Flutter Results Presentation Deck

●

Appendices

-

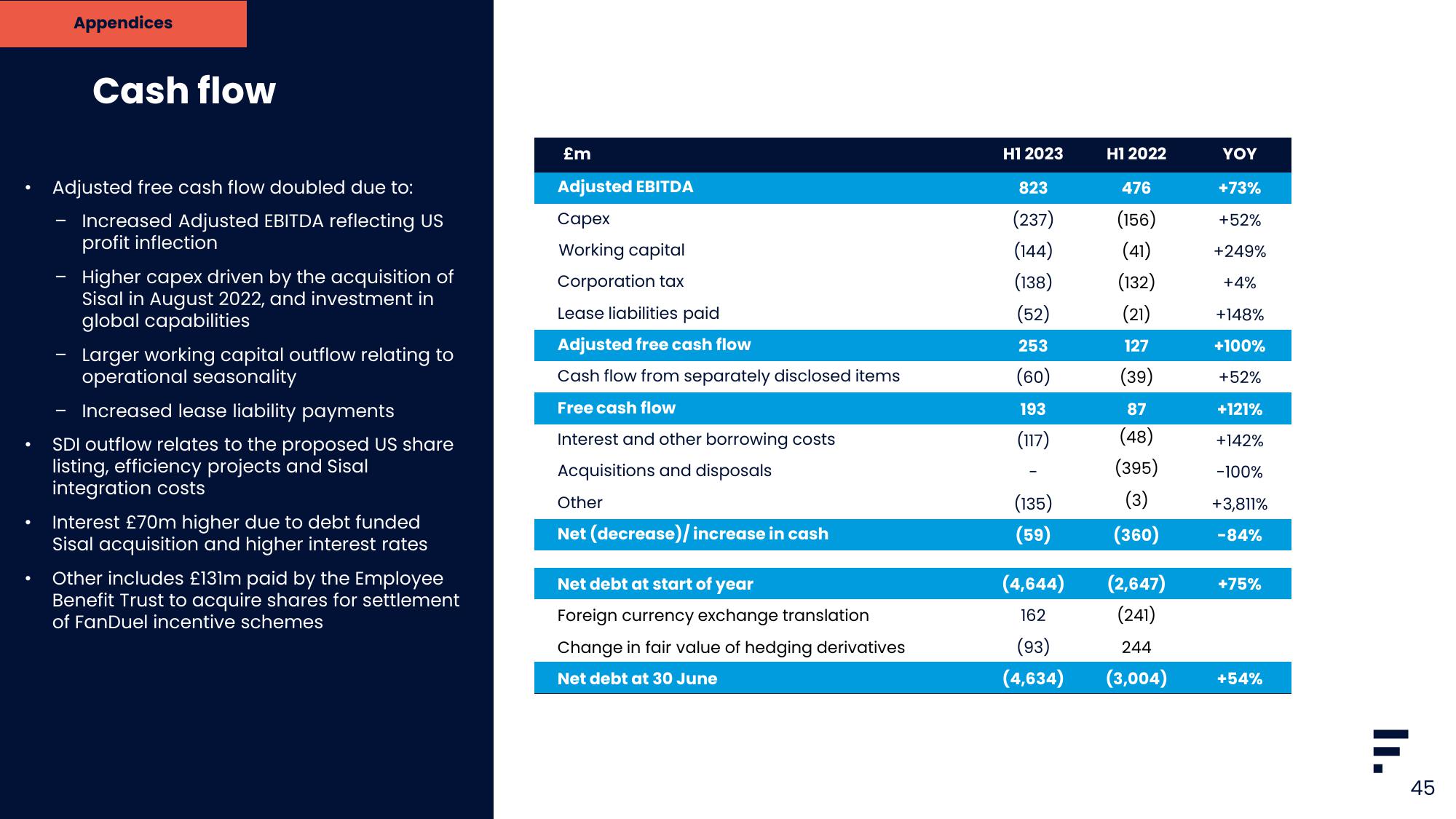

Cash flow

Adjusted free cash flow doubled due to:

Increased Adjusted EBITDA reflecting US

profit inflection

Higher capex driven by the acquisition of

Sisal in August 2022, and investment in

global capabilities

Larger working capital outflow relating to

operational seasonality

Increased lease liability payments

SDI outflow relates to the proposed US share

listing, efficiency projects and Sisal

integration costs

Interest £70m higher due to debt funded

Sisal acquisition and higher interest rates

Other includes £131m paid by the Employee

Benefit Trust to acquire shares for settlement

of FanDuel incentive schemes

£m

Adjusted EBITDA

Capex

Working capital

Corporation tax

Lease liabilities paid

Adjusted free cash flow

Cash flow from separately disclosed items

Free cash flow

Interest and other borrowing costs

Acquisitions and disposals

Other

Net (decrease)/ increase in cash

Net debt at start of year

Foreign currency exchange translation

Change in fair value of hedging derivatives

Net debt at 30 June

H12023

823

(237)

(144)

(138)

(52)

253

(60)

193

(117)

(135)

(59)

(4,644)

162

(93)

(4,634)

H1 2022

476

(156)

(41)

(132)

(21)

127

(39)

87

(48)

(395)

(3)

(360)

(2,647)

(241)

244

(3,004)

YOY

+73%

+52%

+249%

+4%

+148%

+100%

+52%

+121%

+142%

-100%

+3,811%

-84%

+75%

+54%

F

II.

45View entire presentation