Nikola Mergers and Acquisitions Presentation Deck

PAGE

NIKOLA

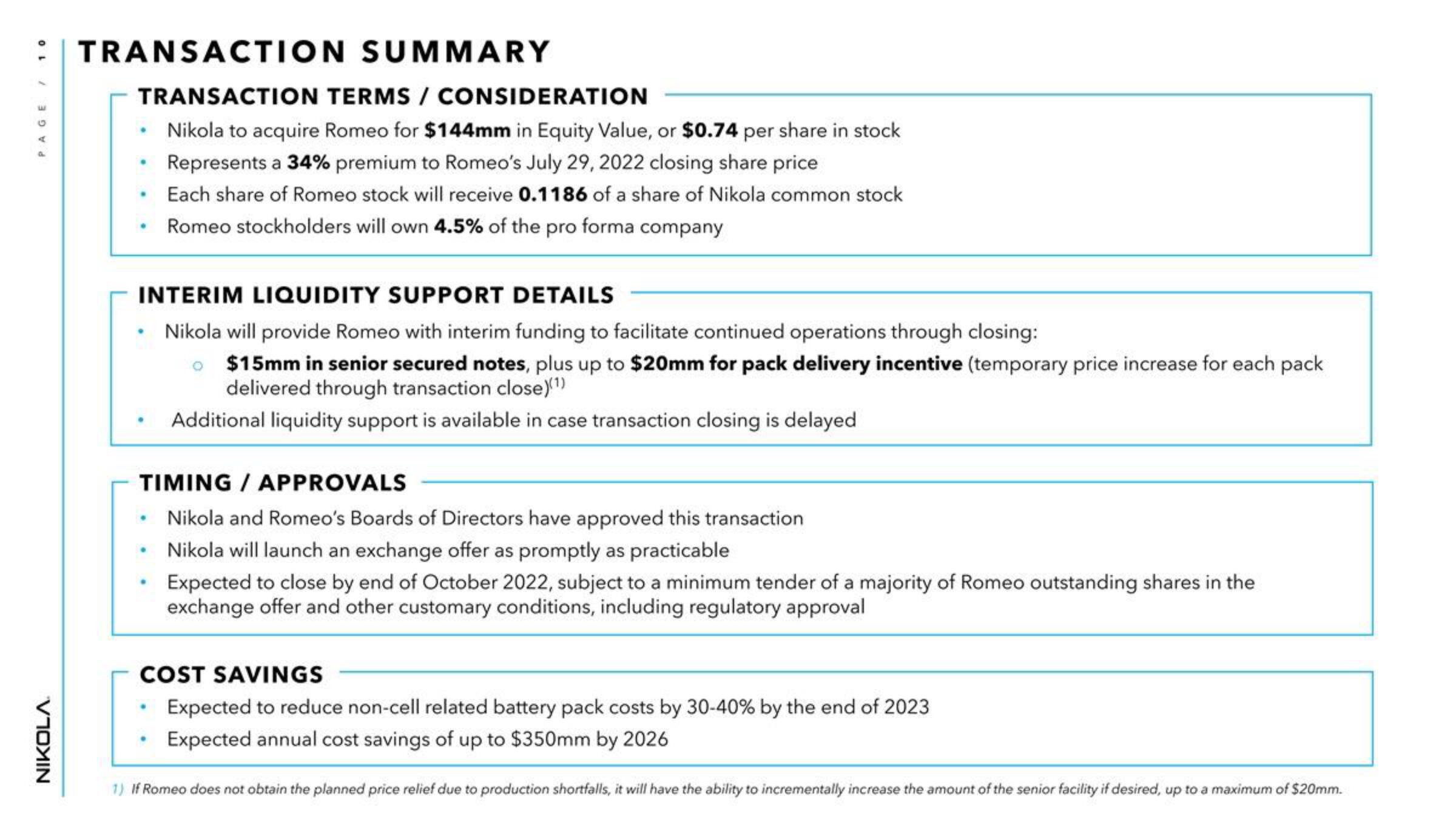

TRANSACTION SUMMARY

TRANSACTION TERMS/ CONSIDERATION

• Nikola to acquire Romeo for $144mm in Equity Value, or $0.74 per share in stock

Represents a 34% premium to Romeo's July 29, 2022 closing share price

Each share of Romeo stock will receive 0.1186 of a share of Nikola common stock

Romeo stockholders will own 4.5% of the pro forma company

.

●

INTERIM LIQUIDITY SUPPORT DETAILS

Nikola will provide Romeo with interim funding to facilitate continued operations through closing:

$15mm in senior secured notes, plus up to $20mm for pack delivery incentive (temporary price increase for each pack

delivered through transaction close)(¹)

Additional liquidity support is available in case transaction closing is delayed

TIMING / APPROVALS

• Nikola and Romeo's Boards of Directors have approved this transaction

Nikola will launch an exchange offer as promptly as practicable

Expected to close by end of October 2022, subject to a minimum tender of a majority of Romeo outstanding shares in the

exchange offer and other customary conditions, including regulatory approval

COST SAVINGS

• Expected to reduce non-cell related battery pack costs by 30-40% by the end of 2023

Expected annual cost savings of up to $350mm by 2026

1) If Romeo does not obtain the planned price relief due to production shortfalls, it will have the ability to incrementally increase the amount of the senior facility if desired, up to a maximum of $20mm.View entire presentation