

Marketing) & at Group level reflects Debswana accounting treatment as a 50/50

joint operation. Mining margin for De Beers on a stand alone basis is based on

proportionate consolidation of mining businesses in De Beers only.

Copper equivalent unit costs are shown on nominal terms and calculated as the

total USD cost base divided by copper equivalent production.

10. Attributable ROCE is defined as attributable underlying EBIT divided by average

attributable capital employed. It excludes the portion of the return and capital

employed attributable to non-controlling interests in operations where the Group

has control but does not hold 100% of the equity.

11. 100% basis.

9.

Environmental incidents are classified in terms of a 5-level severity rating. Incidents

with medium, high and major impacts, as defined by standard internal definitions,

are reported as level 3-5 incidents.

2020 Energy and GHG (Scope 1 & 2) savings are calculated relative to projected

'business as usual' consumption levels. 2030 target based on a net reduction in

GHG emissions across the business vs 2016 baseline adjusted for structural

changes. For more information on carbon neutral targets see Sustainable

Performance presentation from 30 October 2020.

Copper equivalent production is calculated using long-term consensus parameters.

Excludes domestic / cost-plus production. Includes assets sold, closed or placed

on care and maintenance. Future production levels are indicative.

Metrics on an underlying basis - before special items and remeasurements

adjusted to include the Group's attributable share of associates' and joint ventures'

results.

12. Sustaining attributable free cash flow is defined as net cash inflows from operating

activities net of capital expenditure (sustaining/lifex only), net interest paid,

dividends paid to minorities and capital repayment of lease obligations.

13. Group EBITDA also includes thermal coal, exploration expenditure and unallocated

corporate costs.

Anglo American

14. Bulks excludes thermal coal businesses.

15.

Price variance calculated as increase/(decrease) in price multiplied by current

period sales volume.

16.

17.

Cost plus volume. Volume: increase/(decrease) in sales volumes multiplied by prior

period EBITDA margin (ie flat unit costs, before CPI). Cost: change in total USD

costs, again, before CPI inflation. For assets with no prior period comparative (eg

in ramp up) all EBITDA is included in the volume variance. Excludes impact of

production and sales disruption due to Covid-19 as well as Met Coal and PGMs

operational incidents - both excluded and shown separately.

18. Cash expenditure on property, plant and equipment including related derivatives,

net of proceeds from disposal of property, plant and equipment and includes direct

funding for capital expenditure from non-controlling interests and reimbursement of

capital expenditure. Shown excluding capitalised operating cash flows.

Consequently, for Quellaveco, reflects attributable share of capex, see appendix.

Guidance includes unapproved projects and is, therefore, subject to progress of

growth project studies and Woodsmith is excluded after 2021 pending completion

of technical review.

19.

Cost & volume improvement in EBITDA also impacted by above-CPI cost inflation

of $0.2bn across 2018-2020.

Inflation variance calculated using CPI on prior period cash operating costs that

have been impacted directly by inflation.

20.

Oxford Economics.

21. 2019 Diamond Jewellery Market size: $78bn.

22. $100bn represents potential cumulative incremental demand from China by 2030.

23. Industry analyst range.

24. Internal forecasts.

25. Johnson Matthey Platinum Survey 2021.

26. Based on Anglo American mix of PGMs sold.

27. Internal analysis, existing production capacity and projects in execution.

28. High quality iron ore and metallurgical coal.

29. It is also our intention to exit from our 33.3% shareholding in the Cerrejón thermal

coal operation in Colombia in a responsible way and within three years.

Targets and guidance as announced on 7 May 2020.

30.

31. Included within Healthy Environment related Global Stretch Goals in Sustainable

Mining Plan (https://www.angloamerican.com/sustainability/environment).

32. Long-term target for 'Sustaining attributable free cash flow'/ capital employed.

34View entire presentation