Bausch Health Companies Investor Conference Presentation Deck

21

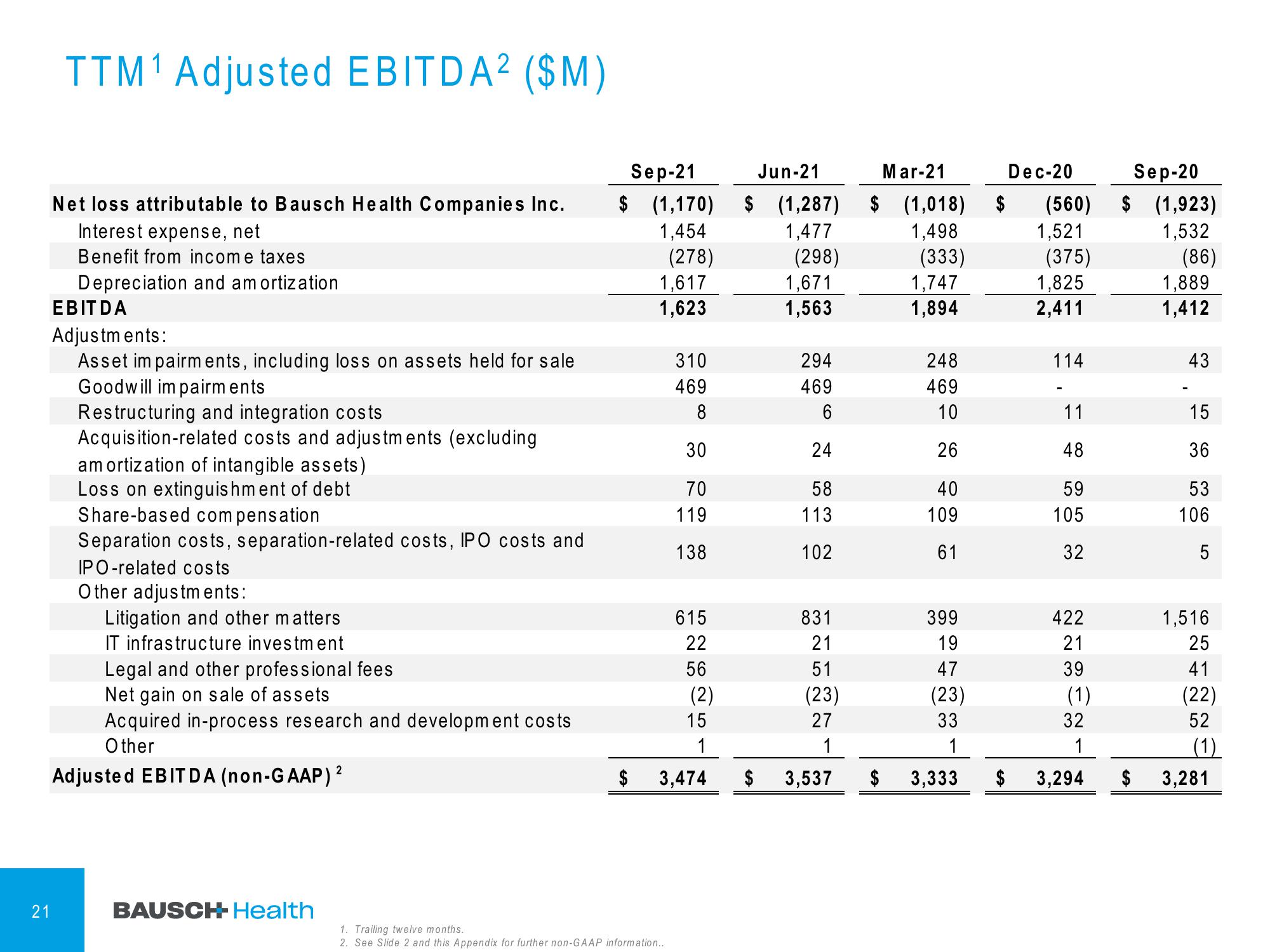

TTM¹ Adjusted EBITDA² ($M)

Net loss attributable to Bausch Health Companies Inc.

Interest expense, net

Benefit from income taxes

Depreciation and amortization

EBITDA

Adjustments:

Asset impairments, including loss on assets held for sale

Goodwill impairments

Restructuring and integration costs

Acquisition-related costs and adjustments (excluding

amortization of intangible assets)

Loss on extinguishment of debt

Share-based compensation

Separation costs, separation-related costs, IPO costs and

IPO-related costs

Other adjustments:

Litigation and other matters

IT infrastructure investment

Legal and other professional fees

Net gain on sale of assets

Acquired in-process research and development costs

Other

2

Adjusted EBITDA (non-GAAP) ²

BAUSCH- Health

Sep-21

$ (1,170)

1,454

$

(278)

1,617

1,623

1. Trailing twelve months.

2. See Slide 2 and this Appendix for further non-GAAP information..

310

469

8

30

70

119

138

615

22

56

(2)

15

1

3,474

Jun-21

Mar-21

Dec-20

$ (1,287) $ (1,018) $ (560)

1,477

1,498

1,521

$

(298)

1,671

1,563

294

469

6

24

58

113

102

831

21

51

(23)

27

1

3,537

$

(333)

1,747

1,894

248

469

10

26

40

109

61

399

19

47

(23)

33

1

3,333

$

(375)

1,825

2,411

114

11

48

59

105

32

422

21

39

(1)

32

1

3,294

Sep-20

$ (1,923)

1,532

$

(86)

1,889

1,412

43

15

36

53

106

LO

5

1,516

25

41

(22)

52

(1)

3,281View entire presentation