LSE Mergers and Acquisitions Presentation Deck

1

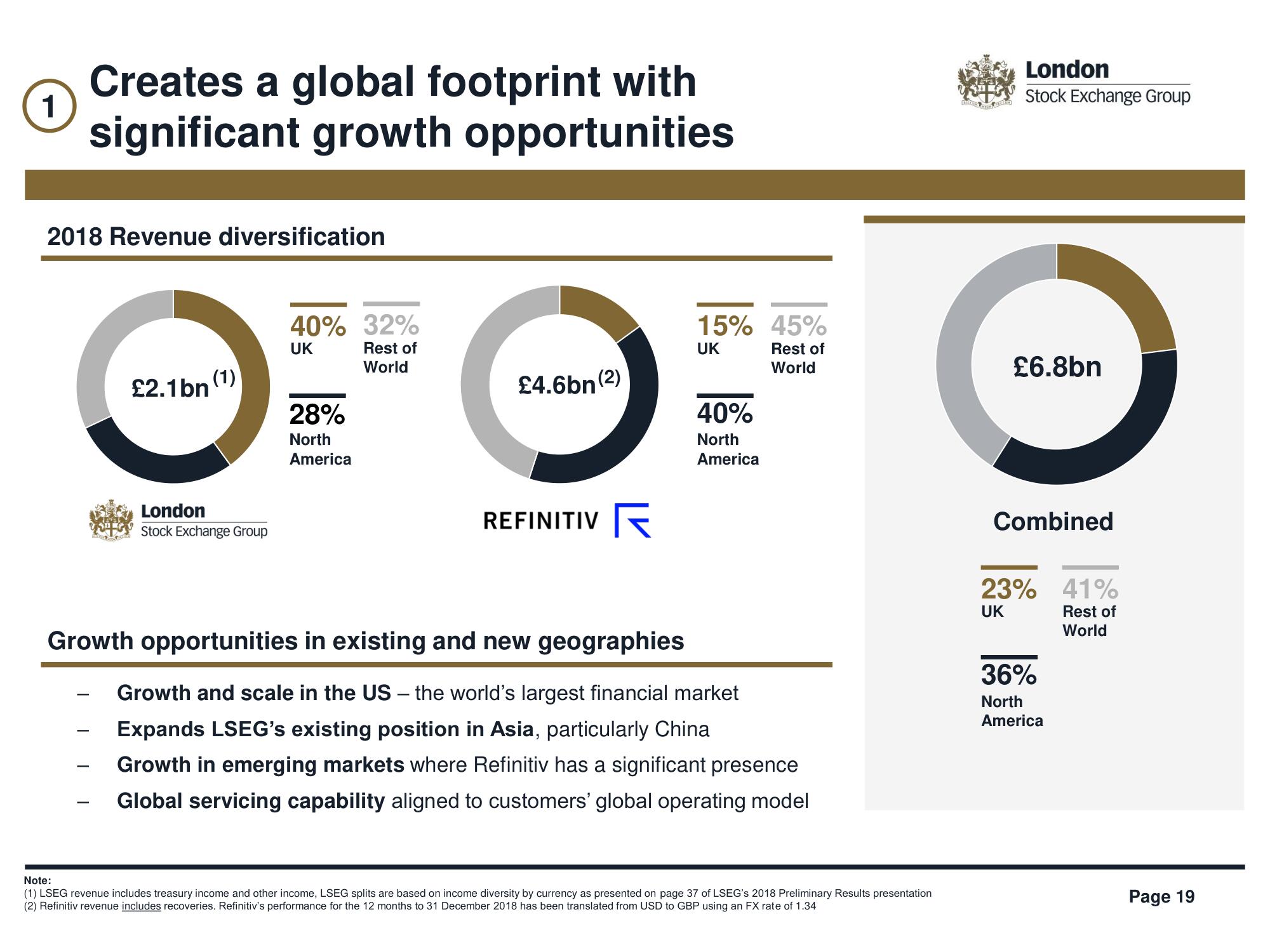

Creates a global footprint with

significant growth opportunities

2018 Revenue diversification

£2.1bn (1)

London

Stock Exchange Group

40% 32%

UK

Rest of

World

28%

North

America

£4.6bn (2)

REFINITIV

15% 45%

UK

Rest of

World

40%

North

America

Growth opportunities in existing and new geographies

Growth and scale in the US - the world's largest financial market

Expands LSEG's existing position in Asia, particularly China

Growth in emerging markets where Refinitiv has a significant presence

Global servicing capability aligned to customers' global operating model

Note:

(1) LSEG revenue includes treasury income and other income, LSEG splits are based on income diversity by currency as presented on page 37 of LSEG's 2018 Preliminary Results presentation

(2) Refinitiv revenue includes recoveries. Refinitiv's performance for the 12 months to 31 December 2018 has been translated from USD to GBP using an FX rate of 1.34

London

Stock Exchange Group

£6.8bn

Combined

23% 41%

UK

Rest of

World

36%

North

America

Page 19View entire presentation