UBS Fixed Income Presentation Deck

Liquidity

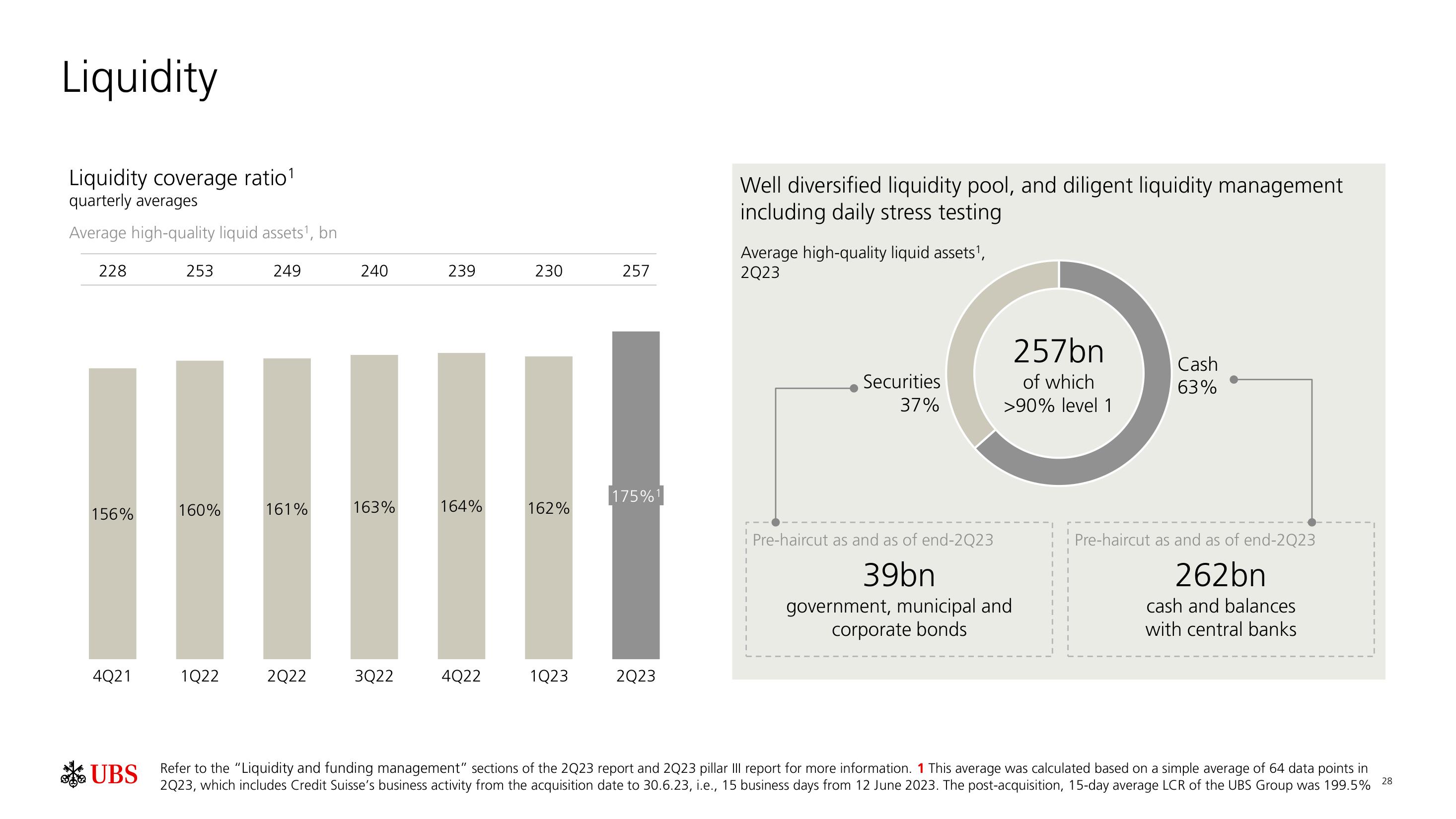

Liquidity coverage ratio¹

quarterly averages

Average high-quality liquid assets¹, bn

228

156%

4Q21

UBS

253

11

161%

160%

249

1Q22

2Q22

240

163%

3Q22

239

164%

4Q22

230

162%

1Q23

257

175%1

2Q23

Well diversified liquidity pool, and diligent liquidity management

including daily stress testing

Average high-quality liquid assets¹,

2Q23

Securities

37%

Pre-haircut as and as of end-2Q23

39bn

257bn

of which

>90% level 1

government, municipal and

corporate bonds

Cash

63%

Pre-haircut as and as of end-2Q23

262bn

cash and balances

with central banks

Refer to the "Liquidity and funding management" sections of the 2Q23 report and 2Q23 pillar III report for more information. 1 This average was calculated based on a simple average of 64 data points in

2Q23, which includes Credit Suisse's business activity from the acquisition date to 30.6.23, i.e., 15 business days from 12 June 2023. The post-acquisition, 15-day average LCR of the UBS Group was 199.5%

I

1

28View entire presentation