Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

21,766

6,347

3,445

12,476

PERFORMANCE

(502)

FY20

ASSET QUALITY

17 | Barclays Q4 2021 Results | 23 February 2022

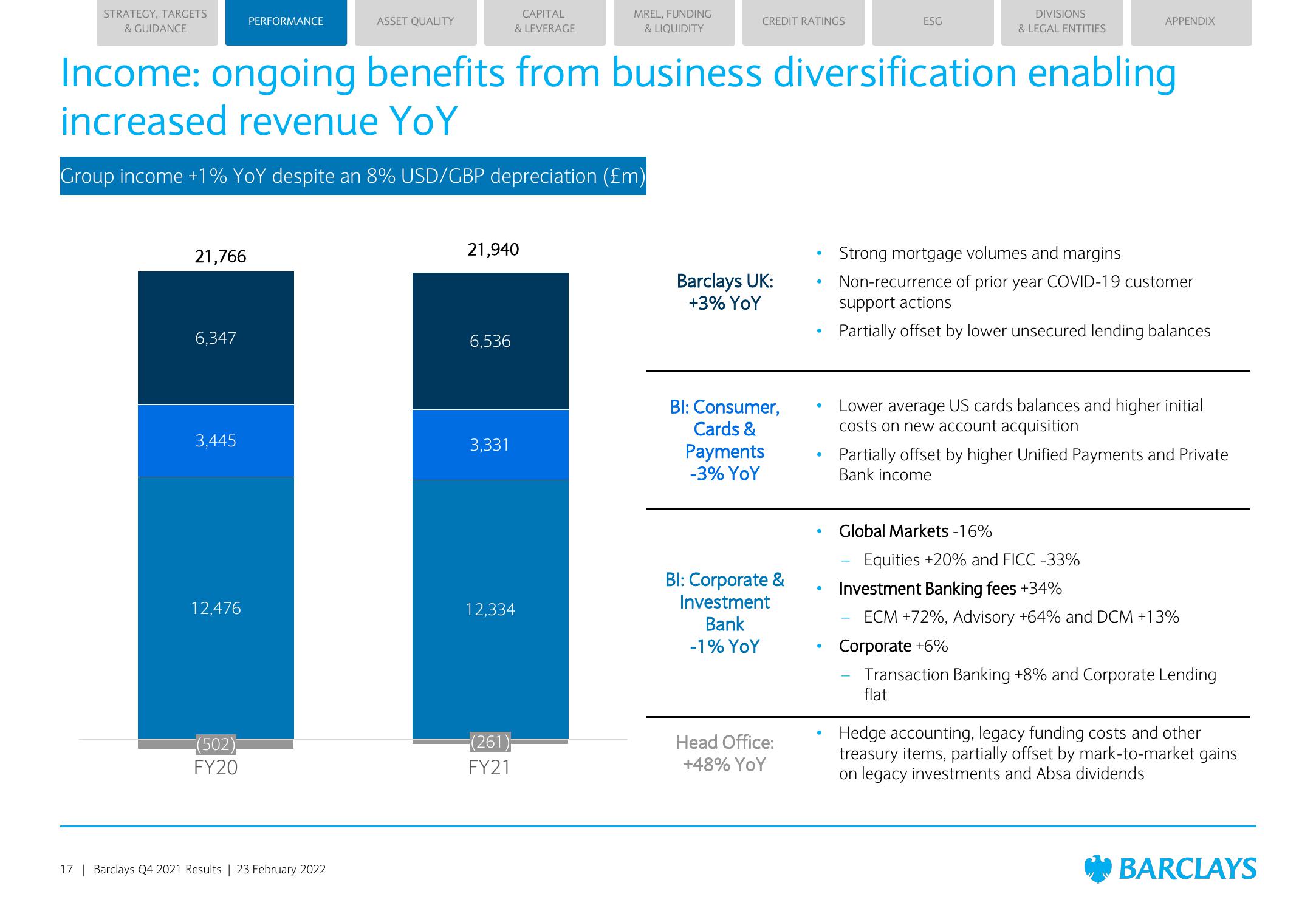

Income: ongoing benefits from business diversification enabling

increased revenue YoY

Group income +1% YoY despite an 8% USD/GBP depreciation (£m)

21,940

6,536

CAPITAL

& LEVERAGE

3,331

12,334

(261);

FY21

MREL, FUNDING

& LIQUIDITY

CREDIT RATINGS

Barclays UK:

+3% YoY

Bl: Consumer,

Cards &

Payments

-3% YoY

Bl: Corporate &

Investment

Bank

-1% YoY

ESG

Head Office:

+48% YoY

DIVISIONS

& LEGAL ENTITIES

APPENDIX

Strong mortgage volumes and margins

Non-recurrence of prior year COVID-19 customer

support actions

Partially offset by lower unsecured lending balances

Lower average US cards balances and higher initial

costs on new account acquisition

Global Markets -1

Partially offset by higher Unified Payments and Private

Bank income

Equities +20% and FICC -33%

Investment Banking fees +34%

ECM +72%, Advisory +64% and DCM +13%

Corporate +6%

Transaction Banking +8% and Corporate Lending

flat

Hedge accounting, legacy funding costs and other

treasury items, partially offset by mark-to-market gains

on legacy investments and Absa dividends

BARCLAYSView entire presentation