Zegna Investor Presentation Deck

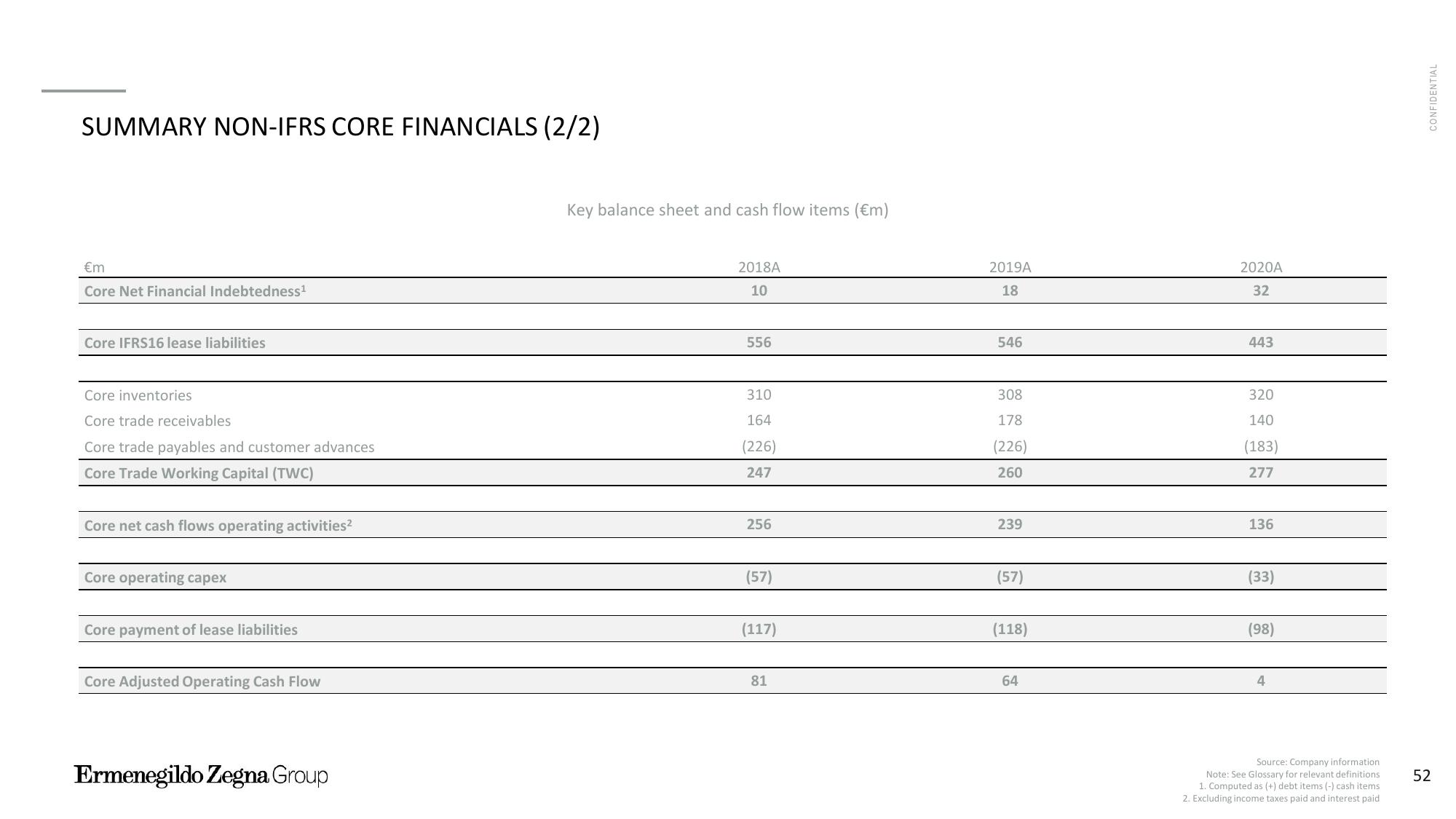

SUMMARY NON-IFRS CORE FINANCIALS (2/2)

€m

Core Net Financial Indebtedness¹

Core IFRS16 lease liabilities

Core inventories

Core trade receivables

Core trade payables and customer advances

Core Trade Working Capital (TWC)

Core net cash flows operating activities²

Core operating capex

Core payment of lease liabilities

Core Adjusted Operating Cash Flow

Ermenegildo Zegna Group

Key balance sheet and cash flow items (€m)

2018A

10

556

310

164

(226)

247

256

(57)

(117)

81

2019A

18

546

308

178

(226)

260

239

(57)

(118)

64

2020A

32

443

320

140

(183)

277

136

(33)

(98)

4

Source: Company information

Note: See Glossary for relevant definitions

1. Computed as (+) debt items (-) cash items

2. Excluding income taxes paid and interest paid

CONFIDENTIAL

52View entire presentation