Trian Partners Activist Presentation Deck

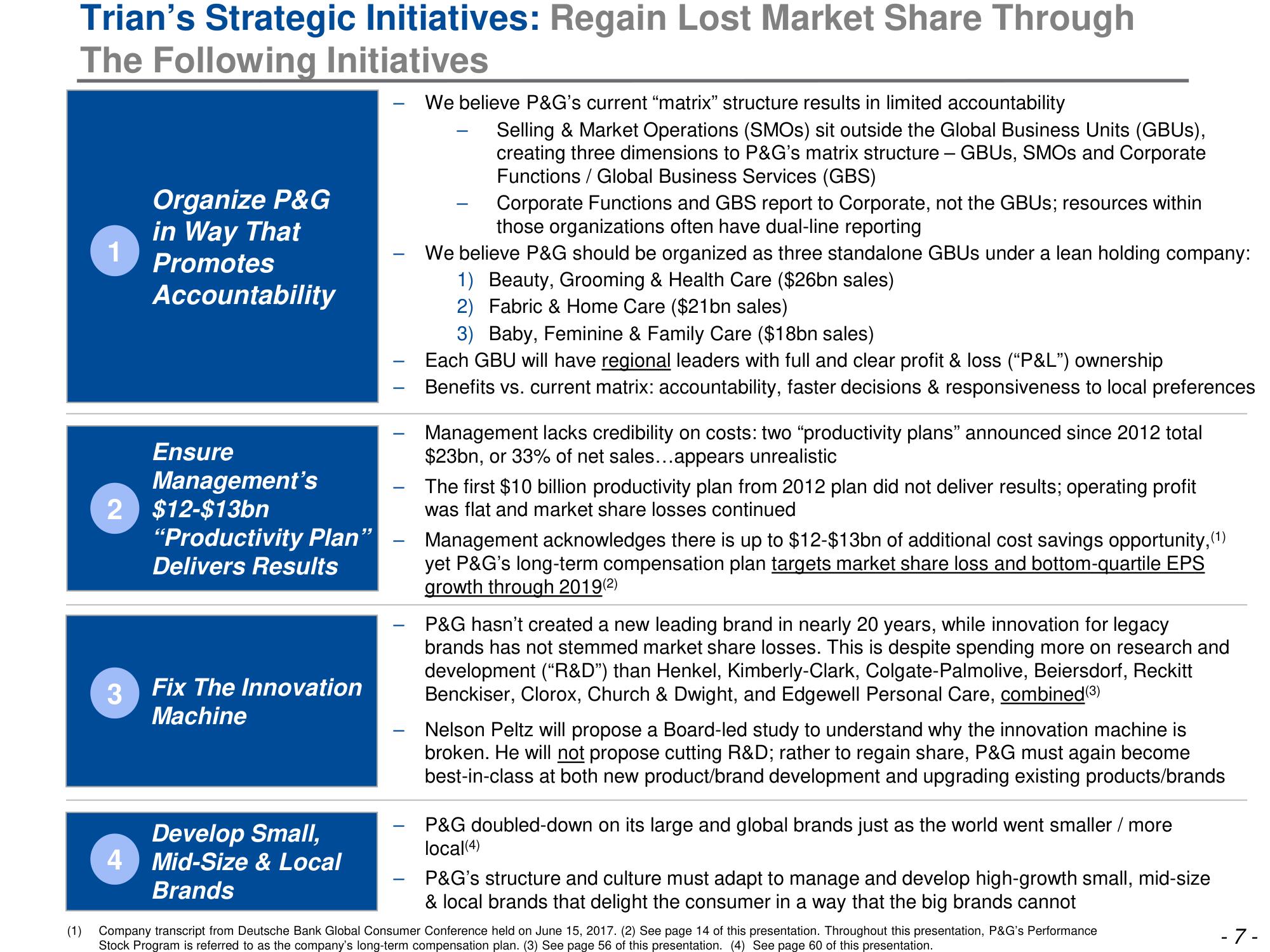

Trian's Strategic Initiatives: Regain Lost Market Share Through

The Following Initiatives

1

3

Organize P&G

in Way That

Promotes

Accountability

2 $12-$13bn

4

Ensure

Management's

"Productivity Plan"

Delivers Results

Fix The Innovation

Machine

Develop Small,

Mid-Size & Local

Brands

-

-

We believe P&G's current "matrix" structure results in limited accountability

Selling & Market Operations (SMOS) sit outside the Global Business Units (GBUs),

creating three dimensions to P&G's matrix structure GBUS, SMOS and Corporate

Functions / Global Business Services (GBS)

Corporate Functions and GBS report to Corporate, not the GBUS; resources within

those organizations often have dual-line reporting

We believe P&G should be organized as three standalone GBUS under a lean holding company:

1) Beauty, Grooming & Health Care ($26bn sales)

2) Fabric & Home Care ($21bn sales)

3) Baby, Feminine & Family Care ($18bn sales)

Each GBU will have regional leaders with full and clear profit & loss ("P&L") ownership

Benefits vs. current matrix: accountability, faster decisions & responsiveness to local preferences

Management lacks credibility on costs: two "productivity plans" announced since 2012 total

$23bn, or 33% of net sales...appears unrealistic

The first $10 billion productivity plan from 2012 plan did not deliver results; operating profit

was flat and market share losses continued

Management acknowledges there is up to $12-$13bn of additional cost savings opportunity, (1

yet P&G's long-term compensation plan targets market share loss and bottom-quartile EPS

growth through 2019(2)

P&G hasn't created a new leading brand in nearly 20 years, while innovation for legacy

brands has not stemmed market share losses. This is despite spending more on research and

development ("R&D”) than Henkel, Kimberly-Clark, Colgate-Palmolive, Beiersdorf, Reckitt

Benckiser, Clorox, Church & Dwight, and Edgewell Personal Care, combined (³)

Nelson Peltz will propose a Board-led study to understand why the innovation machine is

broken. He will not propose cutting R&D; rather to regain share, P&G must again become

best-in-class at both new product/brand development and upgrading existing products/brands

P&G doubled-down on its large and global brands just as the world went smaller / more

local(4)

P&G's structure and culture must adapt to manage and develop high-growth small, mid-size

& local brands that delight the consumer in a way that the big brands cannot

(1) Company transcript from Deutsche Bank Global Consumer Conference held on June 15, 2017. (2) See page 14 of this presentation. Throughout this presentation, P&G's Performance

Stock Program is referred to as the company's long-term compensation plan. (3) See page 56 of this presentation. (4) See page 60 of this presentation.

-7-View entire presentation