Enact IPO Presentation Deck

Enact | Investor Presentation

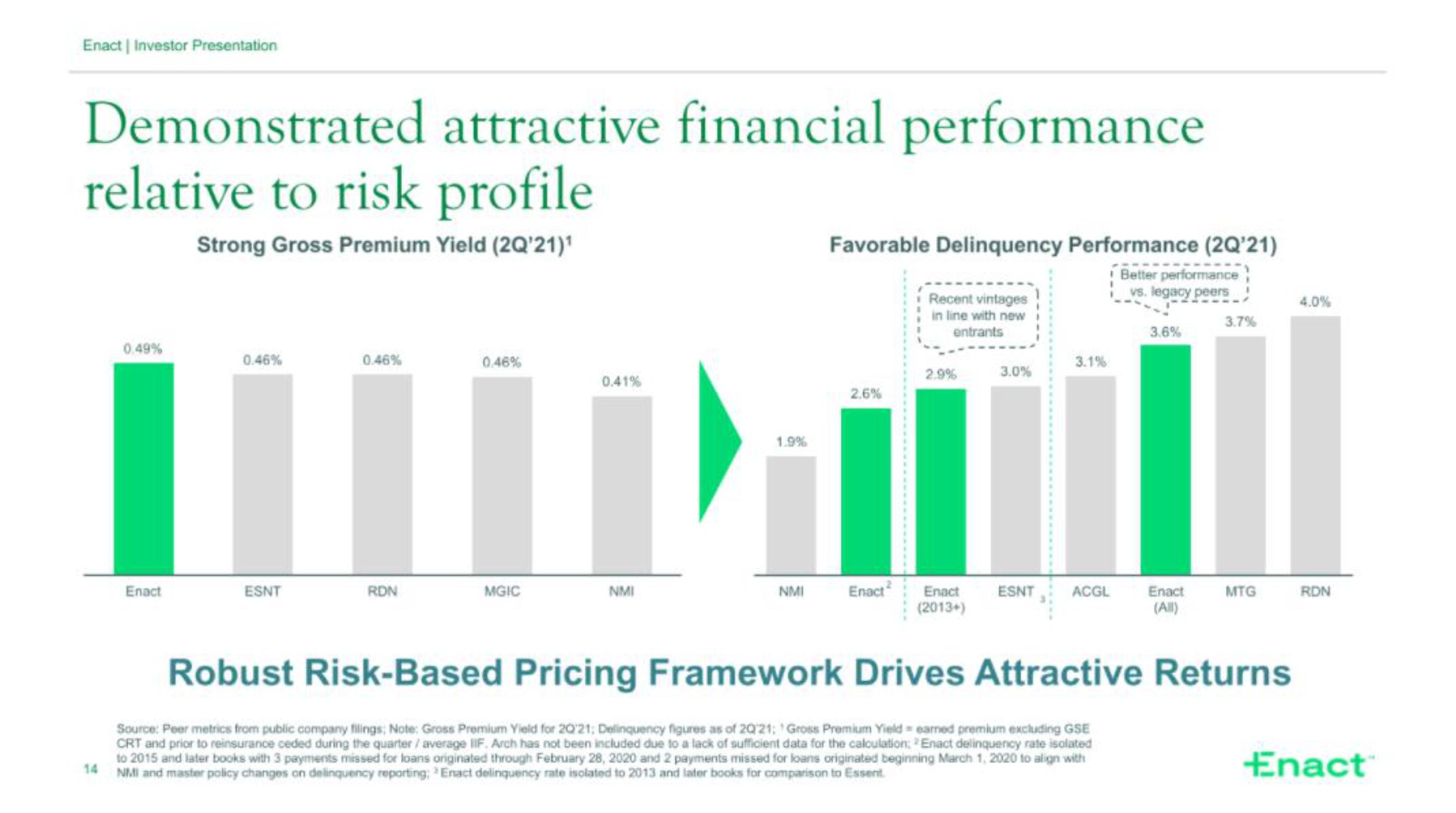

Demonstrated attractive financial performance

relative to risk profile

Strong Gross Premium Yield (2Q'21)¹

0.49%

Enact

0.46%

ESNT

0.46%

RDN

0.46%

MGIC

0.41%

NMI

1.9%

NMI

Favorable Delinquency Performance (2Q'21)

Better performance

vs. legacy peers

2.6%

Enact

Recent vintages

in line with new

entrants

2.9%

Enact

(2013+)

3.0%

3.1%

ESNT ACGL

3.6%

Source: Peer metrics from public company filings; Note: Gross Premium Yield for 20'21; Delinquency figures as of 20'21; Gross Premium Yield eamed premium excluding GSE

CRT and prior to reinsurance ceded during the quarter / average IIF. Arch has not been included due to a lack of sufficient data for the calculation, Enact delinquency rate isolated

to 2015 and later books with 3 payments missed for loans originated through February 28, 2020 and 2 payments missed for loans originated beginning March 1, 2020 to align with

14 NMI and master policy changes on delinquency reporting: Enact delinquency rate isolated to 2013 and later books for comparison to Essent

Enact

(All)

3.7%

MTG

Robust Risk-Based Pricing Framework Drives Attractive Returns

4.0%

RDN

EnactView entire presentation