OnesSpaWorld SPAC

TRANSACTION OVERVIEW

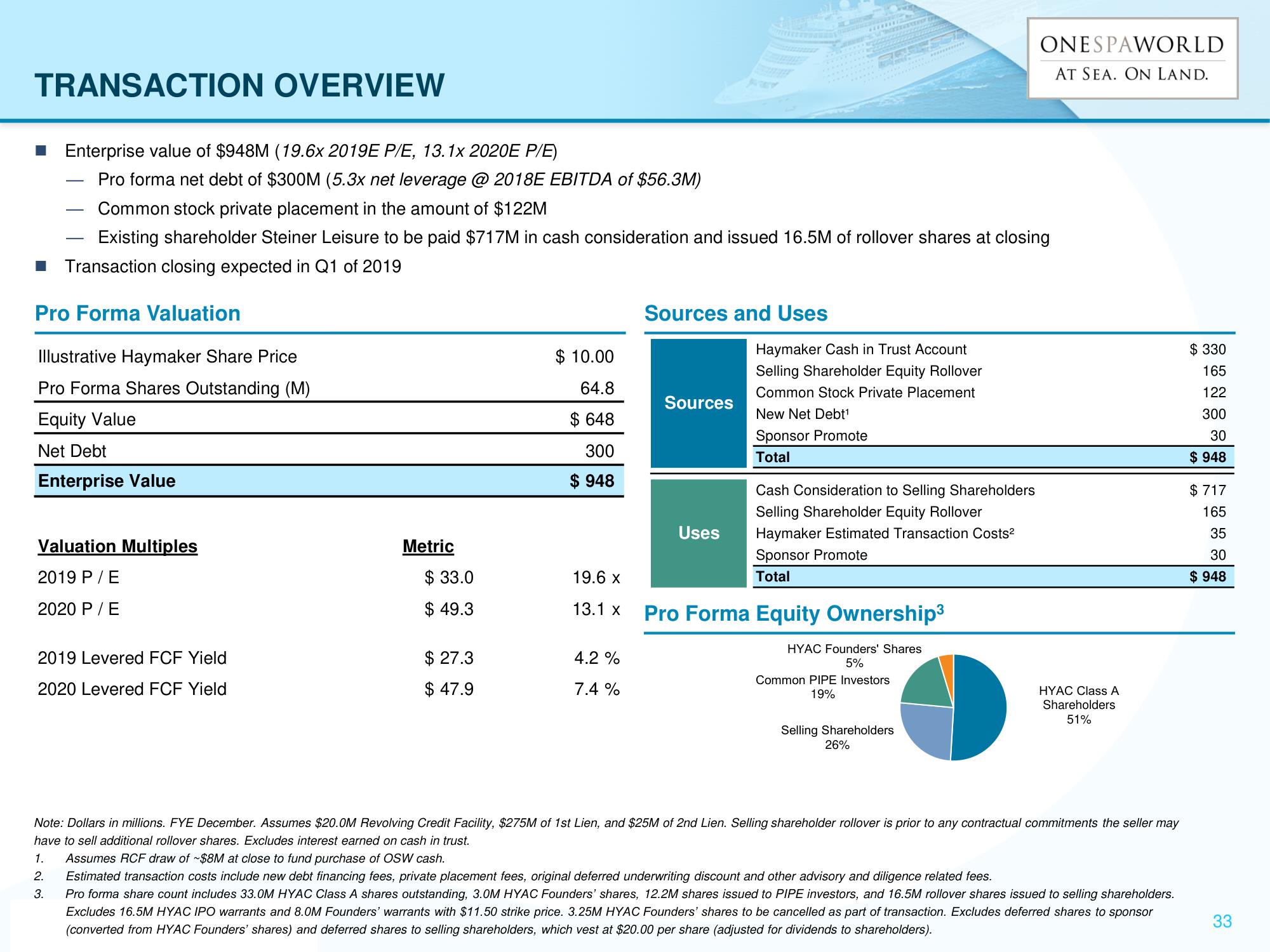

■ Enterprise value of $948M (19.6x 2019E P/E, 13.1x 2020E P/E)

Pro forma net debt of $300M (5.3x net leverage @ 2018E EBITDA of $56.3M)

Common stock private placement in the amount of $122M

Existing shareholder Steiner Leisure to be paid $717M in cash consideration and issued 16.5M of rollover shares at closing

■ Transaction closing expected in Q1 of 2019

Pro Forma Valuation

Illustrative Haymaker Share Price

Pro Forma Shares Outstanding (M)

Equity Value

Net Debt

Enterprise Value

Valuation Multiples

2019 P/E

2020 P/E

2019 Levered FCF Yield

2020 Levered FCF Yield

Metric

$ 33.0

$49.3

$ 27.3

$ 47.9

$10.00

64.8

$ 648

300

$948

19.6 X

13.1 x

4.2 %

7.4 %

Sources and Uses

Sources

Uses

Haymaker Cash in Trust Account

Selling Shareholder Equity Rollover

Common Stock Private Placement

New Net Debt¹

Sponsor Promote

Total

Cash Consideration to Selling Shareholders

Selling Shareholder Equity Rollover

Haymaker Estimated Transaction Costs²

Sponsor Promote

Total

Pro Forma Equity Ownership³

HYAC Founders' Shares

5%

Common PIPE Investors

19%

ONESPAWORLD

AT SEA. ON LAND.

Selling Shareholders

26%

HYAC Class A

Shareholders

51%

Note: Dollars in millions. FYE December. Assumes $20.0M Revolving Credit Facility, $275M of 1st Lien, and $25M of 2nd Lien. Selling shareholder rollover is prior to any contractual commitments the seller may

have to sell additional rollover shares. Excludes interest earned on cash in trust.

1. Assumes RCF draw of ~$8M at close to fund purchase of OSW cash.

2. Estimated transaction costs include new debt financing fees, private placement fees, original deferred underwriting discount and other advisory and diligence related fees.

3.

Pro forma share count includes 33.0M HYAC Class A shares outstanding, 3.0M HYAC Founders' shares, 12.2M shares issued to PIPE investors, and 16.5M rollover shares issued to selling shareholders.

Excludes 16.5M HYAC IPO warrants and 8.0M Founders' warrants with $11.50 strike price. 3.25M HYAC Founders' shares to be cancelled as part of transaction. Excludes deferred shares to sponsor

(converted from HYAC Founders' shares) and deferred shares to selling shareholders, which vest at $20.00 per share (adjusted for dividends to shareholders).

$330

165

122

300

30

$948

$717

165

35

30

$948

33View entire presentation