Satellogic SPAC

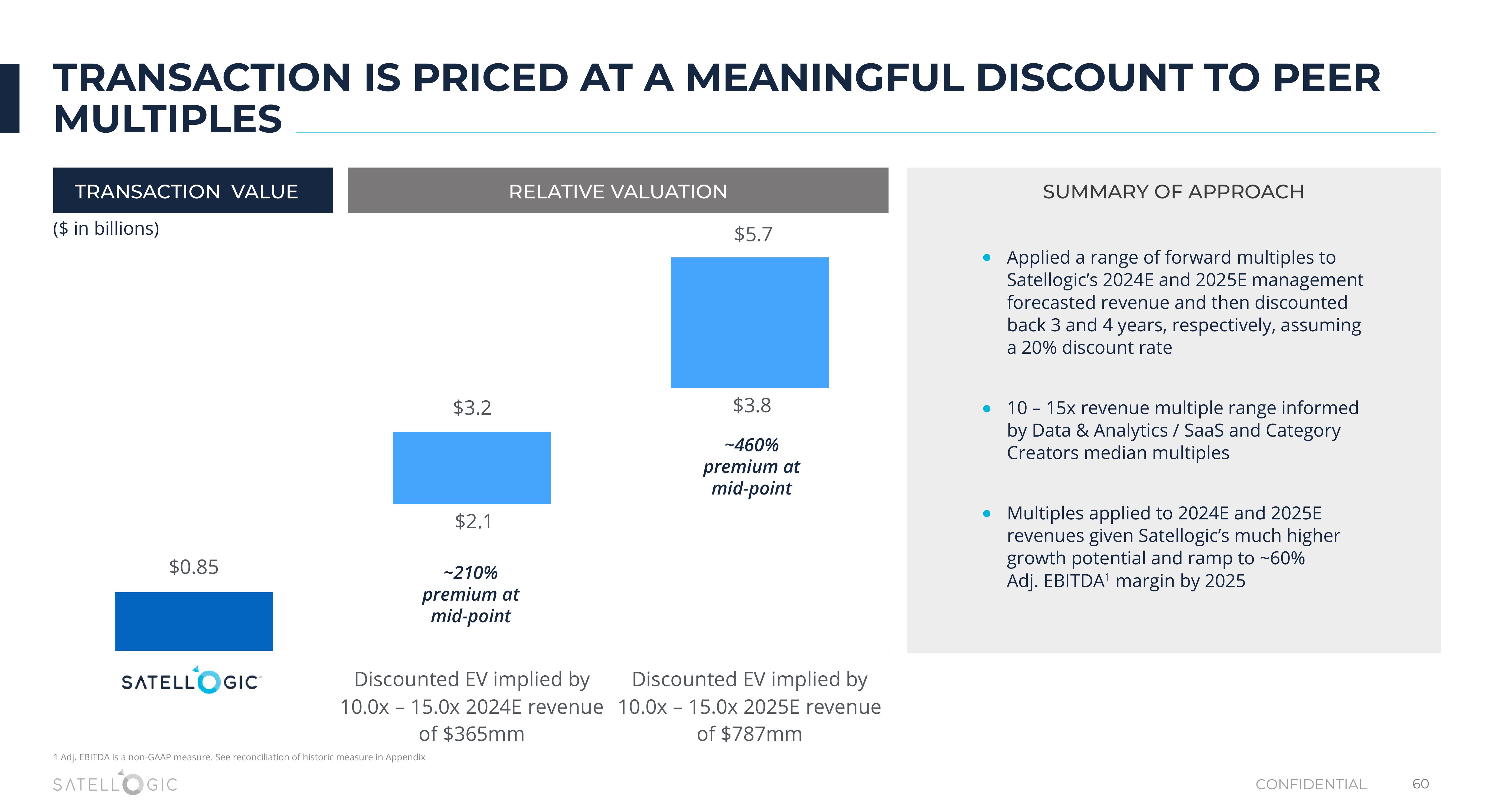

TRANSACTION IS PRICED AT A MEANINGFUL DISCOUNT TO PEER

MULTIPLES

TRANSACTION VALUE

($ in billions)

$0.85

SATELLOGIC

$3.2

$2.1

1 Adj. EBITDA is a non-GAAP measure. See reconciliation of historic measure in Appendix

SATELLOGIC

RELATIVE VALUATION

-210%

premium at

mid-point

Discounted EV implied by

10.0x 15.0x 2024E revenue

of $365mm

$5.7

$3.8

-460%

premium at

mid-point

Discounted EV implied by

10.0x - 15.0x 2025E revenue

of $787mm

SUMMARY OF APPROACH

• Applied a range of forward multiples to

Satellogic's 2024E and 2025E management

forecasted revenue and then discounted

back 3 and 4 years, respectively, assuming

a 20% discount rate

10 - 15x revenue multiple range informed

by Data & Analytics / SaaS and Category

Creators median multiples

• Multiples applied to 2024E and 2025E

revenues given Satellogic's much higher

growth potential and ramp to -60%

Adj. EBITDA¹ margin by 2025

CONFIDENTIAL

60View entire presentation