WeWork Results Presentation Deck

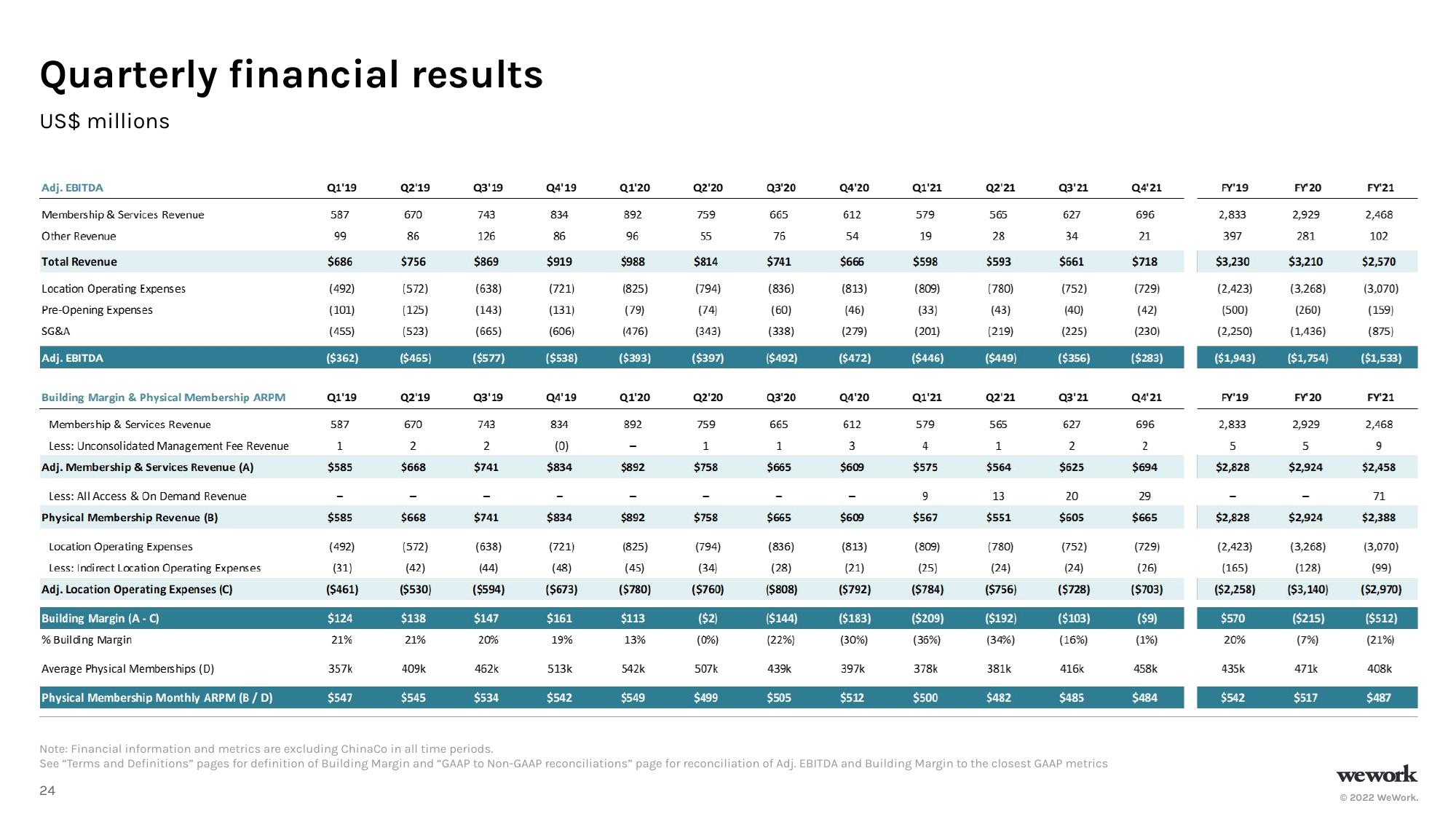

Quarterly financial results

US$ millions

Adj. EBITDA

Membership & Services Revenue

Other Revenue

Total Revenue

Location Operating Expenses

Pre-Opening Expenses

SG&A

Adj. EBITDA

Building Margin & Physical Membership ARPM

Membership & Services Revenue

Less: Unconsolidated Management Fee Revenue

Adj. Membership & Services Revenue (A)

