Azek IPO Presentation Deck

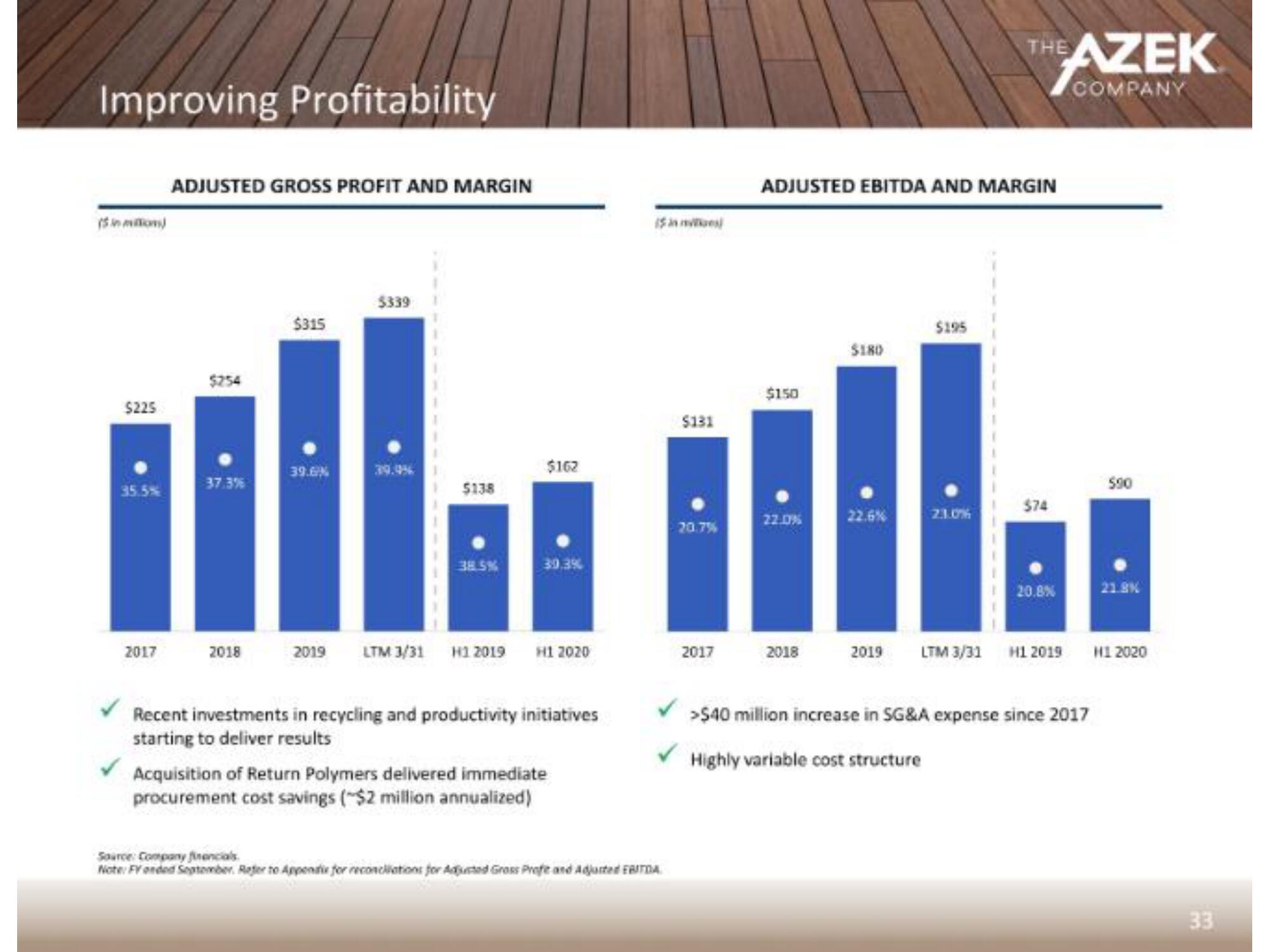

Improving Profitability

($inion)

$225

35.5%

2017

ADJUSTED GROSS PROFIT AND MARGIN

$254

37.3%

2018

$315

39.6%

$339

$138

38.5%

$162

39.3%

2019 LTM 3/31 H1 2019 H1 2020

Recent investments in recycling and productivity initiatives

starting to deliver results

Acquisition of Return Polymers delivered immediate

procurement cost savings (~$2 million annualized)

($n

$131

Source: Company financials

Note: FY onded September. Refer to Appende for reconciliations for Adjusted Gross Profe and Adjusted EBITDA

20.7%

2017

ADJUSTED EBITDA AND MARGIN

$150

27.0%

2018

$180

22.6%

$195

THE AZEK

COMPANY

23.0%

$74

20.8%

✓ >$40 million increase in SG&A expense since 2017

Highly variable cost structure

$90

21.8%

2019 LTM 3/31 H1 2019 H1 2020

33View entire presentation