Ratification of PwC as Auditor

MANAGEMENT PROPOSALS

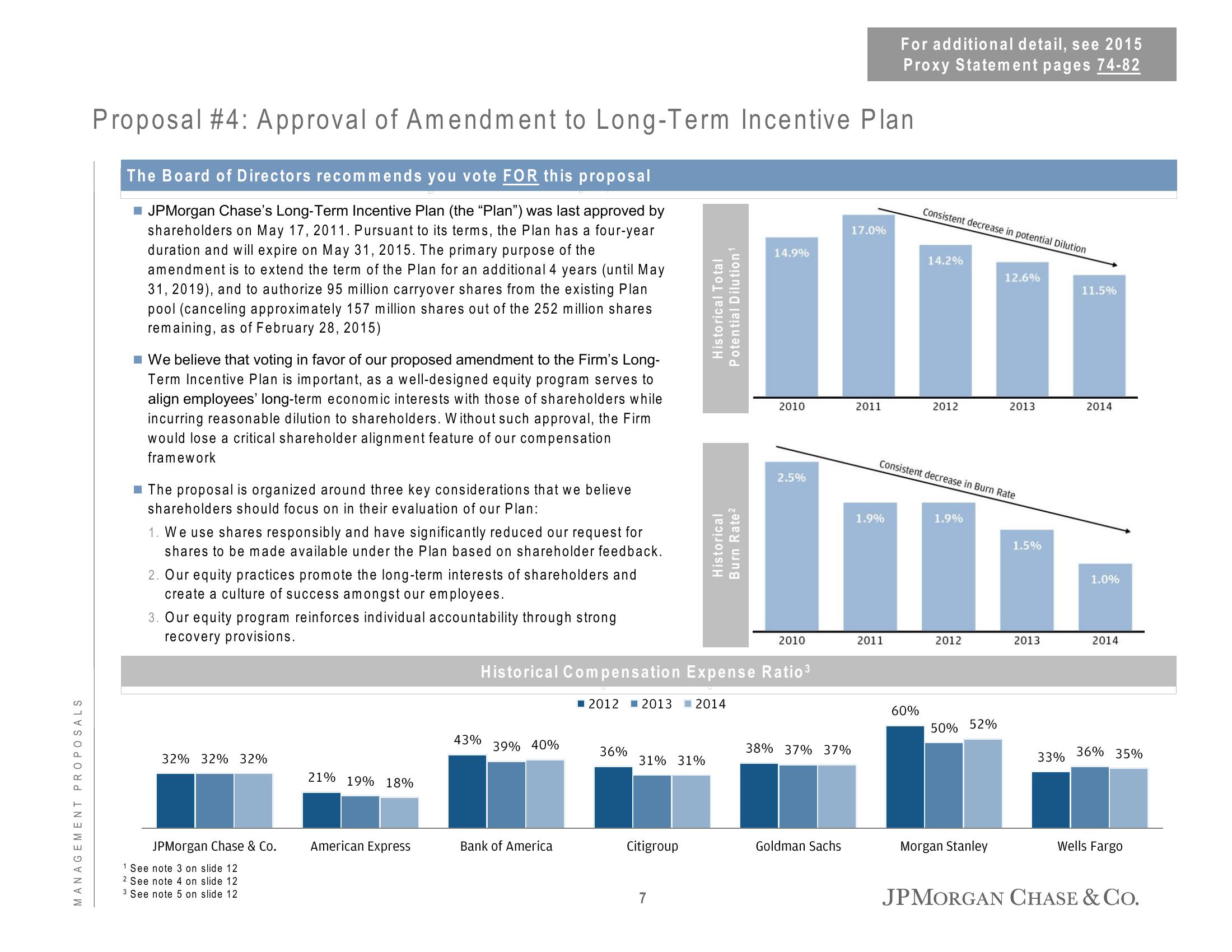

Proposal #4: Approval of Amendment to Long-Term Incentive Plan

The Board of Directors recommends you vote FOR this proposal

JPMorgan Chase's Long-Term Incentive Plan (the "Plan") was last approved by

shareholders on May 17, 2011. Pursuant to its terms, the Plan has a four-year

duration and will expire on May 31, 2015. The primary purpose of the

amendment is to extend the term of the Plan for an additional 4 years (until May

31, 2019), and to authorize 95 million carryover shares from the existing Plan

pool (canceling approximately 157 million shares out of the 252 million shares

remaining, as of February 28, 2015)

We believe that voting in favor of our proposed amendment to the Firm's Long-

Term Incentive Plan is important, as a well-designed equity program serves to

align employees' long-term economic interests with those of shareholders while

incurring reasonable dilution to shareholders. Without such approval, the Firm

would lose a critical shareholder alignment feature of our compensation

framework

The proposal is organized around three key considerations that we believe

shareholders should focus on in their evaluation of our Plan:

1. We use shares responsibly and have significantly reduced our request for

shares to be made available under the Plan based on shareholder feedback.

2. Our equity practices promote the long-term interests of shareholders and

create a culture of success amongst our employees.

3. Our equity program reinforces individual accountability through strong

recovery provisions.

32% 32% 32%

JPMorgan Chase & Co.

1 See note 3 on slide 12

2 See note 4 on slide 12

3 See note 5 on slide 12

21% 19% 18%

American Express

43%

39% 40%

Bank of America

36%

2012 2013 2014

31% 31%

Historical Total

Potential Dilution ¹

Historical Compensation Expense Ratio³

Citigroup

Historical

Burn Rate²

7

14.9%

2010

2.5%

2010

38% 37% 37%

Goldman Sachs

17.0%

2011

For additional detail, see 2015

Proxy Statement pages 74-82

1.9%

2011

Consistent decrease in potential Dilution

60%

14.2%

2012

Consistent decrease in Burn Rate

1.9%

2012

50% 52%

12.6%

Morgan Stanley

2013

1.5%

2013

33%

11.5%

2014

1.0%

2014

36% 35%

Wells Fargo

JPMORGAN CHASE & Co.View entire presentation