Less: All Access & On Demand Revenue

Physical Membership Revenue (B)

Location Operating Expenses

Less: Indirect Location Operating Expenses

Adj. Location Operating Expenses (C)

Building Margin (A - C)

% Building Margin

Average Physical Memberships (D)

Physical Membership Monthly ARPM (B/ D)

Q1'19

587

99

$686

(492)

(101)

(455)

($362)

Q1'19

587

1

$585

$585

(492)

(31)

($461)

$124

21%

357k

$547

Q2'19

670

86

$756

(572)

(125)

(523)

($465)

Q2'19

670

2

$668

$668

(572)

(42)

($530)

$138

21%

409k

$545

Q3'19

743

126

$869

(638)

(143)

(665)

($577)

Q3'19

743

2

$741

$741

(638)

(44)

($594)

$147

20%

462k

$534

Q4'19

834

86

$919

(721)

(131)

(606)

($538)

Q4'19

834

(0)

$834

$834

(721)

(48)

($673)

$161

19%

513k

$542

Q1'20

892

96

$988

(825)

(79)

(476)

($393)

Q1'20

892

$892

-

$892

(825)

(45)

($780)

$113

13%

542k

$549

Q2'20

759

55

$814

(794)

(74)

(343)

($397)

Q2'20

759

1

$758

$758

(794)

(34)

($760)

($2)

(0%)

507k

$499

Q3'20

665

76

$741

(836)

(60)

(338)

($492)

Q3'20

665

1

$665

$665

(836)

(28)

($808)

($144)

(22%)

439k

$505

Q4'20

612

54

$666

(813)

(46)

(279)

($472)

Q4'20

612

3

$609

-

$609

(813)

(21)

($792)

($183)

(30%)

397k

$512

Q1'21

579

19

$598

(809)

(33)

(201)

($446)

Q1'21

579

4

$575

9

$567

(809)

(25)

($784)

($209)

(36%)

378k

$500

Q2'21

565

28

$593

(780)

(43)

(219)

($449)

Q2'21

565

1

$564

13

$551

(780)

(24)

($756)

($192)

(34%)

381k

$482

Q3'21

627

34

$661

(752)

(40)

(225)

($356)

Q3'21

627

2

$625

20

$605

(752)

(24)

($728)

($103)

(16%)

416k

$485

Note: Financial information and metrics are excluding ChinaCo in all time periods.

See "Terms and Definitions" pages for definition of Building Margin and "GAAP to Non-GAAP reconciliations" page for reconciliation of Adj. EBITDA and Building Margin to the closest GAAP metrics

24

Q4'21

696

21

$718

(729)

(42)

(230)

($283)

Q4'21

696

2

$694

29

$665

(729)

(26)

($703)

($9)

(1%)

458k

$484

FY'19

2,833

397

$3,230

(2,423)

(500)

(2,250)

($1,943)

FY'19

2,833

5

$2,828

$2,828

(2,423)

(165)

($2,258)

$570

20%

435k

$542

FY' 20

2,929

281

$3,210

(3,268)

(260)

(1,436)

($1,754)

FY' 20

2,929

5

$2,924

$2,924

(3,268)

(128)

($3,140)

($215)

(7%)

471k

$517

FY'21

2,468

102

$2,570

(3,070)

(159)

(875)

($1,533)

FY¹21

2,468

9

$2,458

71

$2,388

(3,070)

(99)

($2,970)

($512)

(21%)

408k

$487

wework

Ⓒ2022 WeWork.View entire presentation