LSE Mergers and Acquisitions Presentation Deck

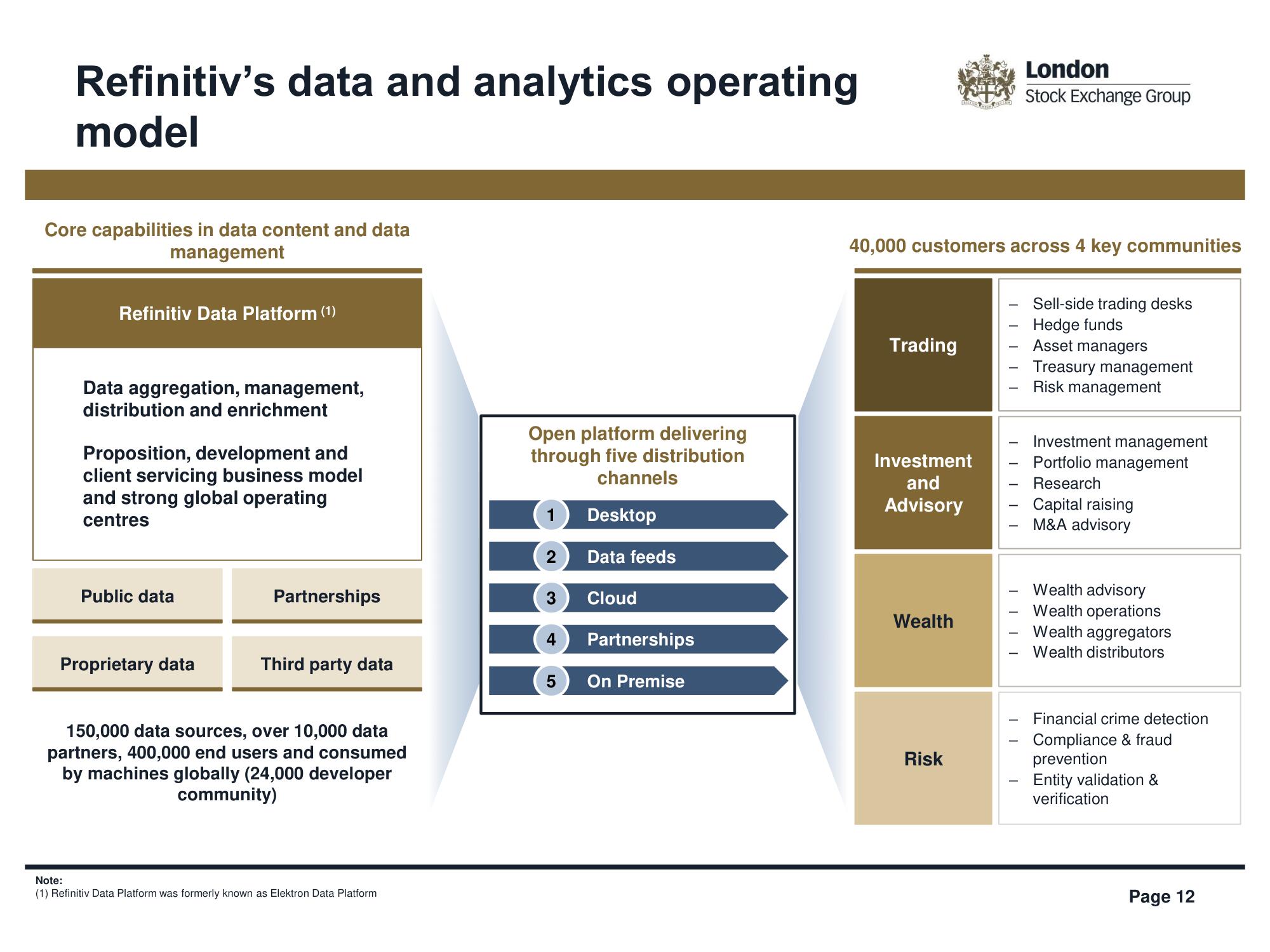

Refinitiv's data and analytics operating

model

Core capabilities in data content and data

management

Refinitiv Data Platform (1)

Data aggregation, management,

distribution and enrichment

Proposition, development and

client servicing business model

and strong global operating

centres

Public data

Proprietary data

Partnerships

Third party data

150,000 data sources, over 10,000 data

partners, 400,000 end users and consumed

by machines globally (24,000 developer

community)

Note:

(1) Refinitiv Data Platform was formerly known as Elektron Data Platform

Open platform delivering

through five distribution

channels

Desktop

1

2

3

Data feeds

Cloud

Partnerships

On Premise

Trading

40,000 customers across 4 key communities

buksaim

Investment

and

Advisory

Wealth

Risk

London

Stock Exchange Group

TITI |

Sell-side trading desks

Hedge funds

Asset managers

Treasury management

Risk management

Investment management

Portfolio management

Research

Capital raising

M&A advisory

Wealth advisory

Wealth operations

Wealth aggregators

Wealth distributors

Financial crime detection

Compliance & fraud

prevention

Entity validation &

verification

Page 12View entire presentation