Q2 Quarter 2023

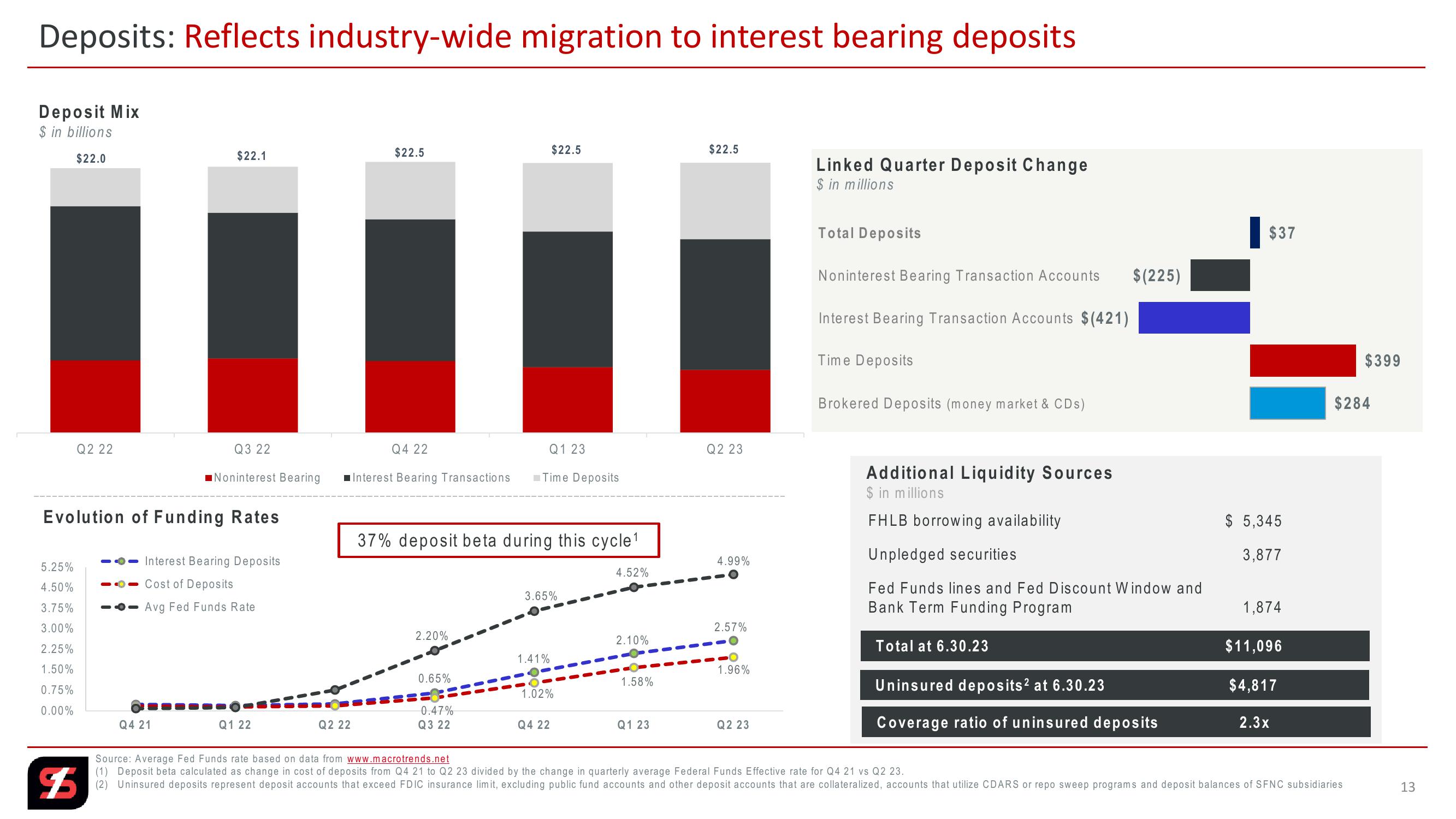

Deposits: Reflects industry-wide migration to interest bearing deposits

Deposit Mix

$ in billions

$22.0

$22.1

$22.5

$22.5

$22.5

Linked Quarter Deposit Change

$ in millions

Total Deposits

$37

Noninterest Bearing Transaction Accounts

$(225)

Interest Bearing Transaction Accounts $(421)

Time Deposits

Brokered Deposits (money market & CDs)

Q2 22

Q3 22

■Noninterest Bearing

Q4 22

Q1 23

Q2 23

■Interest Bearing Transactions ■Time Deposits

Evolution of Funding Rates

37% deposit beta during this cycle¹

5.25%

Interest Bearing Deposits

4.99%

Additional Liquidity Sources

$ in millions

FHLB borrowing availability

$ 5,345

Unpledged securities

3,877

4.52%

4.50%

Cost of Deposits

3.75%

Avg Fed Funds Rate

3.00%

2.25%

1.50%

0.75%

0.00%

Q4 21

Q1 22

Q2 22

3.65%

Fed Funds lines and Fed Discount Window and

Bank Term Funding Program

2.20%

2.57%

2.10%

Total at 6.30.23

1.41%

1.96%

0.65%

1.58%

1.02%

Uninsured deposits² at 6.30.23

0.47%

Q3 22

Q4 22

Q1 23

Q2 23

1,874

$11,096

$4,817

Coverage ratio of uninsured deposits

2.3x

$5

$399

$284

Source: Average Fed Funds rate based on data from www.macrotrends.net

(1) Deposit beta calculated as change in cost of deposits from Q4 21 to Q2 23 divided by the change in quarterly average Federal Funds Effective rate for Q4 21 vs Q2 23.

(2) Uninsured deposits represent deposit accounts that exceed FDIC insurance limit, excluding public fund accounts and other deposit accounts that are collateralized, accounts that utilize CDARS or repo sweep programs and deposit balances of SFNC subsidiaries

13View entire presentation