Moelis & Company Investment Banking Pitch Book

Situation Overview

STRICTLY CONFIDENTIAL

MOELIS & COMPANY

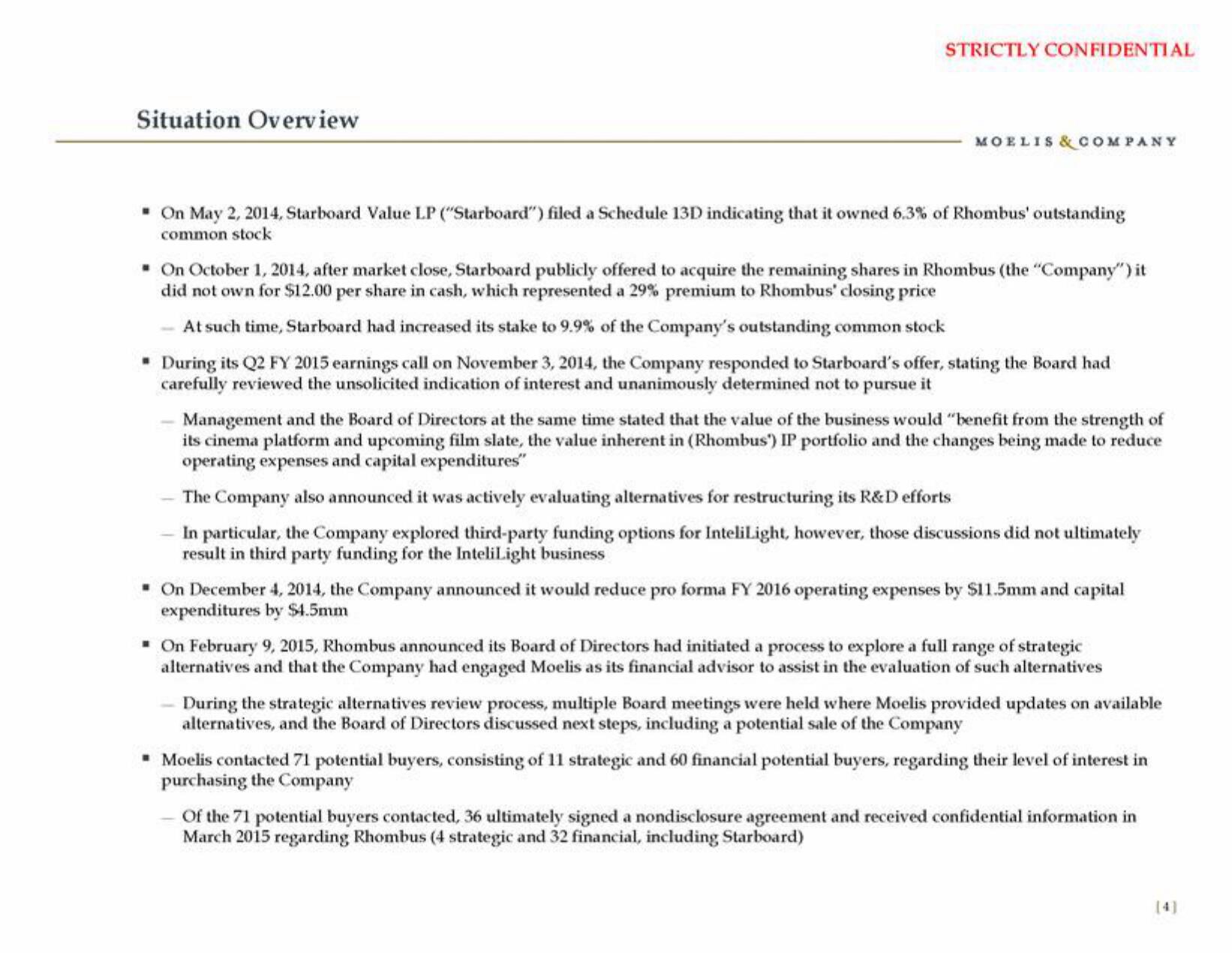

▪ On May 2, 2014, Starboard Value LP ("Starboard") filed a Schedule 13D indicating that it owned 6.3% of Rhombus' outstanding

common stock

▪ On October 1, 2014, after market close, Starboard publicly offered to acquire the remaining shares in Rhombus (the "Company") it

did not own for $12.00 per share in cash, which represented a 29% premium to Rhombus' closing price

- At such time, Starboard had increased its stake to 9.9% of the Company's outstanding common stock

▪ During its Q2 FY 2015 earnings call on November 3, 2014, the Company responded to Starboard's offer, stating the Board had

carefully reviewed the unsolicited indication of interest and unanimously determined not to pursue it

Management and the Board of Directors at the same time stated that the value of the business would "benefit from the strength of

its cinema platform and upcoming film slate, the value inherent in (Rhombus") IP portfolio and the changes being made to reduce

operating expenses and capital expenditures"

- The Company also announced it was actively evaluating alternatives for restructuring its R&D efforts

In particular, the Company explored third-party funding options for InteliLight, however, those discussions did not ultimately

result in third party funding for the InteliLight business

▪ On December 4, 2014, the Company announced it would reduce pro forma FY 2016 operating expenses by $11.5mm and capital

expenditures by $4.5mm

▪ On February 9, 2015, Rhombus announced its Board of Directors had initiated a process to explore a full range of strategic

alternatives and that the Company had engaged Moelis as its financial advisor to assist in the evaluation of such alternatives

During the strategic alternatives review process, multiple Board meetings were held where Moelis provided updates on available

alternatives, and the Board of Directors discussed next steps, including a potential sale of the Company

▪ Moelis contacted 71 potential buyers, consisting of 11 strategic and 60 financial potential buyers, regarding their level of interest in

purchasing the Company

Of the 71 potential buyers contacted, 36 ultimately signed a nondisclosure agreement and received confidential information in

March 2015 regarding Rhombus (4 strategic and 32 financial, including Starboard)View entire presentation