Perfect SPAC Presentation Deck

PERFECT

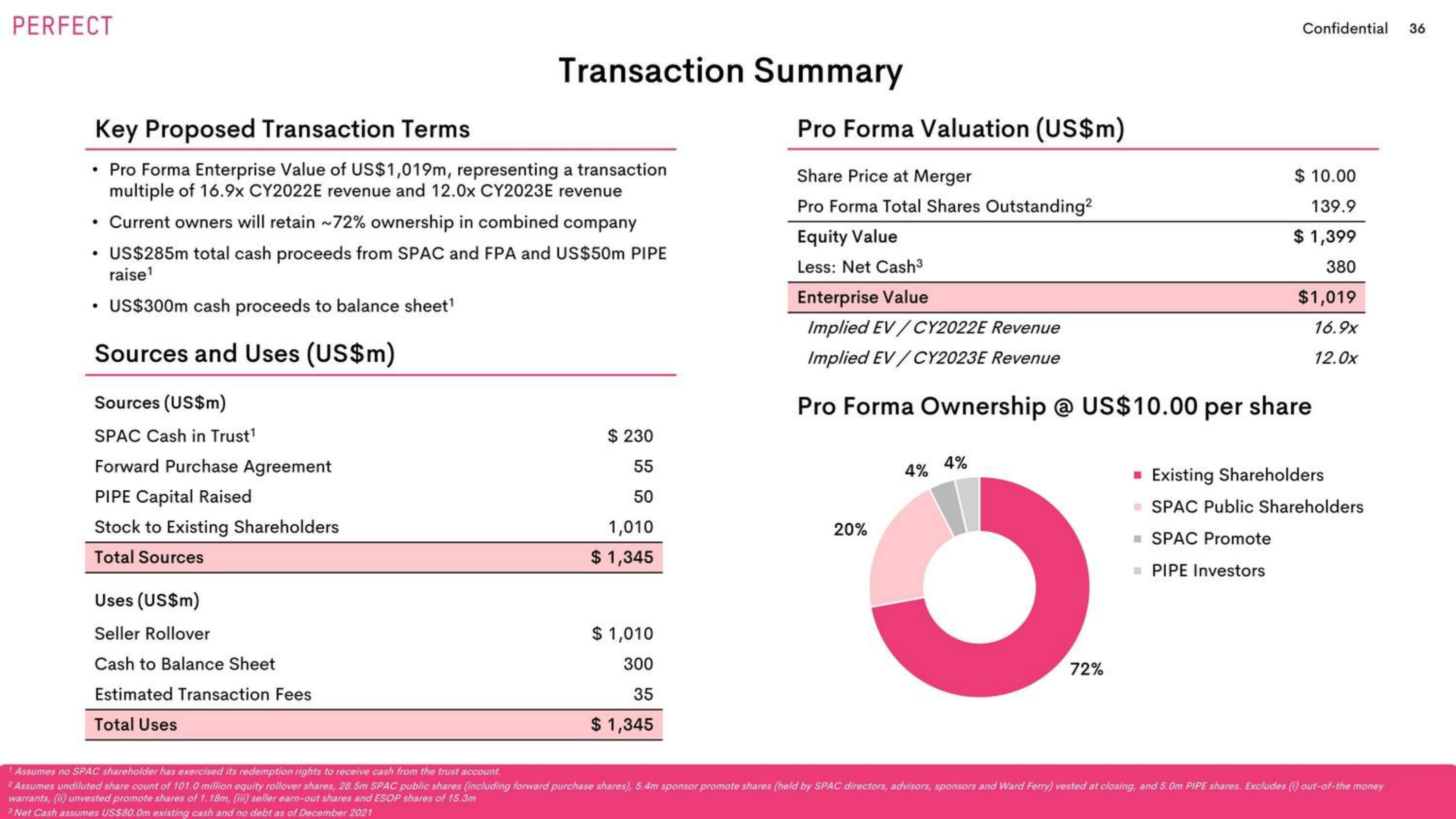

Key Proposed Transaction Terms

Pro Forma Enterprise Value of US$1,019m, representing a transaction

multiple of 16.9x CY2022E revenue and 12.0x CY2023E revenue

• Current owners will retain ~72% ownership in combined company

US$285m total cash proceeds from SPAC and FPA and US$50m PIPE

raise¹

US$300m cash proceeds to balance sheet¹

Sources and Uses (US$m)

●

Sources (US$m)

SPAC Cash in Trust¹

Forward Purchase Agreement

PIPE Capital Raised

Stock to Existing Shareholders

Total Sources

Transaction Summary

Uses (US$m)

Seller Rollover

Cash to Balance Sheet

Estimated Transaction Fees

Total Uses

$ 230

55

50

1,010

$ 1,345

$ 1,010

300

35

$1,345

Pro Forma Valuation (US$m)

Share Price at Merger

Pro Forma Total Shares Outstanding2

Equity Value

Less: Net Cash³

20%

Enterprise Value

Implied EV/CY2022E Revenue

Implied EV/CY2023E Revenue

Pro Forma Ownership @ US$10.00 per share

4%

4%

O

Confidential 36

72%

$10.00

139.9

$ 1,399

380

$1,019

16.9x

12.0x

■ Existing Shareholders

SPAC Public Shareholders

SPAC Promote

PIPE Investors

Assumes no SPAC shareholder has exercised its redemption rights to receive cash from the trust account.

*Assumes undiluted share count of 101.0 million equity rollover shares, 28.5m SPAC public shares (including forward purchase shares), 5.4m sponsor promote shares (held by SPAC directors, advisors, sponsors and Ward Ferry) vested at closing, and 5.0m PIPE shares. Excludes (i) out-of-the money

warrants, (ii) unvested promote shares of 1.18m, (iii) seller earn-out shares and ESOP shares of 15.3m

3 Net Cash assumes US$80.0m existing cash and no debt as of December 2021View entire presentation