Vivid Seats Investor Presentation Deck

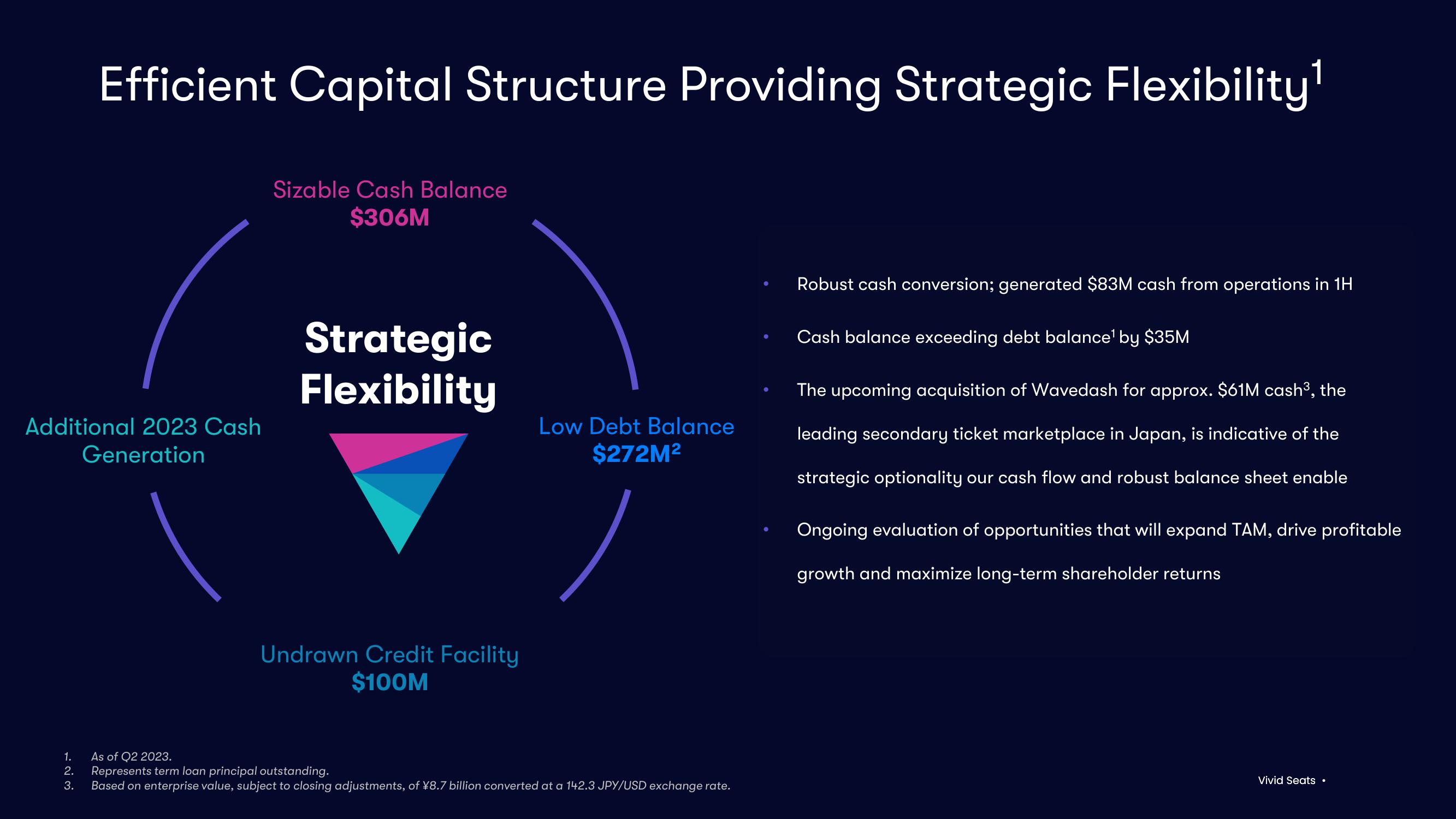

Efficient Capital Structure Providing Strategic Flexibility¹

Additional 2023 Cash

Generation

1.

2.

3.

Sizable Cash Balance

$306M

Strategic

Flexibility

Undrawn Credit Facility

$100M

Low Debt Balance

$272M²

As of Q2 2023.

Represents term loan principal outstanding.

Based on enterprise value, subject to closing adjustments, of ¥8.7 billion converted at a 142.3 JPY/USD exchange rate.

Robust cash conversion; generated $83M cash from operations in 1H

Cash balance exceeding debt balance¹ by $35M

The upcoming acquisition of Wavedash for approx. $61M cash³, the

leading secondary ticket marketplace in Japan, is indicative of the

strategic optionality our cash flow and robust balance sheet enable

Ongoing evaluation of opportunities that will expand TAM, drive profitable

growth and maximize long-term shareholder returns

Vivid Seats .View entire presentation