AngloAmerican Investor Day Presentation Deck

Quellaveco accounting - debt

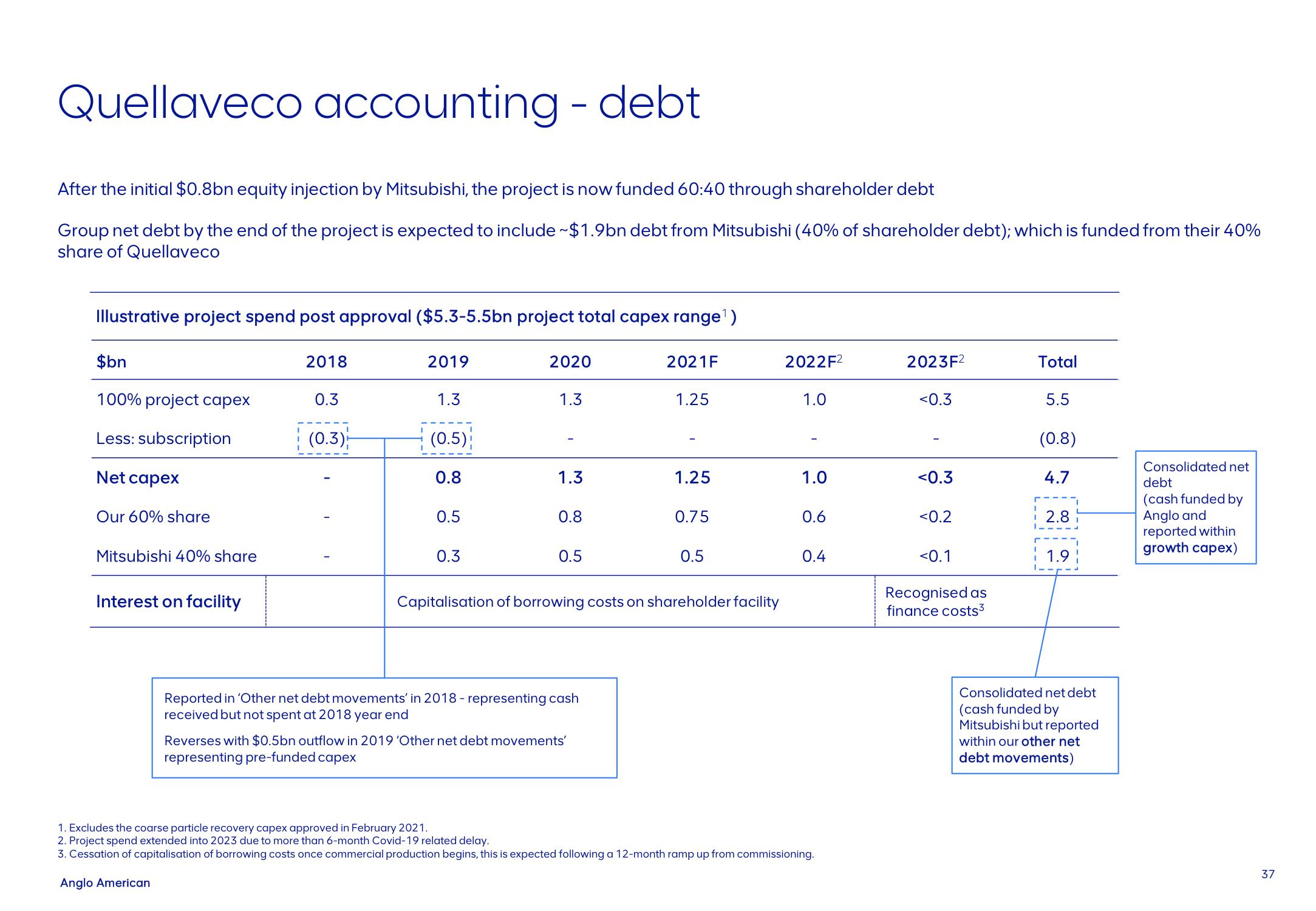

After the initial $0.8bn equity injection by Mitsubishi, the project is now funded 60:40 through shareholder debt

Group net debt by the end of the project is expected to include ~$1.9bn debt from Mitsubishi (40% of shareholder debt); which is funded from their 40%

share of Quellaveco

Illustrative project spend post approval ($5.3-5.5bn project total capex range¹)

$bn

100% project capex

Less: subscription

Net capex

Our 60% share

Mitsubishi 40% share

Interest on facility

2018

0.3

(0.3)

2019

1.3

(0.5)

0.8

0.5

0.3

2020

1.3

1.3

0.8

0.5

Reported in 'Other net debt movements' in 2018 - representing cash

received but not spent at 2018 year end

2021F

Reverses with $0.5bn outflow in 2019 'Other net debt movements'

representing pre-funded capex

1.25

1.25

0.75

Capitalisation of borrowing costs on shareholder facility

0.5

2022F²

1.0

1.0

0.6

0.4

1. Excludes the coarse particle recovery capex approved in February 2021.

2. Project spend extended into 2023 due to more than 6-month Covid-19 related delay.

3. Cessation of capitalisation of borrowing costs once commercial production begins, this is expected following a 12-month ramp up from commissioning.

Anglo American

2023F²

<0.3

<0.3

<0.2

<0.1

Recognised as

finance costs3

Total

5.5

(0.8)

4.7

2.8

1.9

Consolidated net debt

(cash funded by

Mitsubishi but reported

within our other net

debt movements)

Consolidated net

debt

(cash funded by

Anglo and

reported within

growth capex)

37View entire presentation