Baird Investment Banking Pitch Book

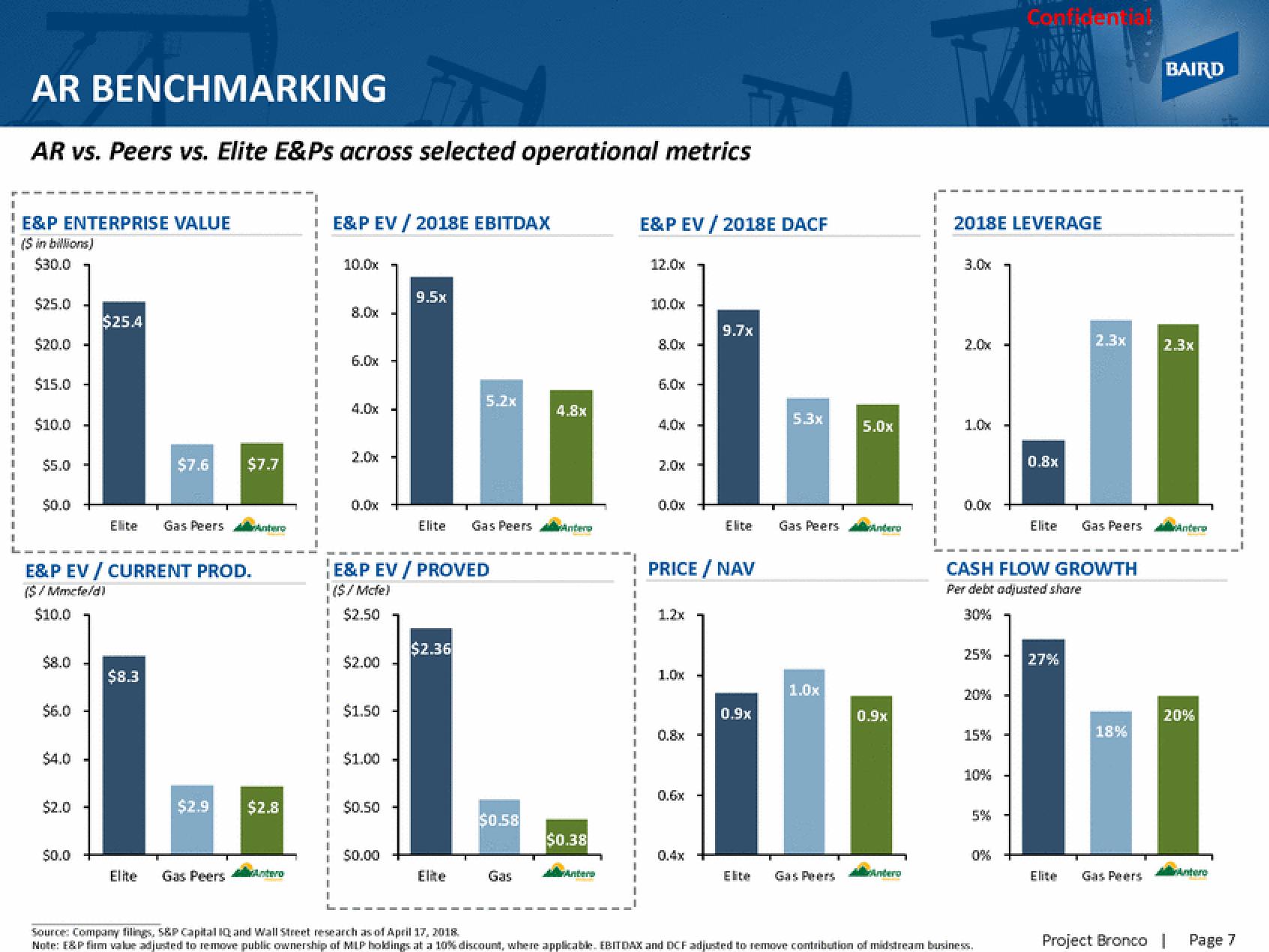

AR BENCHMARKING

AR vs. Peers vs. Elite E&Ps across selected operational metrics

E&P ENTERPRISE VALUE

($ in billions)

$30.0

$25.0

$20.0

$15.0

$10.0

$5.0

$0.0

$8.0

$6.0

$4.0

E&P EV / CURRENT PROD.

($/Mmcfe/d)

$10.0

$2.0

$25.4

$0.0

Elite Gas Peers

$7.6

$8.3

Elite

$7.7

Gas Peers

Antero

$2.9 $2.8

Antero

E&P EV / 2018E EBITDAX

10.0x

I

8.0x

6.0x

4.0x

2.0x

0.0x

$2.00

E&P EV / PROVED

($/Mcfe)

! $2.50

$1.50

$1.00

i $0.50

9.5x

50.00

5.2x

Elite Gas Peers Avantere

$2.36

Elite

$0.58

4.8x

Gas

$0.38

Antero

E&P EV / 2018E DACF

I

12.0x

10.0x

8.0x

6.0x

4.0x

2.0x

0.0x

i PRICE / NAV

1.2x

1.0x

0.8x

0.6x -

9.7x

0.4x

Elite

0.9x

Elite

5.3x

Gas Peers ondero

1.0x

5.0x

Gas Peers

0.9x

Antero

2018E LEVERAGE

3.0x

2.0x

1.0x

0.0x

25%

20%

15%

10%

CASH FLOW GROWTH

Per debt adjusted share

30%

5%

Confidential

0%

Source: Company filings, S&P Capital IQ and Wall Street research as of April 17, 2018

Note: E&P firm value adjusted to remove public ownership of MLP holdings at a 10% discount, where applicable. EBITDAX and DCF adjusted to remove contribution of midstream business.

0.8x

Elite

27%

2.3x

Elite

Gas Peers

18%

Gas Peers

Project Bronco

BAIRD

2.3x

Spaintera

20%

Antero

Page 7

1

I

1

IView entire presentation