Bank of America Results Presentation Deck

All Other¹

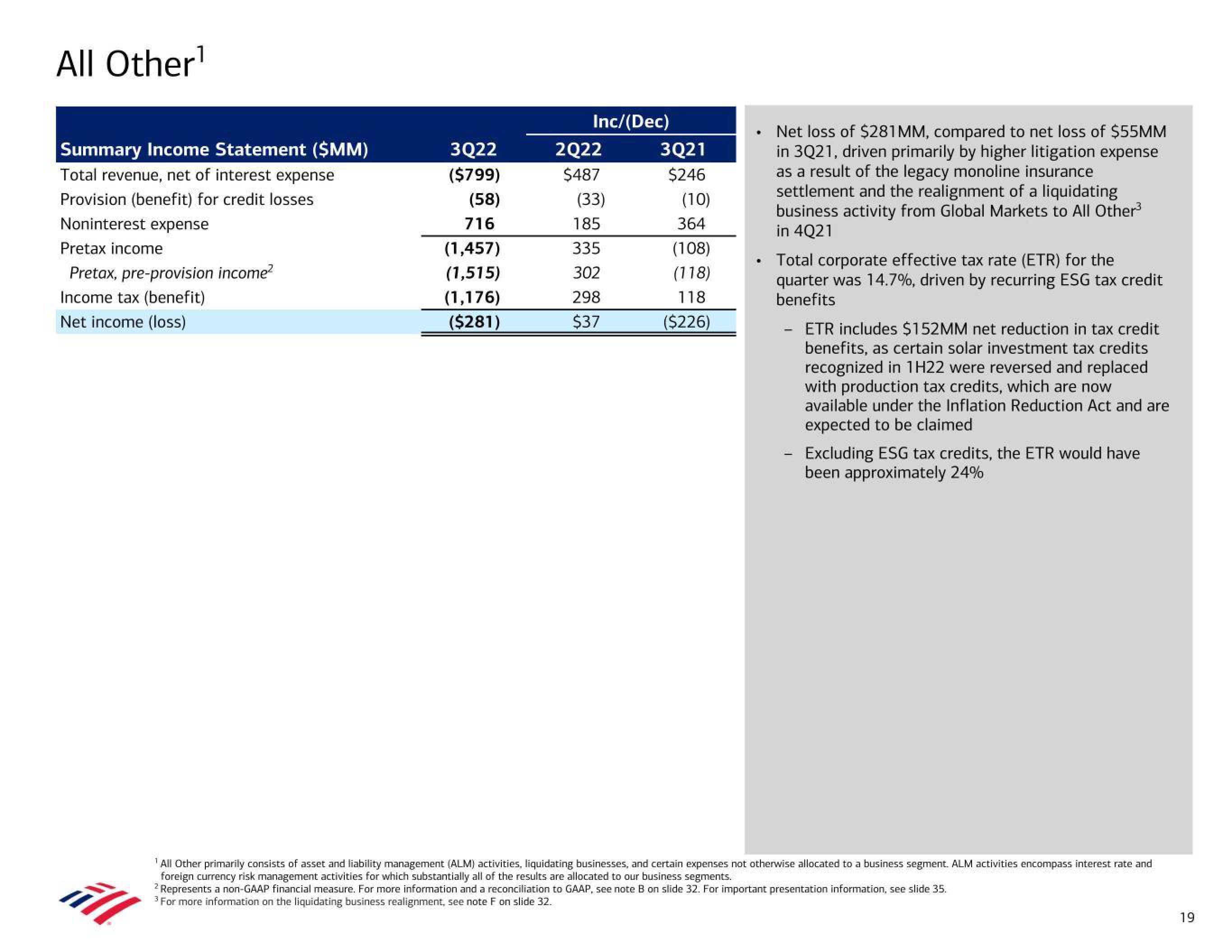

Summary Income Statement ($MM)

Total revenue, net of interest expense

Provision (benefit) for credit losses

Noninterest expense

Pretax income

Pretax, pre-provision income²

Income tax (benefit)

Net income (loss)

ill

3Q22

($799)

(58)

716

(1,457)

(1,515)

(1,176)

($281)

Inc/(Dec)

2Q22

$487

(33)

185

335

302

298

$37

3Q21

$246

(10)

364

(108)

(118)

118

($226)

Net loss of $281MM, compared to net loss of $55MM

in 3Q21, driven primarily by higher litigation expense

as a result of the legacy monoline insurance

settlement and the realignment of a liquidating

business activity from Global Markets to All Other³

in 4Q21

Total corporate effective tax rate (ETR) for the

quarter was 14.7%, driven by recurring ESG tax credit

benefits

-

ETR includes $152MM net reduction in tax credit

benefits, as certain solar investment tax credits

recognized in 1H22 were reversed and replaced

with production tax credits, which are now

available under the Inflation Reduction Act and are

expected to be claimed

Excluding ESG tax credits, the ETR would have

been approximately 24%

¹ All Other primarily consists of asset and liability management (ALM) activities, liquidating businesses, and certain expenses not otherwise allocated to a business segment. ALM activities encompass interest rate and

foreign currency risk management activities for which substantially all of the results are allocated to our business segments.

2 Represents a non-GAAP financial measure. For more information and a reconciliation to GAAP, see note B on slide 32. For important presentation information, see slide 35.

3 For more information on the liquidating business realignment, see note F on slide 32.

19View entire presentation