J.P.Morgan Results Presentation Deck

Consumer & Community Banking ¹

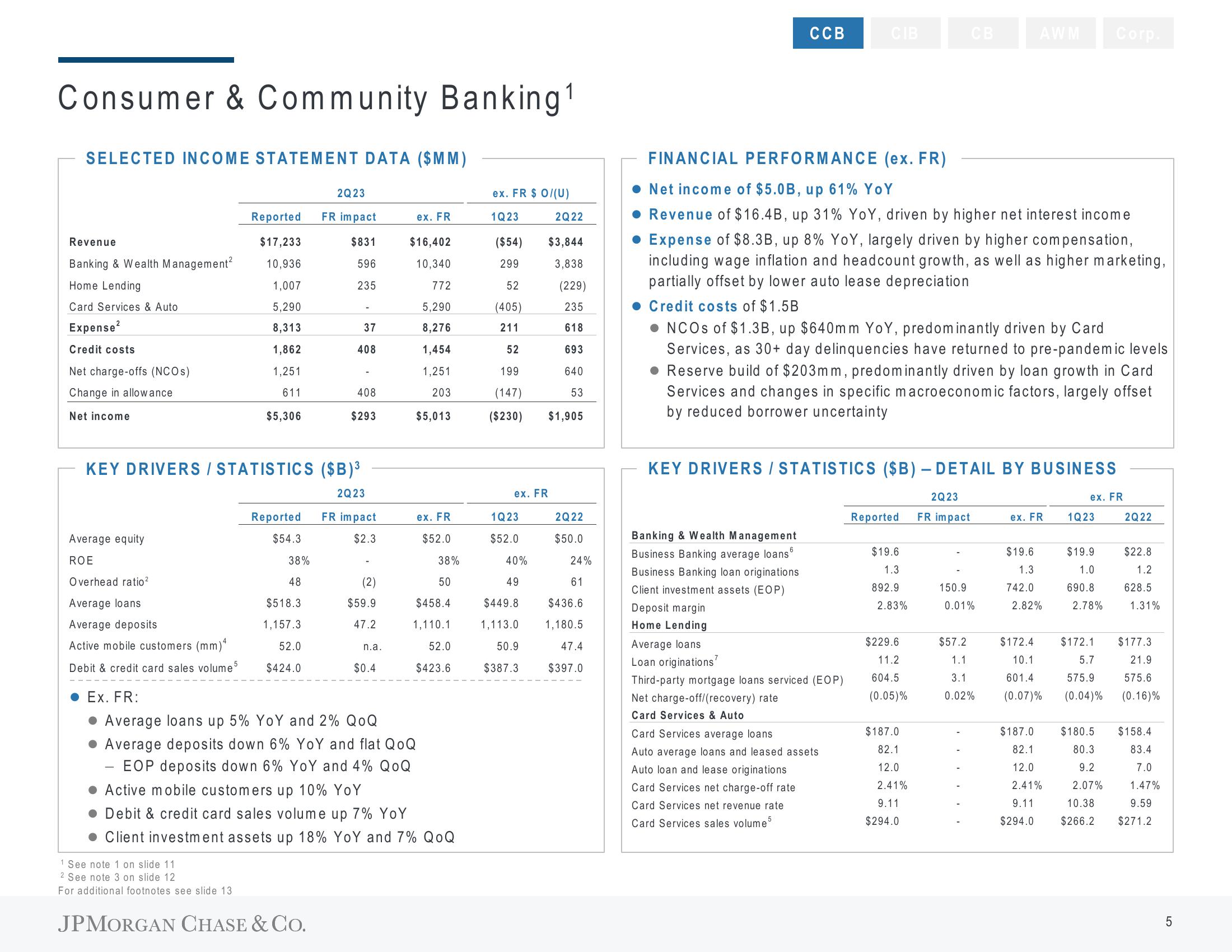

SELECTED INCOME STATEMENT DATA ($MM)

Revenue

Banking & Wealth Management²

Home Lending

Card Services & Auto

Expense²

Credit costs

Net charge-offs (NCOs)

Change in allowance

Net income

Average equity

ROE

Overhead ratio²

Average loans

Average deposits

Active mobile customers (mm)4

Debit & credit card sales volume 5

Reported

$17,233

10,936

1,007

5,290

8,313

1,862

1,251

611

$5,306

1 See note 1 on slide 11

2 See note 3 on slide 12

For additional footnotes see slide 13.

