Cannae SPAC Presentation Deck

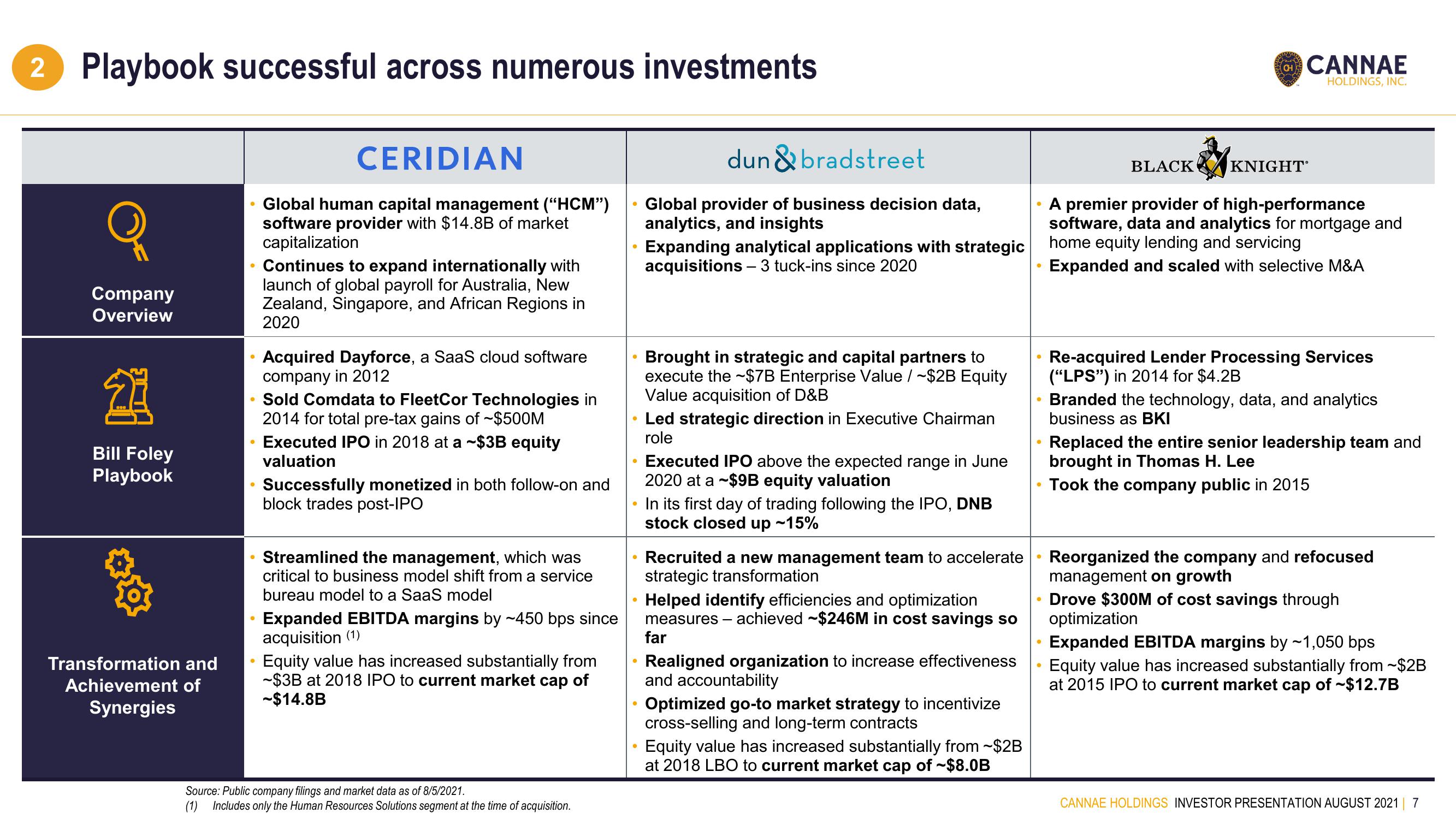

2 Playbook successful across numerous investments

Company

Overview

2

Bill Foley

Playbook

Transformation and

Achievement of

Synergies

●

•

●

●

●

CERIDIAN

Global human capital management ("HCM")

software provider with $14.8B of market

capitalization

Ⓡ

Continues to expand internationally with

launch of global payroll for Australia, New

Zealand, Singapore, and African Regions in

2020

Acquired Dayforce, a SaaS cloud software

company in 2012

Sold Comdata to FleetCor Technologies in

2014 for total pre-tax gains of ~$500M

Executed IPO in 2018 at a ~$3B equity

valuation

• Streamlined the management, which was

critical to business model shift from a service

bureau model to a SaaS model

Successfully monetized in both follow-on and

block trades post-IPO

Expanded EBITDA margins by ~450 bps since

acquisition (1)

Equity value has increased substantially from

-$3B at 2018 IPO to current market cap of

-$14.8B

Source: Public company filings and market data as of 8/5/2021.

Includes only the Human Resources Solutions segment at the time of acquisition.

●

●

dun & bradstreet

Global provider of business decision data,

analytics, and insights

• Led strategic direction in Executive Chairman

role

●

Expanding analytical applications with strategic

acquisitions - 3 tuck-ins since 2020

●

Brought in strategic and capital partners to

execute the ~$7B Enterprise Value / ~$2B Equity

Value acquisition of D&B

●

In its first day of trading following the IPO, DNB

stock closed up -15%

●

• Recruited a new management team to accelerate

strategic transformation

Helped identify efficiencies and optimization

measures - achieved -$246M in cost savings so

far

Executed IPO above the expected range in June

2020 at a $9B equity valuation

Realigned organization to increase effectiveness

and accountability

Optimized go-to market strategy to incentivize

cross-selling and long-term contracts

Equity value has increased substantially from ~$2B

at 2018 LBO to current market cap of ~$8.0B

●

●

●

BLACK

•

A premier provider of high-performance

software, data and analytics for mortgage and

home equity lending and servicing

Expanded and scaled with selective M&A

●

CH

KNIGHT

CANNAE

HOLDINGS, INC.

Re-acquired Lender Processing Services

("LPS") in 2014 for $4.2B

Branded the technology, data, and analytics

business as BKI

Replaced the entire senior leadership team and

brought in Thomas H. Lee

Took the company public in 2015

Reorganized the company and refocused

management on growth

Drove $300M of cost savings through

optimization

Expanded EBITDA margins by ~1,050 bps

Equity value has increased substantially from ~$2B

at 2015 IPO to current market cap of $12.7B

CANNAE HOLDINGS INVESTOR PRESENTATION AUGUST 2021 7View entire presentation