Moelis & Company Investment Banking Pitch Book

(5 in millions, except per share values) 03/31/15A 2020E

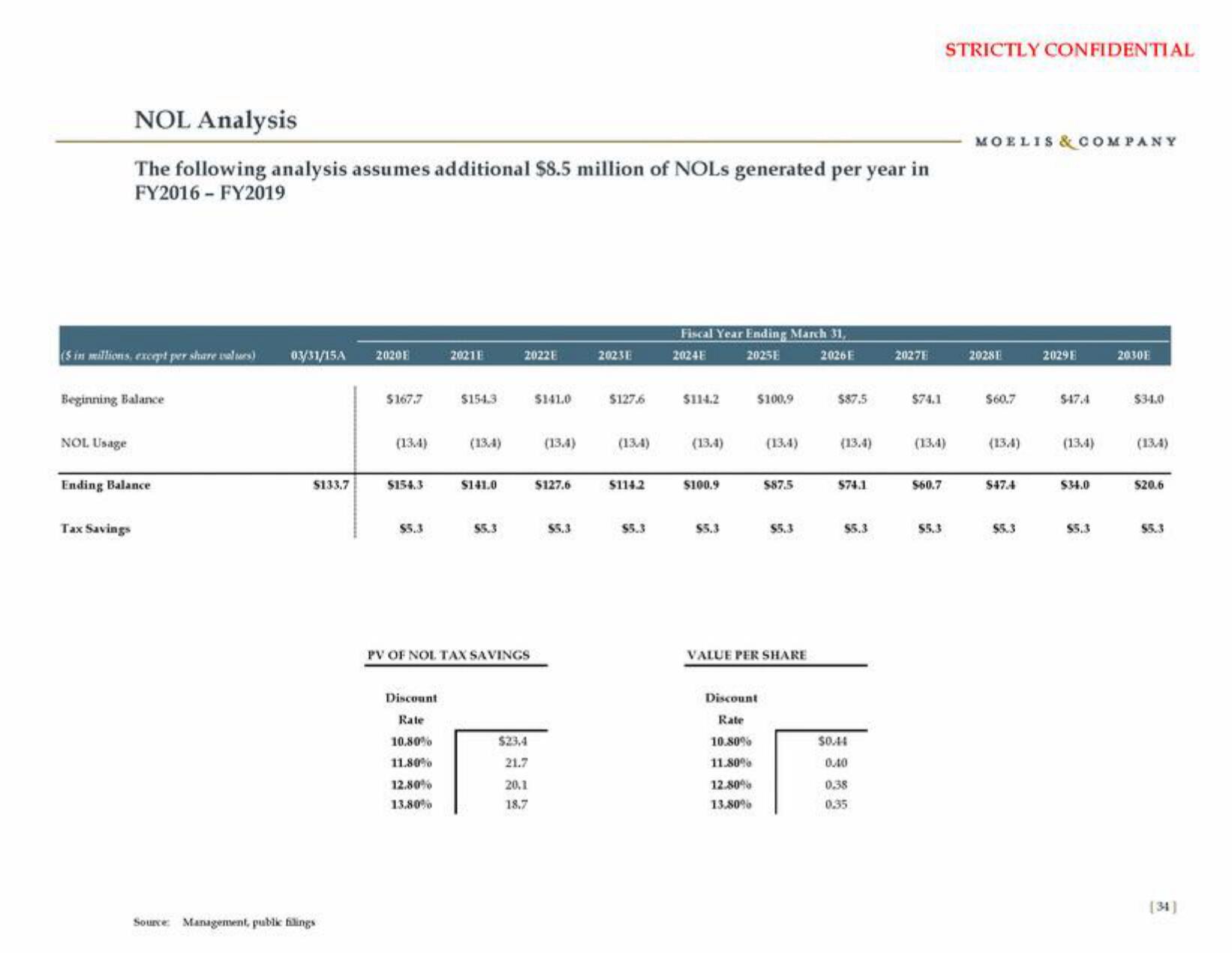

NOL Analysis

The following analysis assumes additional $8.5 million of NOLs generated per year in

FY2016- FY2019

Beginning Balance

NOL Usage

Ending Balance

Tax Savings

$133.7

Source Management, public filings

$167.7

(134)

$154.3

$5.3

2021E

Discount

Rate

10.80%

11.80%

12.80%

13.80%

$154.3

(134)

$141.0

$5.3

2022E

PV OF NOL TAX SAVINGS

$23,4

21.7

20.1

18.7

$141.0

(13.4)

$127.6

$5.3

2023E

$127.6

(134)

$114.2

$5.3

Fiscal Year Ending March 31,

2024E

2025E

2026E

$114.2

(13.4)

$100.9

$5.3

$100,9

(13.4)

Discount

Rate

10.80%

11.80%

12.80%

13.80%

$87.5

$5.3

VALUE PER SHARE

$87.5

(13.4)

$74.1

$5.3

$0.44

0.40

0.38

0.35

20271

$74.1

(13.4)

$60.7

STRICTLY CONFIDENTIAL

$5.3

MOELIS & COMPANY

20281

$60.7

(134)

$47.4

$5.3

2029E

$47.4

(13.4)

$34.0

$5.3

2030E

$34.0

(134)

$20.6

$5.3

[34]View entire presentation