KEY DRIVERS / STATISTICS ($B)³

2Q23

Reported

$54.3

38%

48

$518.3

1,157.3

52.0

$424.0

2Q23

FR impact

$831

596

235

37

408

JPMORGAN CHASE & CO.

-

408

$293

FR impact

$2.3

(2)

$59.9

47.2

n.a.

$0.4

ex. FR

$16,402

10,340

772

5,290

8,276

1,454

1,251

203

$5,013

ex. FR

$52.0

38%

Ex. FR:

Average loans up 5% YoY nd 2% QoQ

Average deposits down 6% YoY and flat QoQ

-EOP deposits down 6% YoY and 4% QOQ

Active mobile customers up 10% YoY

Debit & credit card sales volume up 7% YoY

Client investment assets up 18% YoY and 7% QOQ

50

$458.4

1,110.1

52.0

$423.6

ex. FR $ 0/(U)

2Q22

$3,844

3,838

(229)

235

1Q23

($54)

299

52

(405)

211

52

199

(147)

53

($230) $1,905

618

693

640

ex. FR

1Q23

$52.0

40%

49

$449.8

1,113.0

50.9

$387.3

2Q22

$50.0

24%

61

$436.6

1,180.5

47.4

$397.0

CCB

Banking & Wealth Management

Business Banking average loans

Business Banking loan originations

Client investment assets (EOP)

Deposit margin

Home Lending

Average loans

Loan originations

CIB

FINANCIAL PERFORMANCE (ex. FR)

Net income of $5.0B, up 61% YoY

Revenue of $16.4B, up 31% YoY, driven by higher net interest income

• Expense of $8.3B, up 8% YoY, largely driven by higher compensation,

including wage inflation and headcount growth, as well as higher marketing,

partially offset by lower auto lease depreciation

Credit costs of $1.5B

NCOs of $1.3B, up $640mm YoY, predominantly driven by Card

Services, as 30+ day delinquencies have returned to pre-pandemic levels

Reserve build of $203mm, predominantly driven by loan growth in Card

Services and changes in specific macroeconomic factors, largely offset

by reduced borrower uncertainty

KEY DRIVERS / STATISTICS ($B) - DETAIL BY BUSINESS

2Q23

FR impact

Third-party mortgage loans serviced (EOP)

Net charge-off/(recovery) rate

Card Services & Auto

Card Services average loans

Auto average loans and leased assets

Auto loan and lease originations

Card Services net charge-off rate

Card Services net revenue rate

Card Services sales volume 5

Reported

$19.6

1.3

892.9

2.83%

$229.6

11.2

604.5

(0.05)%

$187.0

82.1

12.0

2.41%

9.11

$294.0

AWM Corp.

150.9

0.01%

$57.2

1.1

3.1

0.02%

ex. FR

$19.6

1.3

742.0

2.82%

$172.4

10.1

601.4

(0.07)%

$187.0

82.1

12.0

2.41%

9.11

$294.0

ex. FR

1Q23

$19.9

1.0

690.8

2.78%

$172.1

5.7

575.9

(0.04)%

$180.5

80.3

9.2

2.07%

2Q22

$22.8

1.2

628.5

1.31%

$177.3

21.9

575.6

(0.16)%

$158.4

83.4

7.0

1.47%

10.38

9.59

$266.2 $271.2

01

5View entire presentation