Kinnevik Results Presentation Deck

STRONG FINANCIAL DEVELOPMENT IN OUR TWO LARGE LISTED COMPANIES

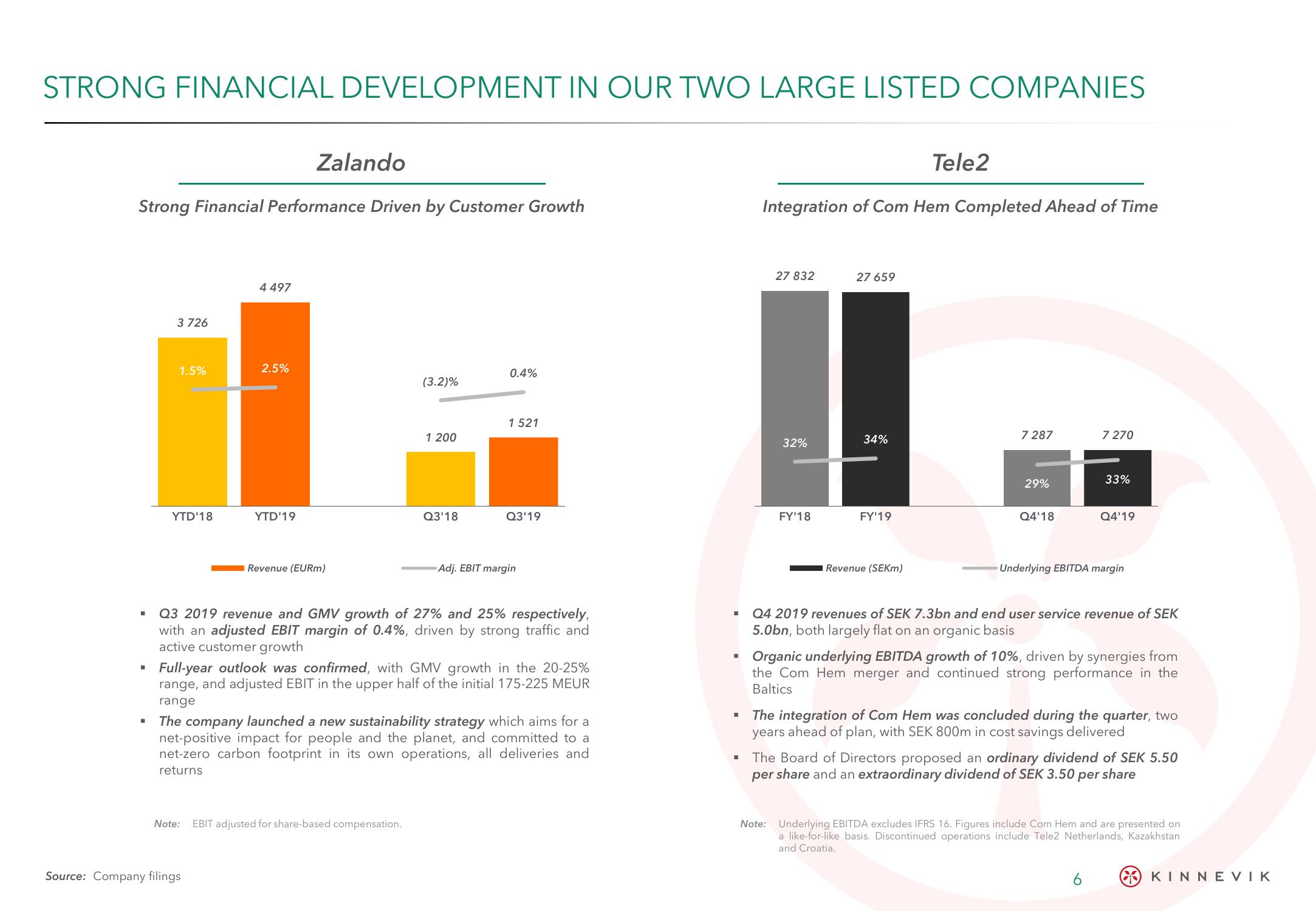

Strong Financial Performance Driven by Customer Growth

I

I

3 726

1.5%

YTD'18

4 497

2.5%

Zalando

YTD'19

Source: Company filings

Revenue (EURm)

(3.2)%

1 200

Note: EBIT adjusted for share-based compensation.

Q3'18

0.4%

1 521

Q3'19

Q3 2019 revenue and GMV growth of 27% and 25% respectively,

with an adjusted EBIT margin of 0.4%, driven by strong traffic and

active customer growth

Adj. EBIT margin

Full-year outlook was confirmed, with GMV growth in the 20-25%

range, and adjusted EBIT in the upper half of the initial 175-225 MEUR

range

The company launched a new sustainability strategy which aims for a

net-positive impact for people and the planet, and committed to a

net-zero carbon footprint in its own operations, all deliveries and

returns

■

I

I

Integration of Com Hem Completed Ahead of Time

27 832

32%

FY'18

27 659

34%

FY¹19

Tele2

Revenue (SEKm)

7 287

29%

Q4'18

7 270

33%

Q4'19

Underlying EBITDA margin

Q4 2019 revenues of SEK 7.3bn and end user service revenue of SEK

5.0bn, both largely flat on an organic basis

Organic underlying EBITDA growth of 10%, driven by synergies from

the Com Hem merger and continued strong performance in the

Baltics

The integration of Com Hem was concluded during the quarter, two

years ahead of plan, with SEK 800m in cost savings delivered

6

The Board of Directors proposed an ordinary dividend of SEK 5.50

per share and an extraordinary dividend of SEK 3.50 per share

Note: Underlying EBITDA excludes IFRS 16. Figures include Com Hem and are presented on

a like-for-like basis. Discontinued operations include Tele2 Netherlands, Kazakhstan

and Croatia.

Ο ΚΙΝΝΕVIKView entire presentation