Freyr Results Presentation Deck

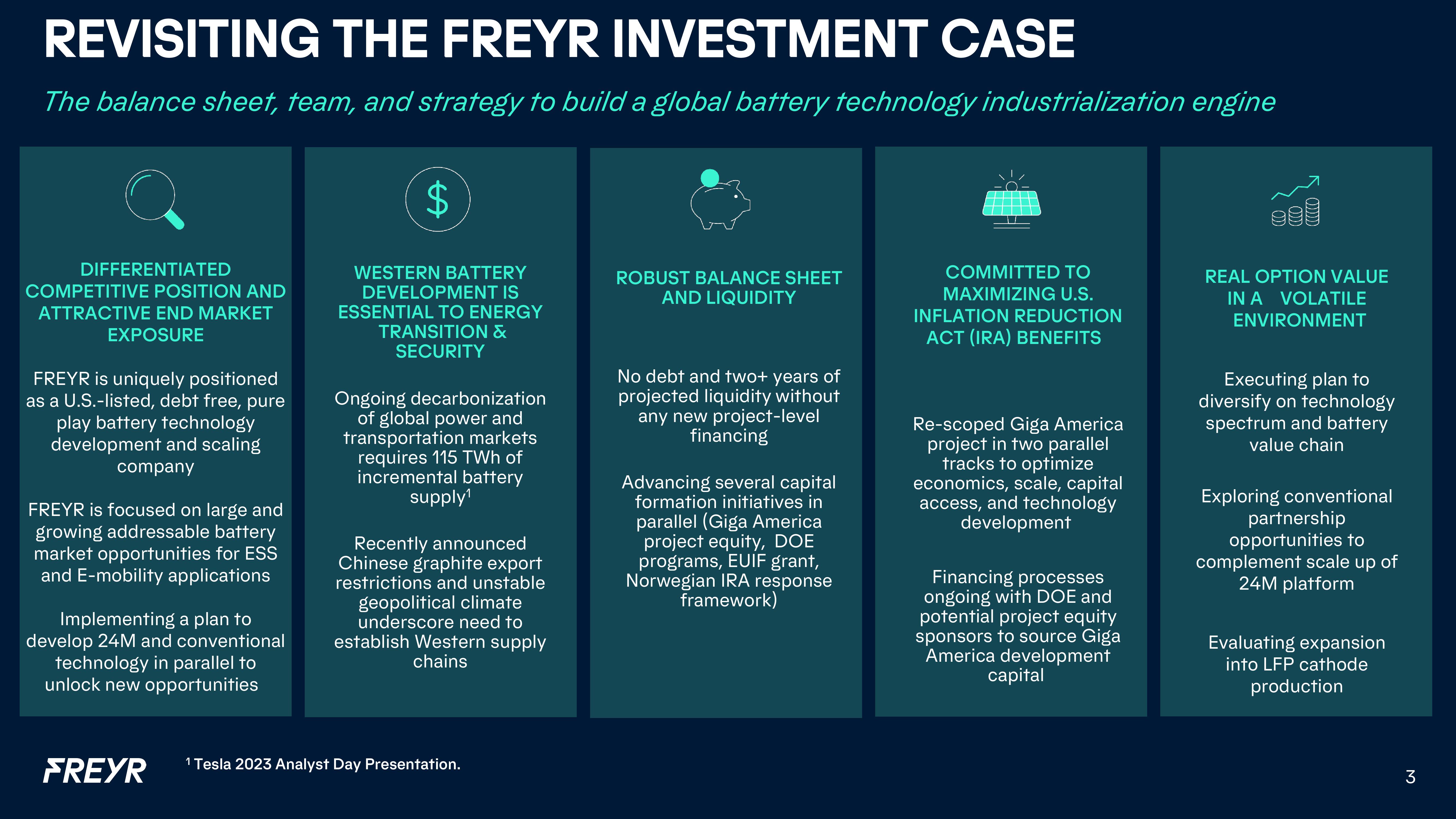

REVISITING THE FREYR INVESTMENT CASE

The balance sheet, team, and strategy to build a global battery technology industrialization engine

DIFFERENTIATED

COMPETITIVE POSITION AND

ATTRACTIVE END MARKET

EXPOSURE

FREYR is uniquely positioned

as a U.S.-listed, debt free, pure

play battery technology

development and scaling

company

FREYR is focused on large and

growing addressable battery

market opportunities for ESS

and E-mobility applications

Implementing a plan to

develop 24M and conventional

technology in parallel to

unlock new opportunities

FREYR

$

WESTERN BATTERY

DEVELOPMENT IS

ESSENTIAL TO ENERGY

TRANSITION &

SECURITY

Ongoing decarbonization

of global power and

transportation markets

requires 115 TWh of

incremental battery

supply¹

Recently announced

Chinese graphite export

restrictions and unstable

geopolitical climate

underscore need to

establish Western supply

chains

¹ Tesla 2023 Analyst Day Presentation.

ROBUST BALANCE SHEET

AND LIQUIDITY

No debt and two+ years of

projected liquidity without

any new project-level

financing

Advancing several capital

formation initiatives in

parallel (Giga America

project equity, DOE

programs, EUIF grant,

Norwegian IRA response

framework)

COMMITTED TO

MAXIMIZING U.S.

INFLATION REDUCTION

ACT (IRA) BENEFITS

Re-scoped Giga America

project in two parallel

tracks to optimize

economics, scale, capital

access, and technology

development

Financing processes

ongoing with DOE and

potential project equity

sponsors to source Giga

America development

capital

REAL OPTION VALUE

IN A VOLATILE

ENVIRONMENT

Executing plan to

diversify on technology

spectrum and battery

value chain

Exploring conventional

partnership

opportunities to

complement scale up of

24M platform

Evaluating expansion

into LFP cathode

production

3View entire presentation