J.P.Morgan Results Presentation Deck

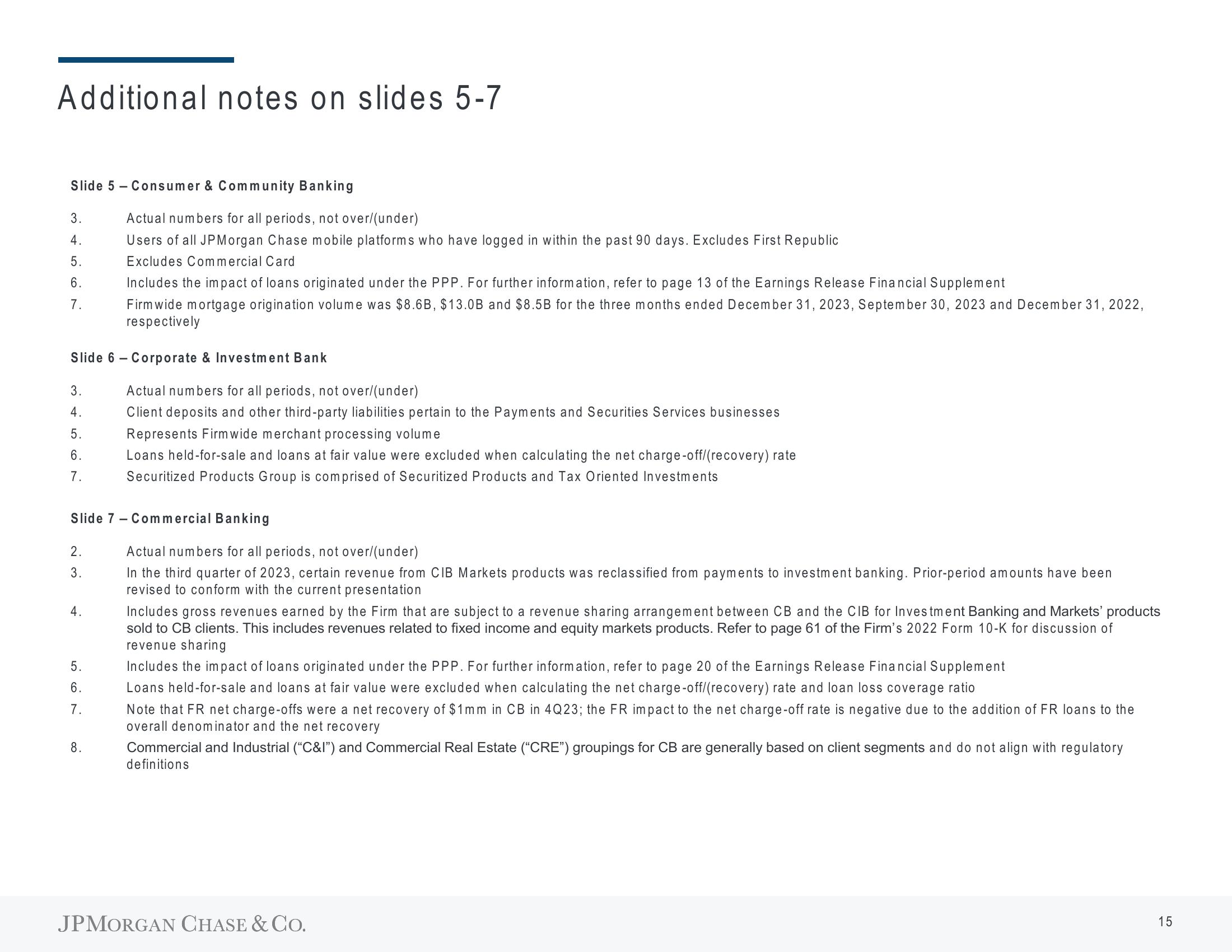

Additional notes on slides 5-7

Slide 5 Consumer & Community Banking

3.

4.

5.

6.

7.

3.

4.

5.

6.

7.

Slide 6 Corporate & Investment Bank

2.

3.

4.

Actual numbers for all periods, not over/(under)

Users of all JPMorgan Chase mobile platforms who have logged in within the past 90 days. Excludes First Republic

Excludes Commercial Card

Slide 7 - Commercial Banking

5.

6.

7.

Includes the impact of loans originated under the PPP. For further information, refer to page 13 of the Earnings Release Financial Supplement

Firmwide mortgage origination volume was $8.6B, $13.0B and $8.5B for the three months ended December 31, 2023, September 30, 2023 and December 31, 2022,

respectively

8.

Actual numbers for all periods, not over/(under)

Client deposits and other third-party liabilities pertain to the Payments and Securities Services businesses

Represents Firmwide merchant processing volume

Loans held-for-sale and loans at fair value were excluded when calculating the net charge-off/(recovery) rate

Securitized Products Group is comprised of Securitized Products and Tax Oriented Investments

Actual numbers for all periods, not over/(under)

In the third quarter of 2023, certain revenue from CIB Markets products was reclassified from payments to investment banking. Prior-period amounts have been

revised to conform with the current presentation

Includes gross revenues earned by the Firm that are subject to a revenue sharing arrangement between CB and the CIB for Investment Banking and Markets' products

sold to CB clients. This includes revenues related to fixed income and equity markets products. Refer to page 61 of the Firm's 2022 Form 10-K for discussion of

revenue sharing

Includes the impact of loans originated under the PPP. For further information, refer to page 20 of the Earnings Release Financial Supplement

Loans held-for-sale and loans at fair value were excluded when calculating the net charge-off/(recovery) rate and loan loss coverage ratio

Note that FR net charge-offs were a net recovery of $1mm in CB in 4Q23; the FR impact to the net charge-off rate is negative due to the addition of FR loans to the

overall denominator and the net recovery

Commercial and Industrial ("C&I") and Commercial Real Estate ("CRE") groupings for CB are generally based on client segments and do not align with regulatory

definitions

JPMORGAN CHASE & CO.

15View entire presentation