Antero Midstream Partners Investor Presentation Deck

Production (MMcfe/d)

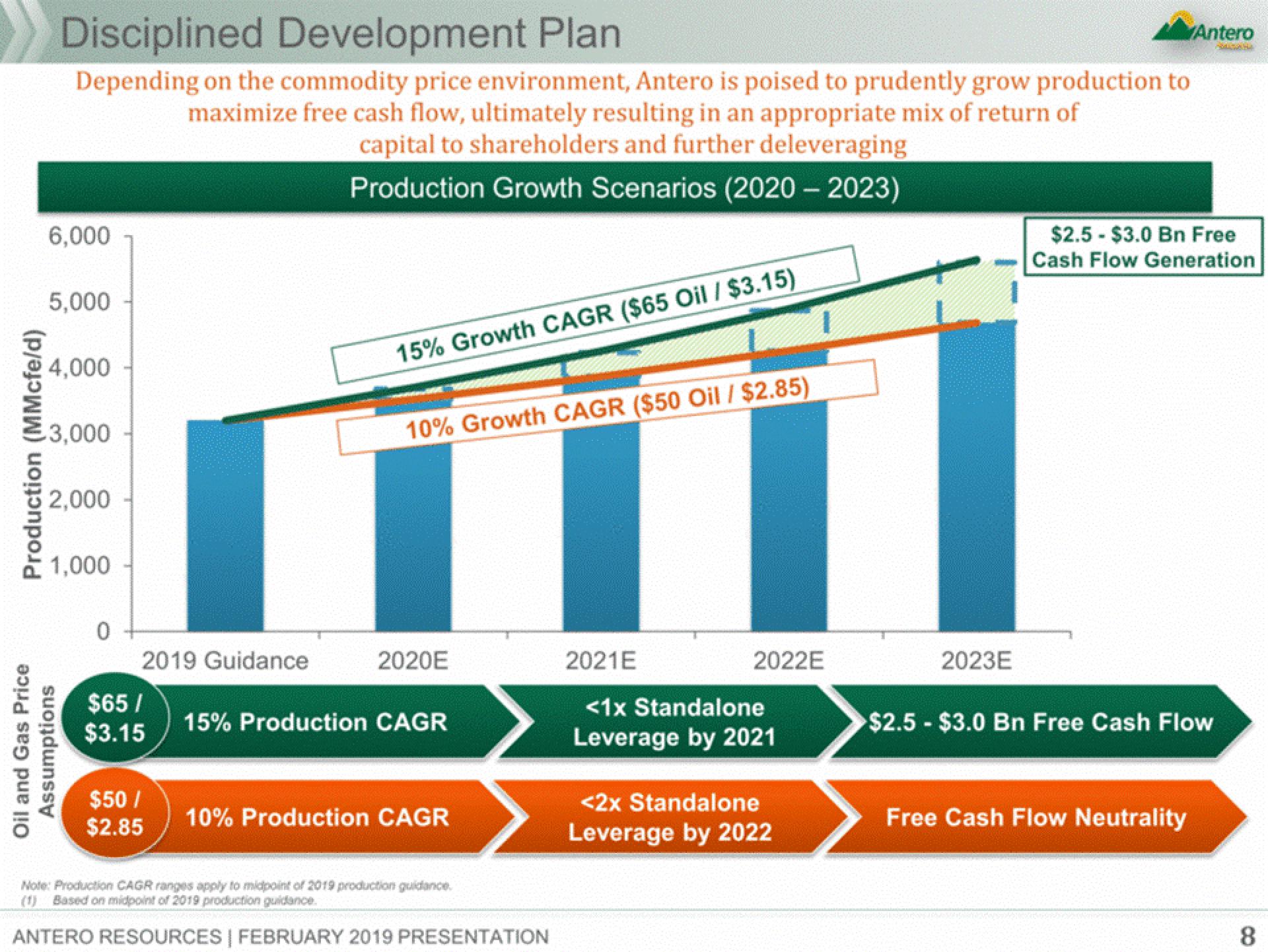

Disciplined Development Plan

Depending on the commodity price environment, Antero is poised to prudently grow production to

maximize free cash flow, ultimately resulting in an appropriate mix of return of

capital to shareholders and further deleveraging

Production Growth Scenarios (2020-2023)

6,000

5,000

4,000

€3,000

2.000

1,000

Oil and Gas Price

Assumptions

0

2019 Guidance

$65 /

$3.15

$50/

$2.85

15% Growth CAGR ($65 Oil / $3.15)

10% Growth CAGR ($50 Oil / $2.85)

2020E

15% Production CAGR

10% Production CAGR

Note: Production CAGR ranges apply to midpoint of 2019 production guidance.

(1) Based on midpoint of 2019 production guidance.

ANTERO RESOURCES | FEBRUARY 2019 PRESENTATION

2021E

<1x Standalone

Leverage by 2021

1

2022E

<2x Standalone

Leverage by 2022

2023E

Antero

$2.5 $3.0 Bn Free

Cash Flow Generation

$2.5 - $3.0 Bn Free Cash Flow

Free Cash Flow Neutrality

8View entire presentation