Sonder Restructuring Presentation Deck

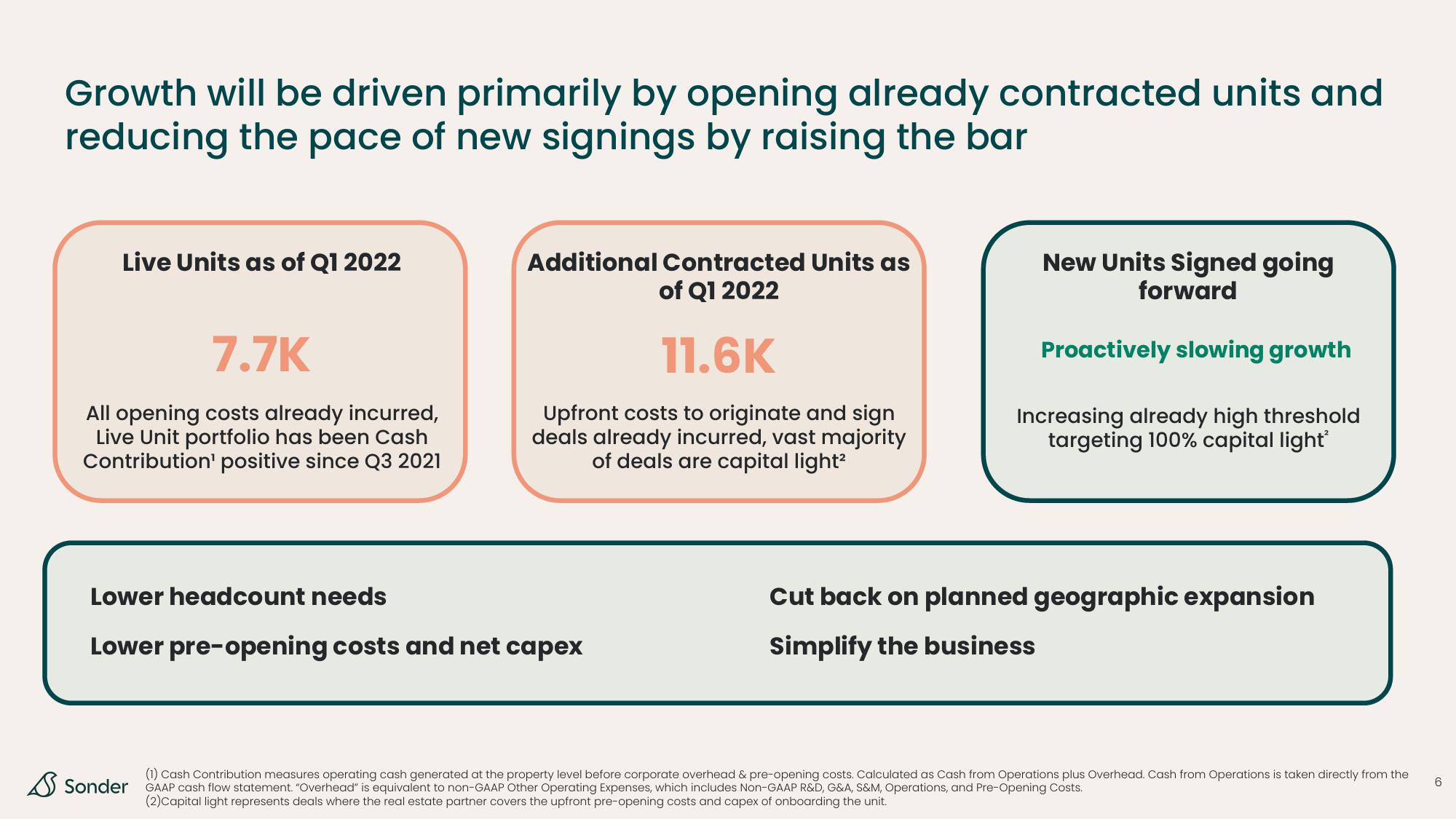

Growth will be driven primarily by opening already contracted units and

reducing the pace of new signings by raising the bar

Live Units as of Q1 2022

7.7K

All opening costs already incurred,

Live Unit portfolio has been Cash

Contribution¹ positive since Q3 2021

Additional Contracted Units as

of Q1 2022

11.6K

Upfront costs to originate and sign

deals already incurred, vast majority

of deals are capital light²

Lower headcount needs

Lower pre-opening costs and net capex

Sonder

New Units Signed going

forward

Proactively slowing growth

Increasing already high threshold

targeting 100% capital light²

Cut back on planned geographic expansion

Simplify the business

(1) Cash Contribution measures operating cash generated at the property level before corporate overhead & pre-opening costs. Calculated as Cash from Operations plus Overhead. Cash from Operations is taken directly from the

GAAP cash flow statement. "Overhead" is equivalent to non-GAAP Other Operating Expenses, which includes Non-GAAP R&D, G&A, S&M, Operations, and Pre-Opening Costs.

(2) Capital light represents deals where the real estate partner covers the upfront pre-opening costs and capex of onboarding the unit.

6View entire presentation