1Q22 Investor Update

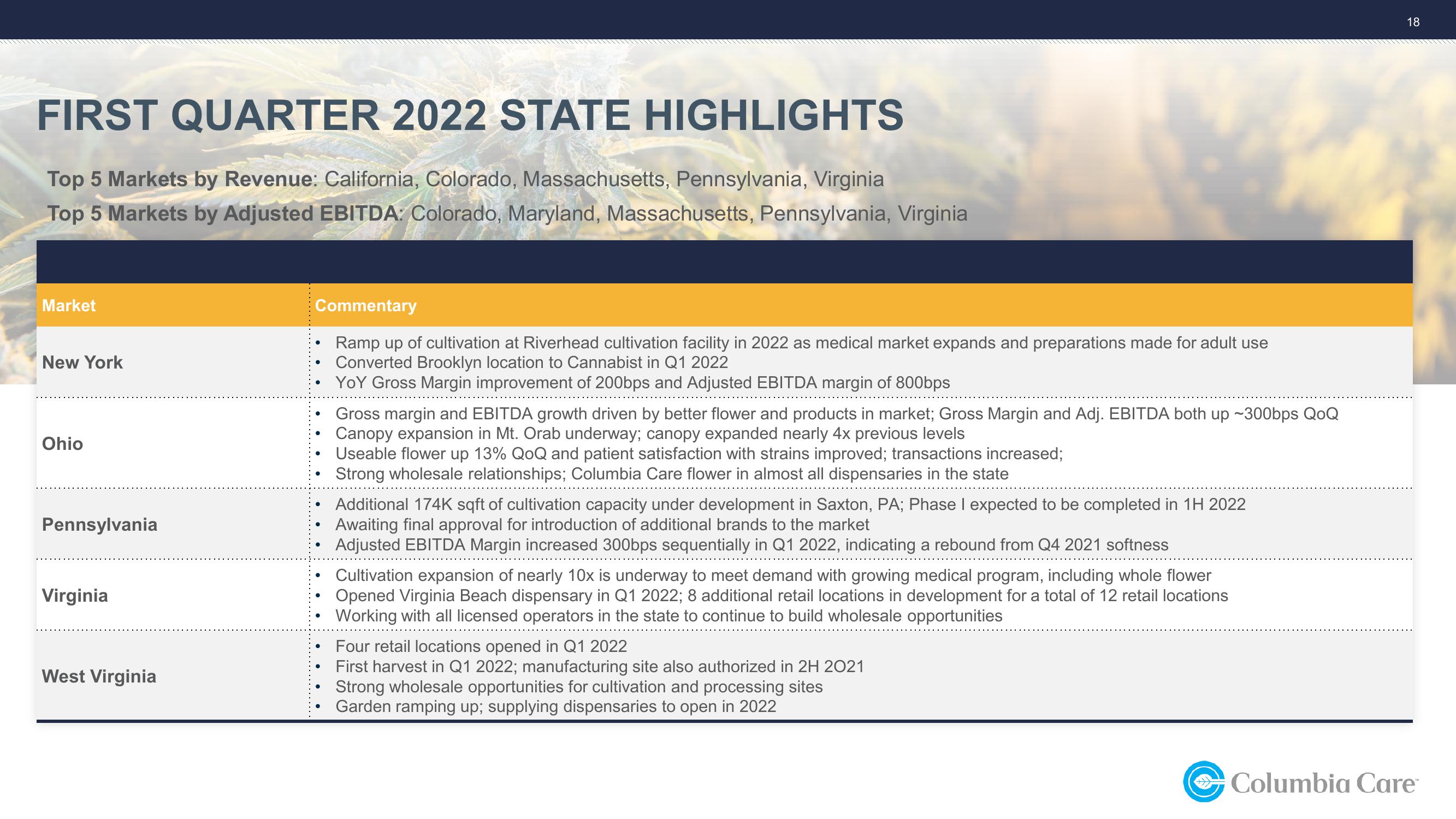

FIRST QUARTER 2022 STATE HIGHLIGHTS

Top 5 Markets by Revenue: California, Colorado, Massachusetts, Pennsylvania, Virginia

Top 5 Markets by Adjusted EBITDA: Colorado, Maryland, Massachusetts, Pennsylvania, Virginia

Market

New York

Ohio

Pennsylvania

Virginia

West Virginia

Commentary

Ramp up of cultivation at Riverhead cultivation facility in 2022 as medical market expands and preparations made for adult use

Converted Brooklyn location to Cannabist in Q1 2022

YOY Gross Margin improvement of 200bps and Adjusted EBITDA margin of 800bps

Gross margin and EBITDA growth driven by better flower and products in market; Gross Margin and Adj. EBITDA both up ~300bps QoQ

Canopy expansion in Mt. Orab underway; canopy expanded nearly 4x previous levels

Useable flower up 13% QoQ and patient satisfaction with strains improved; transactions increased;

Strong wholesale relationships; Columbia Care flower in almost all dispensaries in the state

Additional 174K sqft of cultivation capacity under development in Saxton, PA; Phase I expected to be completed in 1H 2022

Awaiting final approval for introduction of additional brands to the market

Adjusted EBITDA Margin increased 300bps sequentially in Q1 2022, indicating a rebound from Q4 2021 softness

Cultivation expansion of nearly 10x is underway to meet demand with growing medical program, including whole flower

Opened Virginia Beach dispensary in Q1 2022; 8 additional retail locations in development for a total of 12 retail locations

Working with all licensed operators in the state to continue to build wholesale opportunities

Four retail locations opened in Q1 2022

First harvest in Q1 2022; manufacturing site also authorized in 2H 2021

Strong wholesale opportunities for cultivation and processing sites

Garden ramping up; supplying dispensaries to open in 2022

18

Columbia Care™View entire presentation