Baird Investment Banking Pitch Book

1 AM CORE VALUATION APPROACH DETAIL

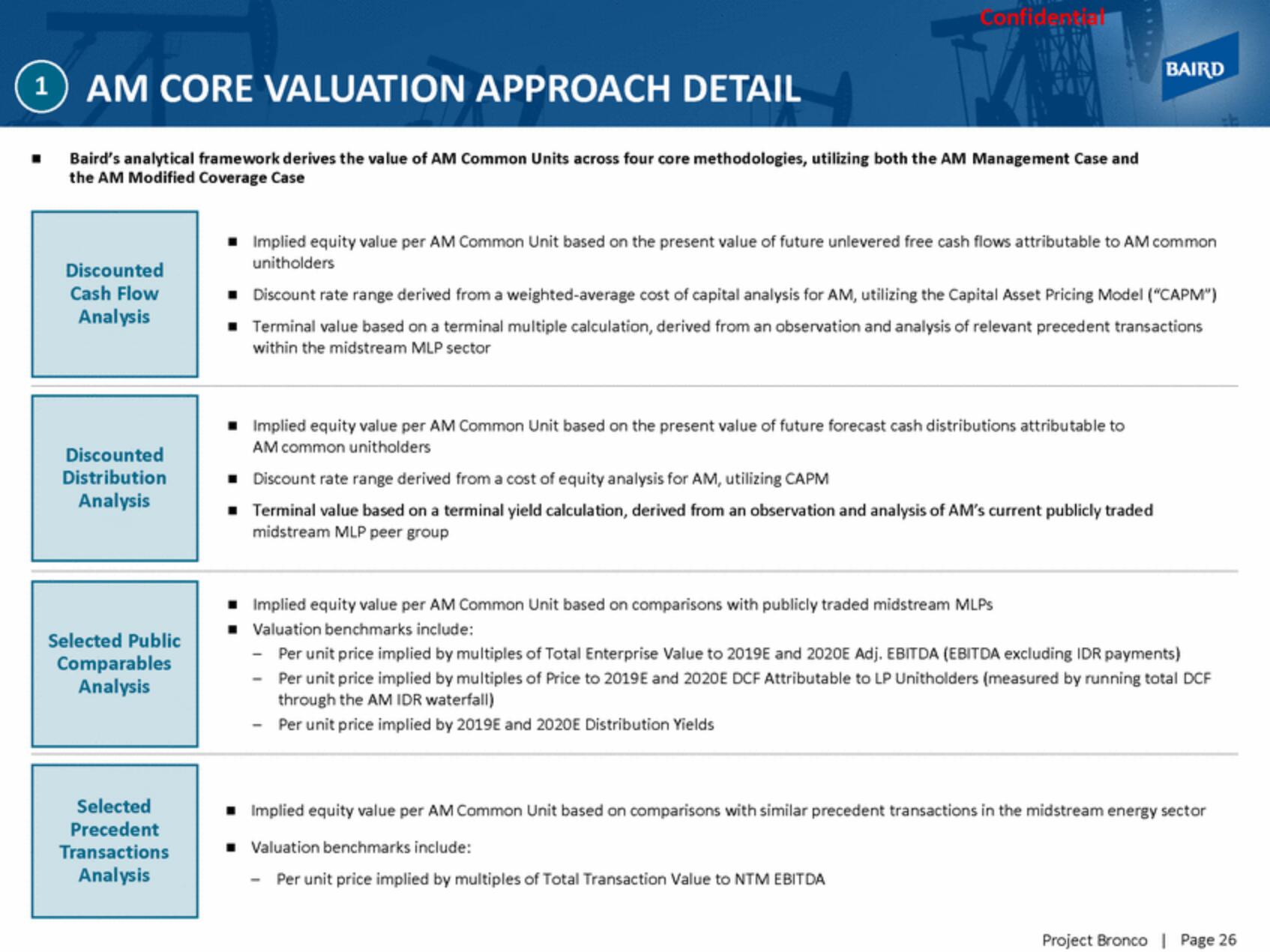

Baird's analytical framework derives the value of AM Common Units across four core methodologies, utilizing both the AM Management Case and

the AM Modified Coverage Case

Discounted

Cash Flow

Analysis

Discounted

Distribution

Analysis

Selected Public

Comparables

Analysis

Confidential

Selected

Precedent

Transactions

Analysis

Implied equity value per AM Common Unit based on the present value of future unlevered free cash flows attributable to AM common

unitholders

Discount rate range derived from a weighted-average cost of capital analysis for AM, utilizing the Capital Asset Pricing Model ("CAPM")

■ Terminal value based on a terminal multiple calculation, derived from an observation and analysis of relevant precedent transactions

within the midstream MLP sector

Implied equity value per AM Common Unit based on the present value of future forecast cash distributions attributable to

AM common unitholders

BAIRD

Discount rate range derived from a cost of equity analysis for AM, utilizing CAPM

■ Terminal value based on a terminal yield calculation, derived from an observation and analysis of AM's current publicly traded

midstream MLP peer group

Implied equity value per AM Common Unit based on comparisons with publicly traded midstream MLPs

Valuation benchmarks include:

Per unit price implied by multiples of Total Enterprise Value to 2019E and 2020E Adj. EBITDA (EBITDA excluding IDR payments)

- Per unit price implied by multiples of Price to 2019E and 2020E DCF Attributable to LP Unitholders (measured by running total DCF

through the AM IDR waterfall)

- Per unit price implied by 2019E and 2020E Distribution Yields

Implied equity value per AM Common Unit based on comparisons with similar precedent transactions in the midstream energy sector

■ Valuation benchmarks include:

Per unit price implied by multiples of Total Transaction Value to NTM EBITDA

Project Bronco | Page 26View entire presentation